Hedge Fund Manager Expects Central Bank to Cut Interest Rates in December

Hedge Fund Manager Expects Central Bank to Cut Interest Rates in December

Citadel CEO and founder Ken Griffin predicts that the Federal Reserve will begin cutting interest rates by the end of the year. Speaking at the Milken Institute Global Conference, Griffin anticipates that the cutting cycle will start at the December policy meeting of the Federal Open Market Committee (FOMC). However, he notes that reaching the central bank’s 2 percent inflation target without a “real recession” is unlikely. Griffin points to the persistence of services inflation, which rose to 5.3 percent in March. He concedes that inflation returning to the desired target is only possible if the United States is in a recession.

Unlikely Return to 2 Percent Target

During a CNBC interview, Griffin admits that it is unlikely for inflation to reach the 2 percent target desired by the Federal Reserve. He suggests that the only way the central bank can achieve this objective is if there is a “real recession.” He also mentions that there is a small chance of one more rate hike later this year. However, he believes it would be challenging for Fed Chair Jerome Powell to cut interest rates due to continued fiscal stimulus. Griffin states that Powell is facing a difficult situation as Washington has a different agenda than he does. Powell is trying to slow the economy and bring inflation down while engineering a soft landing.

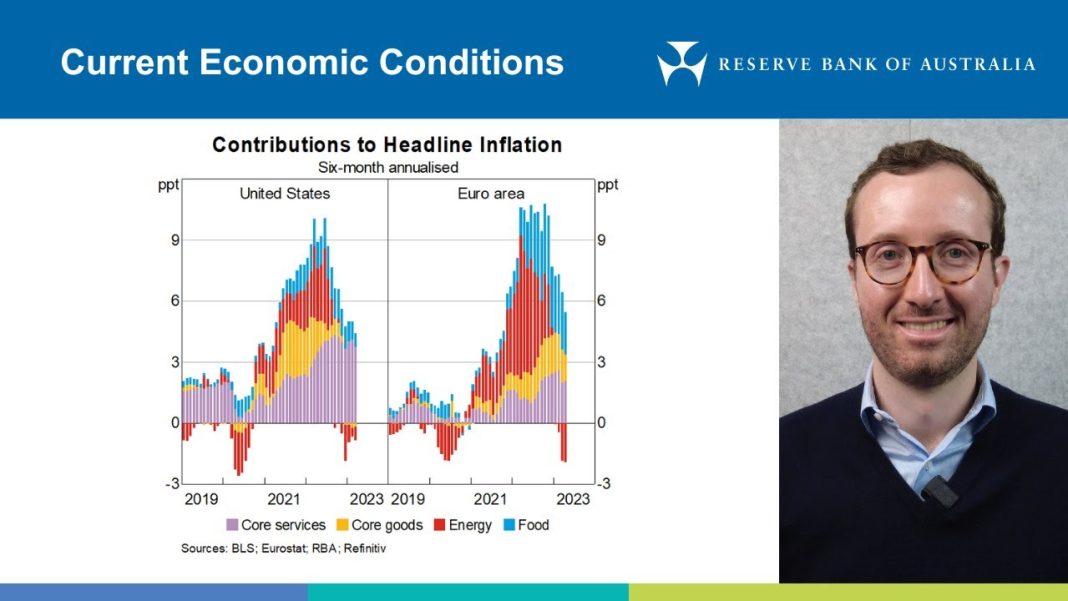

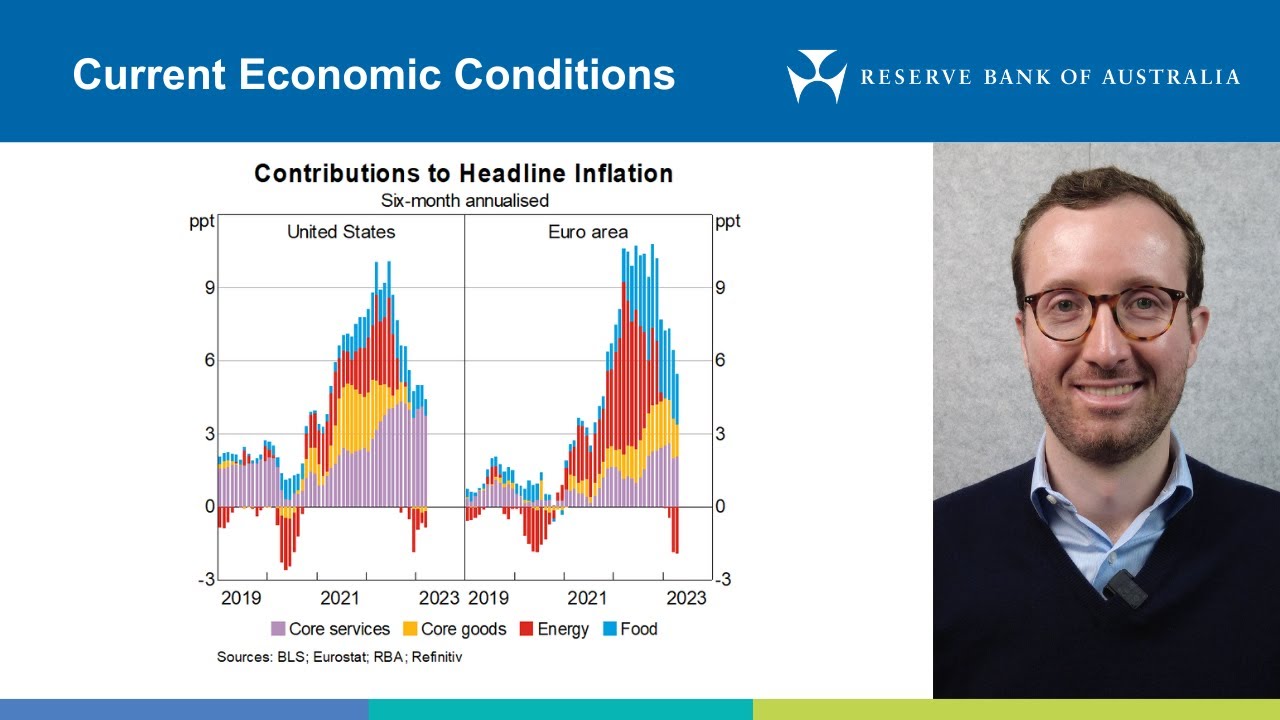

Economic Conditions and Outlooks

Various outlooks and models suggest that economic conditions might be slowing, but a downturn may not be imminent. The Federal Reserve Bank of Atlanta’s GDPNow model estimate suggests that the second-quarter GDP growth rate will be 3.3 percent. The New York Fed Staff Nowcast predicts the economy will grow 2.2 percent in the April-June period. Federal Reserve Chair Jerome Powell dismisses concerns about a stagflation environment similar to the 1970s, stating, “I don’t see the stag or the ‘flation.”

Reasons for the Economy Staying Afloat

