Understanding the Difference Between Speculation and Investing

Understanding the Difference Between Speculation and Investing

Introduction:

Investing, speculation, and gambling are terms often used interchangeably, but they have distinct differences. While investing focuses on earning a financial return by committing money, speculation involves high-risk assets based on price fluctuations and emotion. On the other hand, gambling is the practice of risking money in games or bets. In this article, we will explore the differences and similarities between these terms and highlight the importance of risk assessment in making investment decisions.

Conservative Investing:

Conservative investing prioritizes the preservation of capital over growth or market returns. This strategy is suitable for risk-averse investors who want their money to grow while minimizing the chances of losing their principal investment. Conservative investors often opt for lower-risk securities such as blue-chip stocks, fixed-income securities, money market funds, and cash equivalents. These investments aim to protect the value of the portfolio and provide a steady income stream.

Case Study: Mark’s Investment Dilemma

To illustrate conservative investing, let’s consider Mark, a 67-year-old pastor seeking advice on investing his life savings. Given his age and risk aversion, Mark wanted to protect his principal investment even if it meant lower returns. After consulting an investment advisor, Mark decided to invest in short-term and long-term bonds, along with money market funds. However, the long-term bonds turned out to be riskier than anticipated and lost significant value as interest rates rose. This case emphasizes the importance of understanding the true level of risk associated with different investment options.

Risk Assessment in Investing:

