Wall Street Rallies as U.S. Economy Shows Resilience

Wall Street Rallies as U.S. Economy Shows Resilience

Wall Street experienced a strong rally, inching closer to its record highs, as positive signs emerged indicating that the U.S. economy is holding up better than expected. The S&P 500 surged 1.6 percent on Thursday, marking its sixth consecutive gain and signaling a return to stability after a turbulent period. The Dow Jones Industrial Average rose by 1.4 percent, while the Nasdaq composite saw an impressive gain of 2.3 percent.

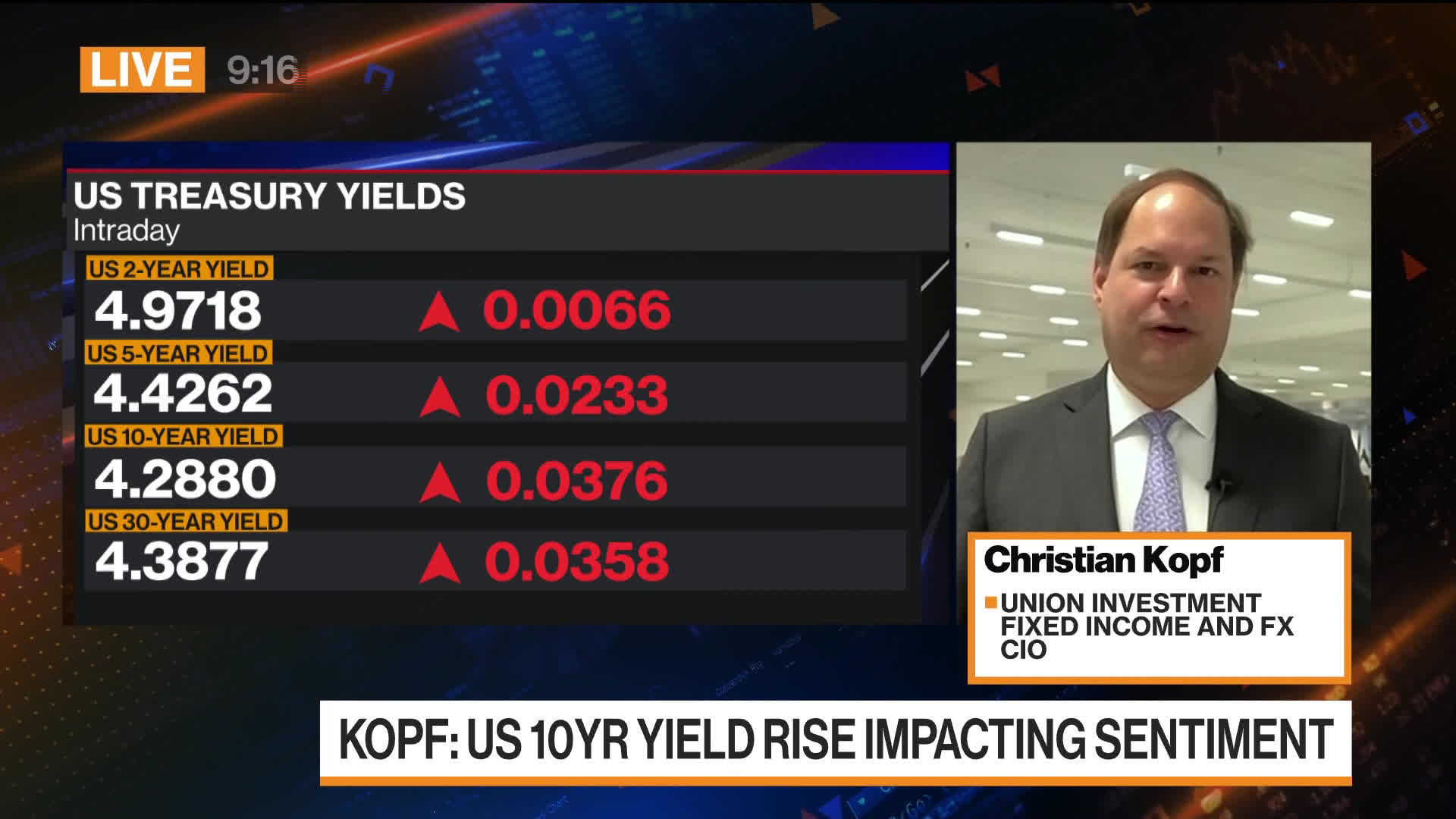

The bond market also witnessed a surge in Treasury yields following reports that shoppers had increased their spending at retailers the previous month, and fewer workers had applied for unemployment benefits. This positive news was further reinforced by Walmart’s sharp rise in stock prices after the company raised its sales forecast. Despite these promising trends, Wall Street still anticipates an interest rate cut by the Federal Reserve in the coming month.

Thursday’s market performance saw the S&P 500 rise by 88.01 points, or 1.6 percent, to reach 5,543.22. The Dow Jones Industrial Average gained 554.67 points, or 1.4 percent, closing at 40,563.06. The Nasdaq composite experienced a substantial increase of 401.89 points, or 2.3 percent, reaching 17,594.50. The Russell 2000 index, which tracks smaller companies, also saw a rise of 51.15 points, or 2.5 percent, to reach 2,135.47.

Looking at the overall performance for the week, the S&P 500 has gained 199.06 points, or 3.7 percent, indicating a positive trend. The Dow has experienced a rise of 1,065.52 points, or 2.7 percent, while the Nasdaq has seen a notable increase of 849.19 points, or 5.1 percent. The Russell 2000 index has also shown growth, with an increase of 54.55 points, or 2.6 percent.

Analyzing the year-to-date performance, the S&P 500 has seen a significant gain of 773.39 points, or 16.2 percent, reflecting a strong performance throughout the year. The Dow has shown a rise of 2,873.52 points, or 7.6 percent, while the Nasdaq has experienced substantial growth, with an increase of 2,583.14 points, or 17.2 percent. The Russell 2000 index has also seen a positive trend, with a gain of 108.40 points, or 5.3 percent.

These positive market trends indicate that the U.S. economy is resilient and on a path of recovery. The increase in consumer spending and the decline in unemployment benefit applications are positive indicators for economic growth. However, it is important to note that Wall Street still anticipates a potential interest rate cut by the Federal Reserve next month, which could impact market dynamics.

In conclusion, the recent rally on Wall Street demonstrates that the U.S. economy is performing better than expected. The positive market trends, including increased consumer spending and lower unemployment benefit applications, indicate a strong foundation for economic growth. However, market analysts are keeping a close eye on the Federal Reserve’s potential interest rate cut, as it could influence future market dynamics.