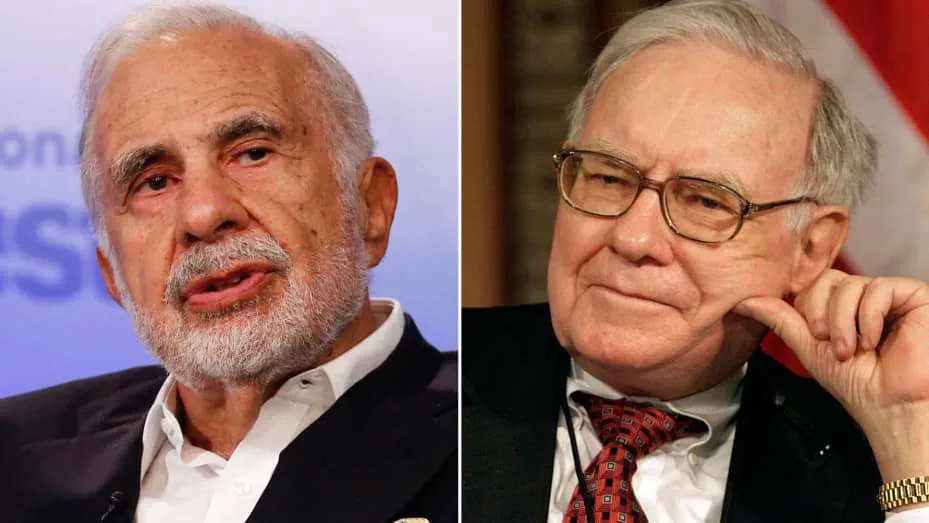

Warren Buffett’s Berkshire Hathaway and Carl Icahn Make Strategic Moves in Investment Portfolio

In a recent development, renowned investor Warren Buffett’s Berkshire Hathaway has made a significant move by reducing its stake in HP Inc. by approximately 50%. Additionally, billionaire investor Carl Icahn has also made strategic changes in his investment portfolio, reducing his position in FirstEnergy Corp. and relinquishing a board seat. These moves have caught the attention of market observers, highlighting the ever-changing nature of investment strategies in the dynamic world of finance.

Warren Buffett’s Berkshire Hathaway Cuts Stake in HP Inc.:

According to regulatory filings submitted on Monday, Berkshire Hathaway, led by legendary investor Warren Buffett, has decided to reduce its stake in HP Inc. by about half. This move comes as a surprise to many, as Berkshire Hathaway has been known for its long-term investment approach. The decision to cut its position in HP Inc. indicates a shift in the company’s investment strategy or a reevaluation of the tech giant’s future prospects.

Carl Icahn Reduces Position in FirstEnergy Corp.:

In another notable development, billionaire investor Carl Icahn has made changes to his investment portfolio by reducing his position in FirstEnergy Corp. Although the exact details of the reduction have not been disclosed, this move suggests that Icahn may be reassessing his outlook on the utility company. FirstEnergy Corp. operates in the highly regulated energy sector, and Icahn’s decision could reflect his response to changing market dynamics or a reallocation of resources to other potential opportunities.

Carl Icahn Relinquishes Board Seat:

Alongside reducing his position in FirstEnergy Corp., Carl Icahn has also relinquished a board seat within the company. This decision indicates a further shift in Icahn’s involvement and influence within the organization. While the reasons behind this move remain undisclosed, it could be a strategic decision to focus on other investments or a reflection of Icahn’s confidence in the company’s management team.

Implications for Investors and Market Observers:

The actions taken by Berkshire Hathaway and Carl Icahn in their investment portfolios have significant implications for both investors and market observers. These moves highlight the importance of continuously reassessing investment strategies and adapting to changing market conditions. The decisions made by these prominent investors may influence others to reevaluate their own portfolios and consider potential adjustments.

Conclusion:

Warren Buffett’s Berkshire Hathaway and Carl Icahn, two highly respected investors, have made notable changes in their investment portfolios. Berkshire Hathaway’s decision to cut its stake in HP Inc. by approximately 50% and Carl Icahn’s reduction in FirstEnergy Corp. position, along with relinquishing a board seat, demonstrate the dynamic nature of investment strategies. These moves serve as a reminder to investors and market observers to stay vigilant, adapt to changing market conditions, and reassess their own investment strategies accordingly.