Rising Unemployment Claims and Cooling Consumer Spending Raise Concerns for US Economy

Rising Unemployment Claims and Cooling Consumer Spending Raise Concerns for US Economy

Introduction:

The president of the Federal Reserve Bank of Chicago, Austan Goolsbee, expressed cautious optimism about inflation coming down but also highlighted several warning signs for the economy. These warning signs include cooling consumer spending, rising unemployment claims, and increases in debt delinquency rates. This article will delve deeper into these concerns and analyze their potential impact on the economy.

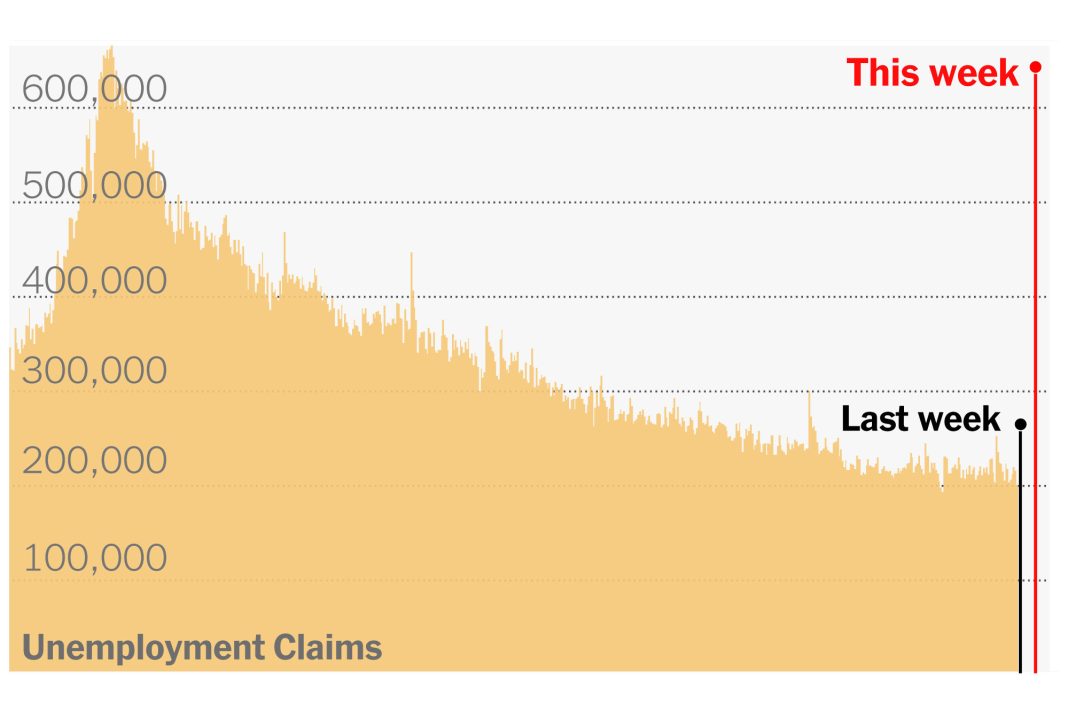

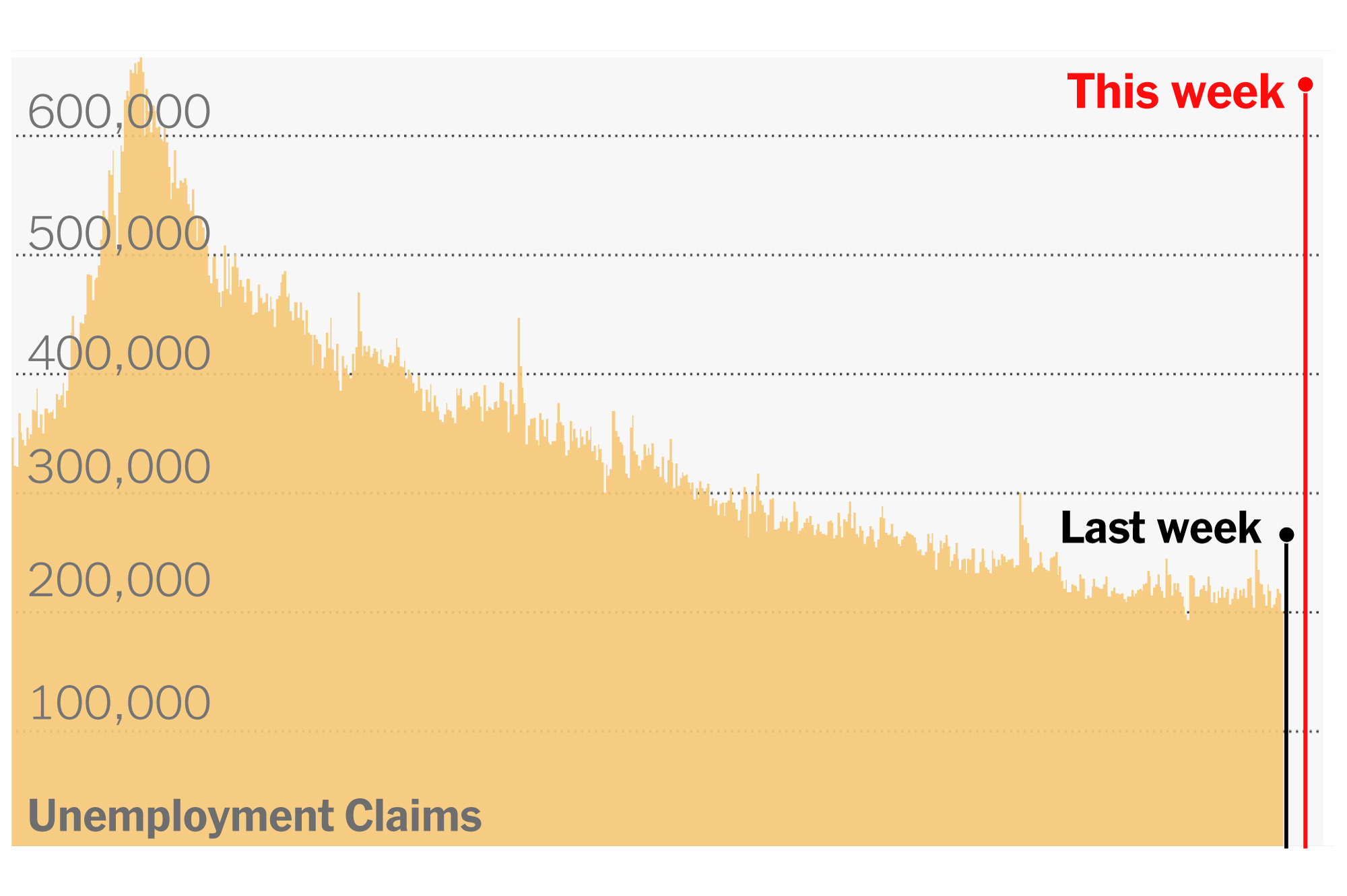

Warning Signs: Rising Unemployment Claims

One of the warning signs mentioned by Goolsbee is the steady rise in unemployment claims. For the week ended June 15, initial jobless claims came in at 238,000, slightly higher than forecast. The four-week moving average, which provides a clearer picture of the overall trend, has been steadily increasing since April. It reached 232,750, the highest level since September 2023. These figures indicate a softening in the labor market, which raises concerns about the overall health of the economy.

Increasing Debt Delinquency Rates

Another cause for concern is the rise in debt delinquency rates and Americans’ increasing worry about losing their jobs. A report from the Federal Reserve Bank of Philadelphia revealed that credit card accounts with past due debt payments reached all-time highs at every time horizon—30 days, 60 days, and 90 days. Additionally, the share of accounts making minimum payments rose to a record high. These data points suggest that consumers are struggling to pay off their credit card debts, which could have broader implications for their financial stability.

Consumer Worry and Delinquency Rates

