The Office of Budget Responsibility (OBR) has issued a warning about the long-term risks to the UK economy, predicting that the national debt will triple over the next 50 years. This projection comes ahead of the October budget, which is expected to include tax changes and public spending cuts. According to the OBR’s Fiscal Risks and Sustainability report, factors contributing to the significant increase in government debt include climate change, an aging population, and geopolitical tension.

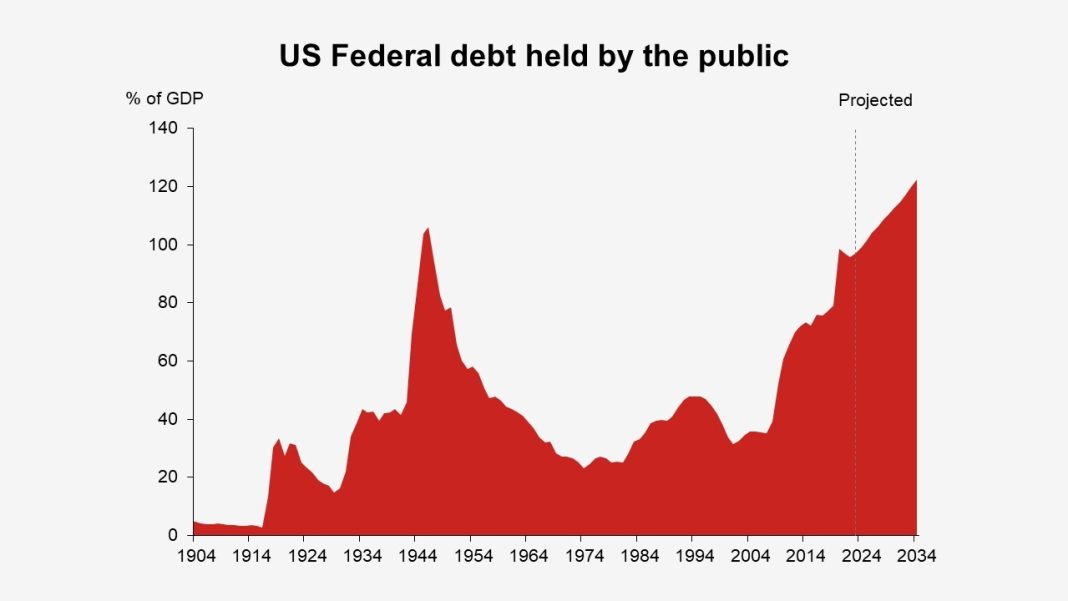

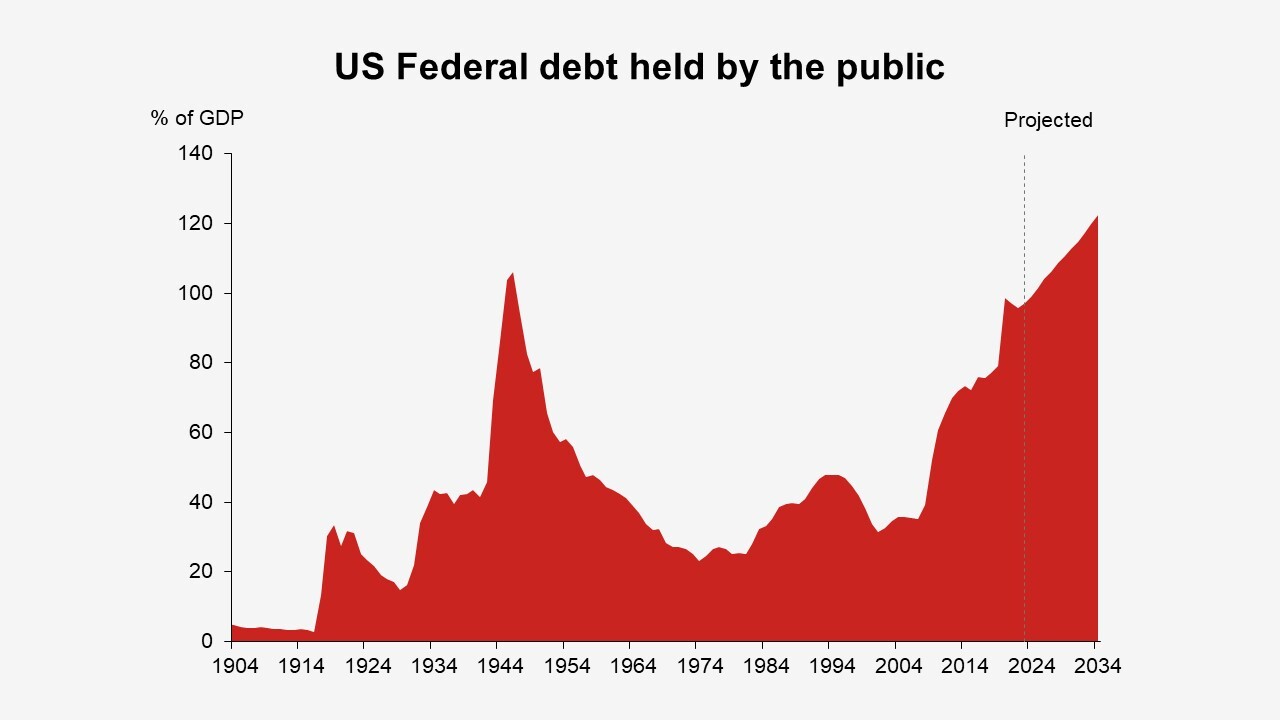

The OBR estimates that government spending will surge from 45 to 60 percent of GDP over the next five decades, while revenues will remain around 40 percent. As a result, the national debt is projected to rise to 274 percent of GDP from the late 2030s. However, the OBR acknowledges that long-term projections like these are highly uncertain, but they anticipate a similar upward debt trajectory in all alternative scenarios considered. When additional shocks and pressures are taken into account, the estimated rise in UK debt could exceed 300 percent of GDP.

Chief Secretary to the Treasury, Darren Jones, described the state of public finances inherited from the previous government as “shocking.” He emphasized that the current government has been taking decisive action to address this by making tough choices on spending and implementing strategies to drive growth.

To alleviate the pressure on the economy, the OBR suggests several measures. One of them is limiting the rise in global temperatures to less than 2 degrees Celsius instead of 3 degrees Celsius. By achieving this, it is estimated that 10 percentage points could be taken off the debt-to-GDP ratio over the next 50 years. Additionally, changes in demographics and an increase in the aging population will put pressure on healthcare spending. However, the long-term benefits of improved health among the population could result in a reduction of debt by 40 percent of GDP, according to the OBR.

The report also emphasizes the need to boost economic growth, as it could have the most significant impact on reducing national debt. The OBR estimates that every 0.1 percent increase in productivity growth will lead to a 25 percent reduction in debt. This highlights the importance of policies and measures that support and stimulate economic growth.

It is important to note that the OBR’s analysis does not factor in any tax and spending policies announced by the new Labour government. Labour has already warned that the upcoming October budget will be “painful” and highlighted a £22 billion deficit in public finances. They plan to raise £2.6 billion through various tax changes, including targeting the tax status of UK resident non-domiciled individuals. Labour also aims to establish stricter reporting requirements for tax avoidance schemes.

Motorists can expect the government to announce an increase in fuel duty in the budget statement. The RAC has already warned that plans are in place to raise the duty to 58p a litre. According to Richard Hughes, the Chair of the OBR, if Labour wants to ensure sustainable public finances, they are likely to consider raising taxes or cutting spending in almost any scenario.

As of July, government borrowing stood at £3.1 billion, the highest July borrowing since 2021. The public sector net debt remains at levels last seen in the early 1960s, estimated at 99.4 percent of GDP. These figures highlight the urgency of addressing the growing national debt and implementing measures to ensure long-term fiscal sustainability.