According to Torsten Slok, the chief economist at Apollo, there are two reasons why the U.S. economy is still staying afloat. First, consumers and firms locked in low interest rates during the COVID-19 pandemic, making the economy less sensitive to higher rates. Second, there are strong demand tailwinds driven by fiscal stimulus, excess savings, immigration, and easy financial conditions.

Path of Interest Rates

The futures market, as indicated by the CME FedWatch Tool, expects two quarter-point rate cuts to begin in September. Powell reassured financial markets that a rate increase is unlikely at the post-FOMC meeting press conference. He stated that inflation is likely to come down and warrant a reduction in the benchmark federal funds rate. However, Minneapolis Fed President Neel Kashkari took a different stance, explaining that a rate hike is unlikely but not completely off the table. Kashkari also noted that the latest inflation data forced the Fed to question if monetary policy is restrictive enough.

Possible Wrong Decisions and Inflation Fight

Ken Mahoney, CEO and president of Mahoney Asset Management, suggests that the monetary authorities may make the wrong decision at the wrong time. He believes that even if the central bank cuts rates by 25 basis points as widely anticipated, it may not be enough to fight inflation. Mahoney points out that the Fed’s ability to combat inflation is limited, especially if fiscal policy is out of control and spending in Congress is excessive. The Cleveland Fed’s Inflation Nowcasting model predicts an unchanged annual inflation rate of 3.5 percent this month, rising to 3.6 percent in May. To restore the Fed’s price stability goal, there needs to be a meaningful slowdown in the labor and housing markets, according to Slok.

In conclusion, while the Federal Reserve is expected to start cutting interest rates by the end of the year, reaching the desired inflation target without a recession seems unlikely. Economic conditions indicate a slowdown but not a downturn, and the economy has been supported by low interest rate sensitivity and strong demand tailwinds. The path of interest rates suggests possible rate cuts, but there are differing opinions within the Fed. The fight against inflation may be challenging, and the central bank’s ability to control it is limited. To restore price stability, there needs to be a slowdown in the labor and housing markets.