The Federal Reserve Bank of New York’s report on consumer expectations in April highlighted rising concerns among Americans about losing their jobs and being able to make minimum debt payments. These worries reached their highest levels since September 2020 when the pandemic-related recession hit. Subsequently, a May report from the Federal Reserve Bank of New York showed an increase in serious delinquency rates. While the overall delinquency rate remained relatively low, specific categories such as credit card, auto loan, and consumer loans saw significant increases. This indicates that consumers are facing challenges in meeting their financial obligations, which could impact their spending habits.

Consumer Spending: A Key Driver of the Economy

Consumer spending plays a pivotal role in driving the U.S. economy, accounting for roughly two-thirds of economic output. However, recent data has shown a slowdown in consumer spending. Retail sales, which serve as a proxy for consumer spending, only rose by 0.1 percent in May after falling 0.2 percent in April. This weak performance raises concerns about the economy’s overall health.

Consumer Optimism and Spending Intentions

Reports from consulting companies McKinsey and Deloitte further support the concerns surrounding consumer spending. McKinsey’s report revealed that consumer optimism fell in the second quarter of 2024 to its lowest level since the end of last year. Economic pessimism grew slightly, driven by concerns over inflation, depleted personal savings, and perceived weaknesses in the labor market. Additionally, Deloitte’s report highlighted that while the financial well-being of consumers remained steady, future spending intentions leaned towards saving rather than overspending.

Conclusion:

The warning signs identified by Austan Goolsbee and supported by various reports indicate potential challenges for the U.S. economy. Rising unemployment claims, increasing debt delinquency rates, and cooling consumer spending all raise concerns about the overall health and stability of the economy. Policymakers will need to carefully consider these factors when determining the appropriate level of interest rates and implementing measures to address potential economic softness. It is crucial to monitor these indicators closely to assess any further developments and their implications for the broader economy.