Warren Buffett’s Berkshire Hathaway has been strategically selling shares of companies like Apple and parking the cash in U.S. Treasury bills (T-bills). In the second quarter, Berkshire purchased an additional $81 billion in T-bills, bringing its total holdings to $235 billion. This means that Berkshire now owns more T-bills than the Federal Reserve. While the Fed’s T-bill holdings stand at $195.29 billion, it still holds approximately $4.5 trillion in U.S. Treasury notes and bonds.

Warren Buffett’s Berkshire Hathaway has been strategically selling shares of companies like Apple and parking the cash in U.S. Treasury bills (T-bills). In the second quarter, Berkshire purchased an additional $81 billion in T-bills, bringing its total holdings to $235 billion. This means that Berkshire now owns more T-bills than the Federal Reserve. While the Fed’s T-bill holdings stand at $195.29 billion, it still holds approximately $4.5 trillion in U.S. Treasury notes and bonds.

The Federal Reserve’s holdings of bonds and mortgage-backed securities have significantly increased over the past 15 years, starting with the financial crisis of 2008–09 and escalating during the COVID-19 pandemic. The Fed’s holdings reached a peak of almost $9 trillion in 2022, but it has recently reduced them to about $7.3 trillion. Despite this reduction, the Fed remains the largest single buyer of U.S. Treasury securities in the world.