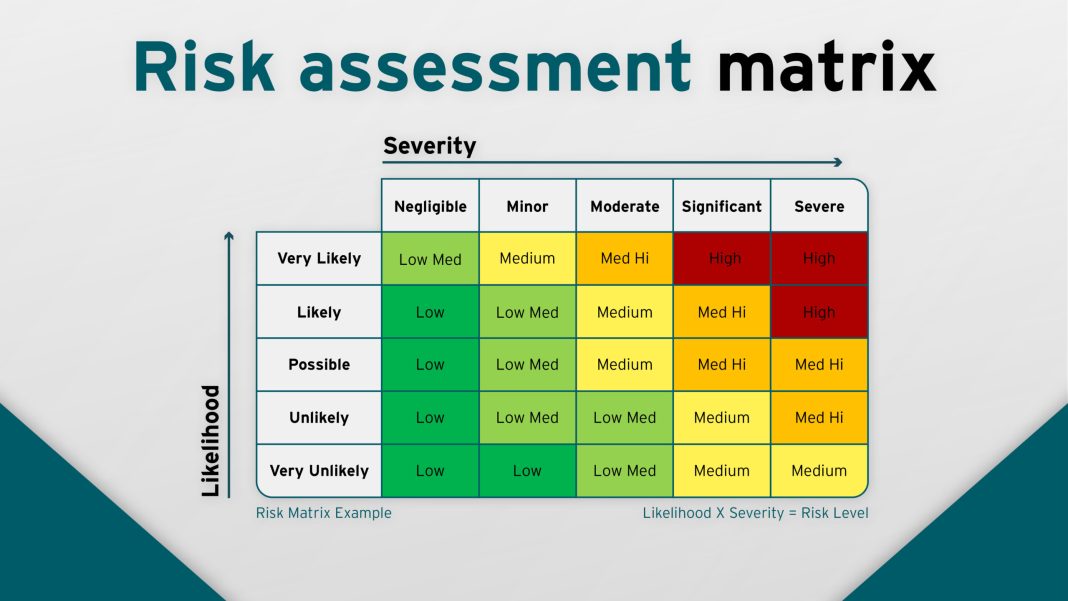

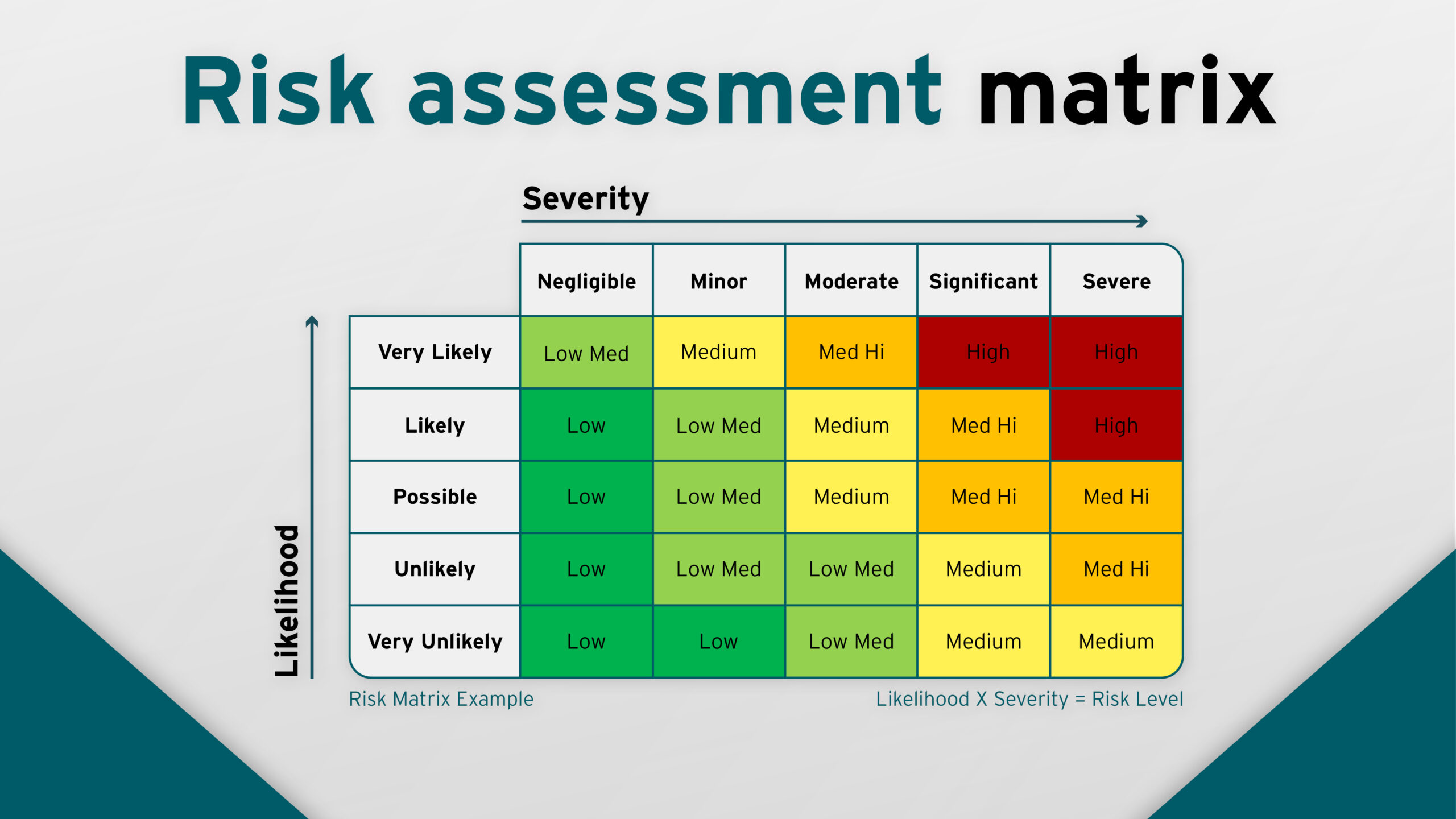

The key differentiating factor between speculation and investing is the level of risk involved. Investors aim to generate satisfactory returns by taking on an average or below-average level of risk. In contrast, speculators seek abnormally high returns from bets that can go either way. To assess risk, various statistical methods can be employed:

1. The Sharpe ratio measures investment performance by considering associated risks.

2. Beta measures the systematic risk of an individual security or sector relative to the entire stock market.

3. Value at Risk (VaR) is a statistical measurement used to assess the level of risk associated with a company.

4. R-Squared represents the percentage of a fund portfolio or security’s movements that can be explained by movements in a benchmark index.

While these methods involve mathematical and statistical analysis, investors can also evaluate potential investments by examining their historical market price volatility over a specific period, such as the last year or two.

Comparing Conservative and Speculative Investments:

When comparing conservative and speculative investments, the primary differentiating factor is the level of risk. Here are examples of each:

Conservative Investments:

1. U.S. Government Bonds: These bonds are considered risk-free as they are guaranteed by the U.S. Department of Treasury.

2. Investment Grade Corporate Bonds: These bonds are issued by large companies with excellent credit ratings, indicating a low risk of default.

3. Cash and Cash Equivalents: Placing money in savings accounts, certificates of deposit, or money market savings accounts provides stability and reasonable returns.

Speculative Investments:

1. Cryptocurrency: Investing in cryptocurrencies like Bitcoin is highly speculative due to their lack of fundamentals, making it challenging to assess risk.

2. Meme Stocks: Meme stocks, such as GameStop and AMC Entertainment, are extremely risky investments that rely on market timing and momentum.

Conclusion:

Investing, speculation, and gambling are distinct concepts that involve varying levels of risk. Conservative investing prioritizes capital preservation, while speculation seeks abnormally high returns through high-risk assets. To make informed investment decisions, understanding risk assessment methodologies and evaluating historical market price volatility are essential. Each individual’s level of risk aversion will determine their investment strategy, from conservative approaches to more speculative endeavors. Remember, it is crucial to evaluate potential risks against potential rewards to make informed investment choices.