Deliberate Approach to Fighting Inflation: The Value of Patience

Deliberate Approach to Fighting Inflation: The Value of Patience

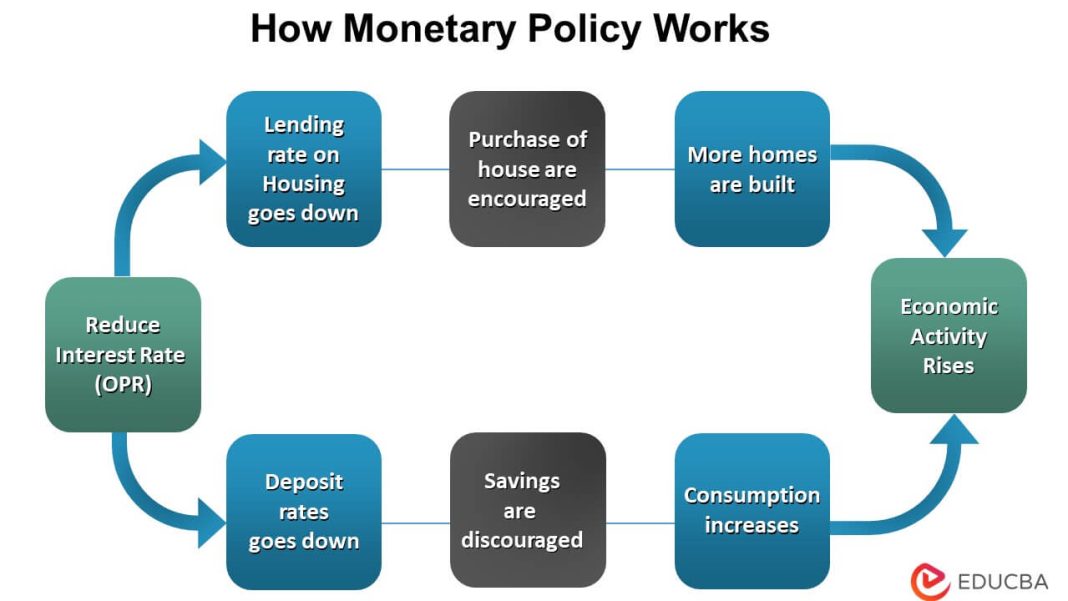

Federal Reserve officials continue to emphasize the importance of patience in achieving their inflation target of 2 percent. New York Fed President John Williams assured financial markets at the Milken Institute 202 Global Conference that interest rate cuts will eventually occur. He stated that monetary policy is currently in a good place and sufficient to combat inflation, despite indications of a reacceleration. Williams did not provide a specific timeline for rate cuts, emphasizing the need to consider all available data.

Fed Chair Jerome Powell echoed this sentiment, stating that it is unlikely that the next policy rate move will be a hike. He assured reporters that there is no evidence of policy being restrictive. These assurances from Fed officials alleviated concerns of a rate hike among investors.

Richmond Fed President Thomas Barkin also stressed the importance of a deliberate approach in fighting inflation. Speaking at the Columbia Rotary Club, Barkin expressed confidence in the central bank’s ability to restore price stability. However, he emphasized the need for patience and further confidence that inflation will sustainably return to the 2 percent target. The recent data whiplash, with inflation rising to 3.5 percent in March, has raised questions about the economic outlook.

The Fed’s Inflation Nowcasting model expects the CPI to remain at 3.5 percent and the core CPI to ease to 3.7 percent in the next report. Powell believes that inflation will move back down over the course of the year, but Fed Gov. Michelle Bowman sees upside inflation risks that could impact her outlook. Despite the current stance of monetary policy appearing restrictive, Bowman remains open to raising the federal funds rate if progress on inflation stalls or reverses.

For now, the central bank leadership consists of “doves looking to gently cut rates,” according to Jay Woods, chief global strategist at Freedom Capital Markets. Powell’s cautious approach suggests a peaceful dove waiting to cut rates if necessary. However, the path forward remains uncertain, and the data will ultimately determine whether the Fed needs to take a more hawkish stance.

In recent weeks, the Fed has tried to strike a balance between dovish and hawkish views. They maintain that there is no urgency to cut rates and that policy can remain restrictive if the economy continues to perform well. However, they acknowledge that the benchmark rate will likely come down later this year. The Fed’s cautious and patient approach reflects their commitment to achieving their inflation target while maintaining economic growth.