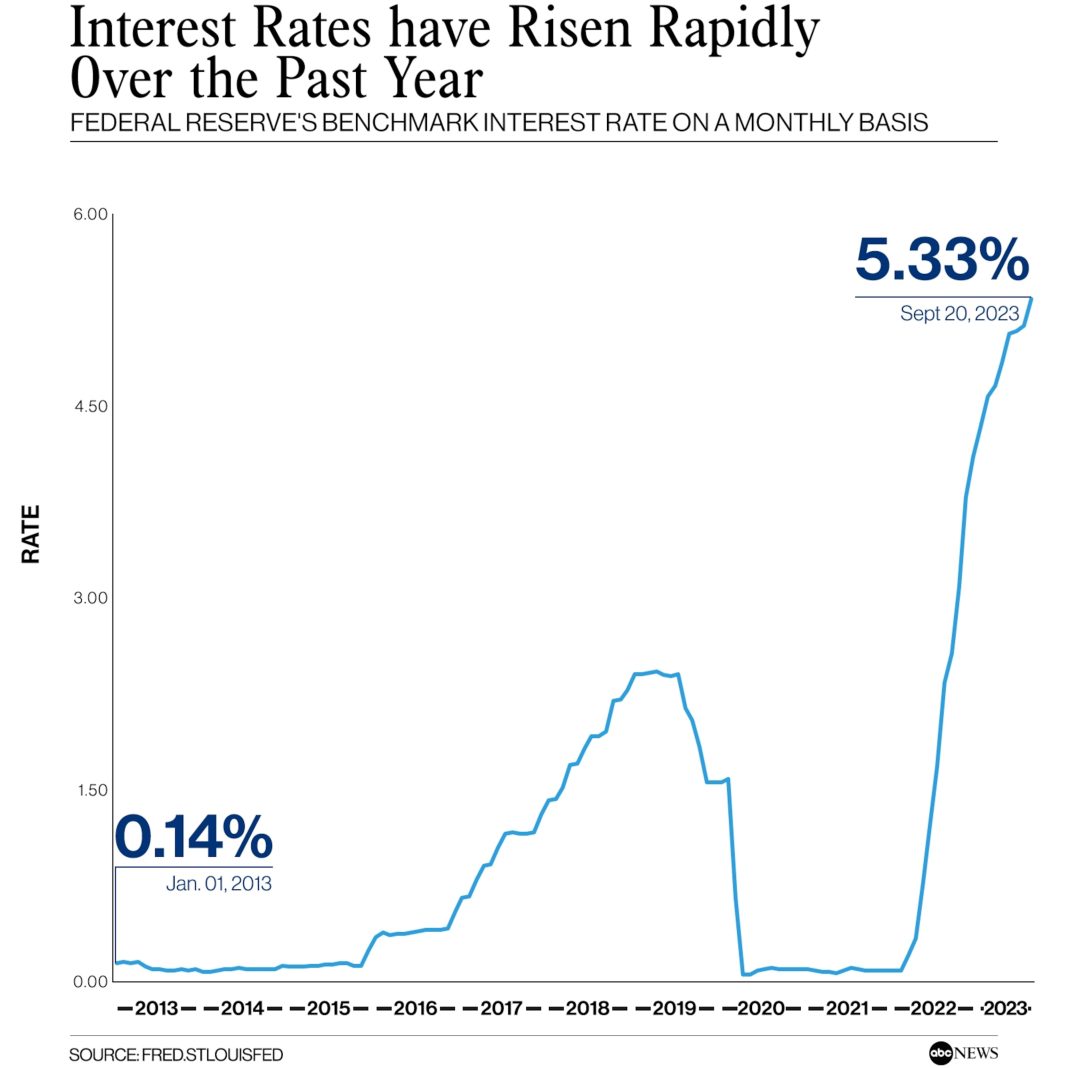

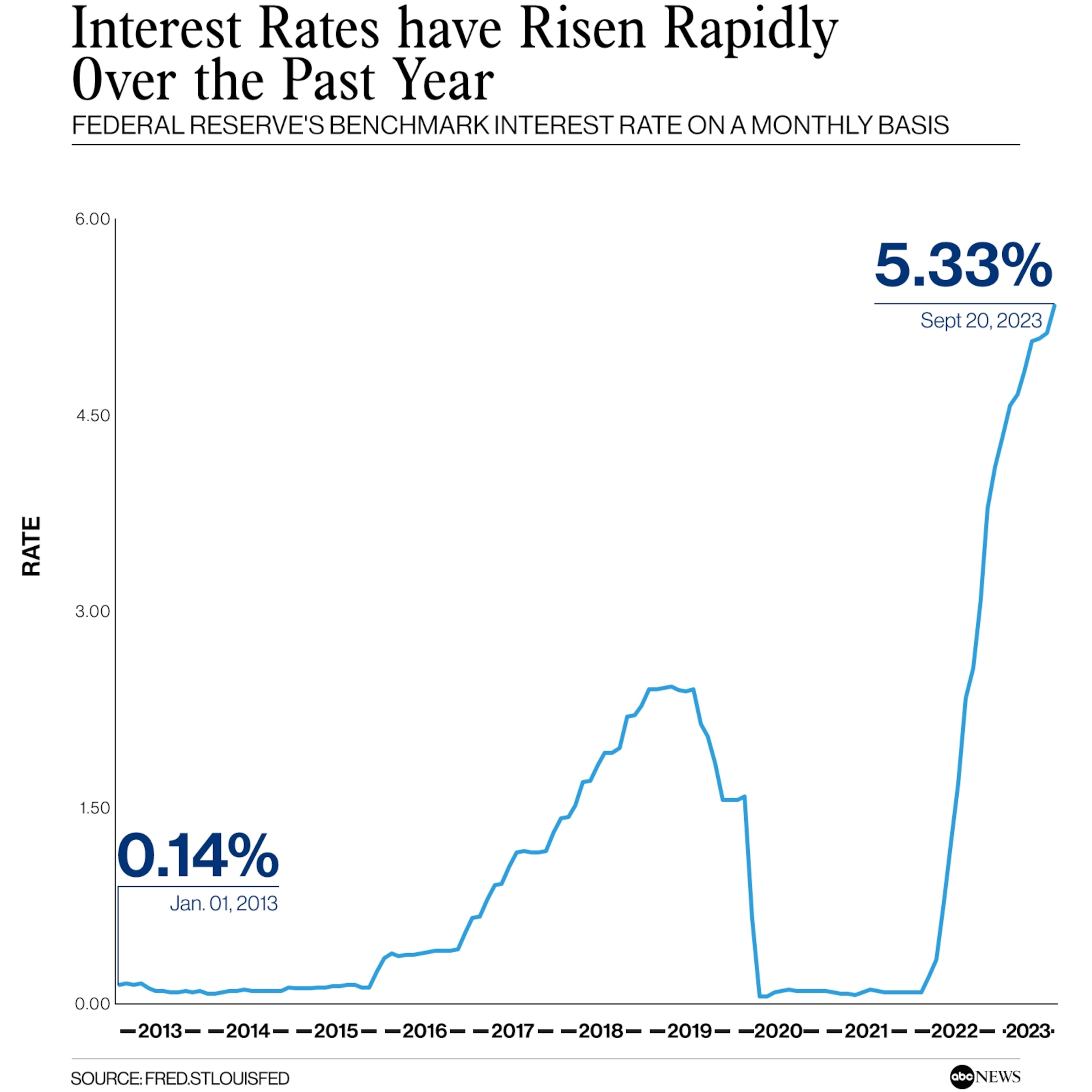

T-bills are typically less appealing to investors compared to higher potential yields in the stock market. However, the Fed’s recent rate hikes have made them more attractive. The return rates on T-bills are currently the highest they have been since February 2007, with one-month yields at about 5.3 percent, six-month yields at around 4.9 percent, and one-year yields at 4.43 percent.

For Buffett’s Berkshire Hathaway, cash is king. The company’s war chest increased to an all-time high of $277 billion in the three-month period. Buffett expressed his desire to deploy the capital, but high prices have made him reluctant. He stated that they won’t spend the cash unless they find an opportunity with very little risk and the potential to make a lot of money.

Buffett surprised the market when it was revealed that he had sold about half of his $160 billion stake in Apple stock in the previous quarter. Market watchers have debated whether he is accumulating cash to pick up stocks at discounted prices during a recession or managing risk in a turbulent investing climate.

The federal government has issued over $2 trillion worth of T-bills in the last 13 months to manage the budget deficit and higher interest payments. T-bills offer lower average financing costs and demand for them has considerably increased in recent years. The Treasury Department plans to borrow approximately $1.3 trillion over the next six months, with short-term debt securities representing 40 percent of net Treasury issuance.

Some analysts have accused the U.S. government of participating in “activist Treasury issuance” (ATI) and engaging in “stealth QE” (quantitative easing). They argue that by manipulating the amount of interest rate risk owned by investors, ATI works similarly to the Fed’s quantitative easing program. According to Hudson Bay Capital’s Nouriel Roubini and Stephen Miran, ATI has reduced 10-year yields by roughly a quarter of a percent over the past year, providing similar stimulus as a one-point cut in the federal funds rate.

Overall, Buffett’s move to invest in T-bills reflects his cautious approach to deploying capital in a market with high prices. The Fed’s significant holdings of U.S. Treasury securities and the government’s issuance of T-bills raise questions about the potential impact on interest rates and the economy. Analysts continue to debate the government’s role in manipulating interest rate risk through ATI and its similarities to quantitative easing.