Dollars and Cents Over the Next Decade

Dollars and Cents Over the Next Decade

The U.S. government is facing significant financial challenges in the coming years, according to the Congressional Budget Office (CBO). The CBO’s latest report reveals that the budget deficit for fiscal year 2024 is expected to be $1.9 trillion, higher than the previous forecast of $1.5 trillion. This increase is due to recently enacted legislation, including additional funds for student loan forgiveness, Medicaid, and emergency aid to Ukraine, Israel, and Indo-Pacific countries.

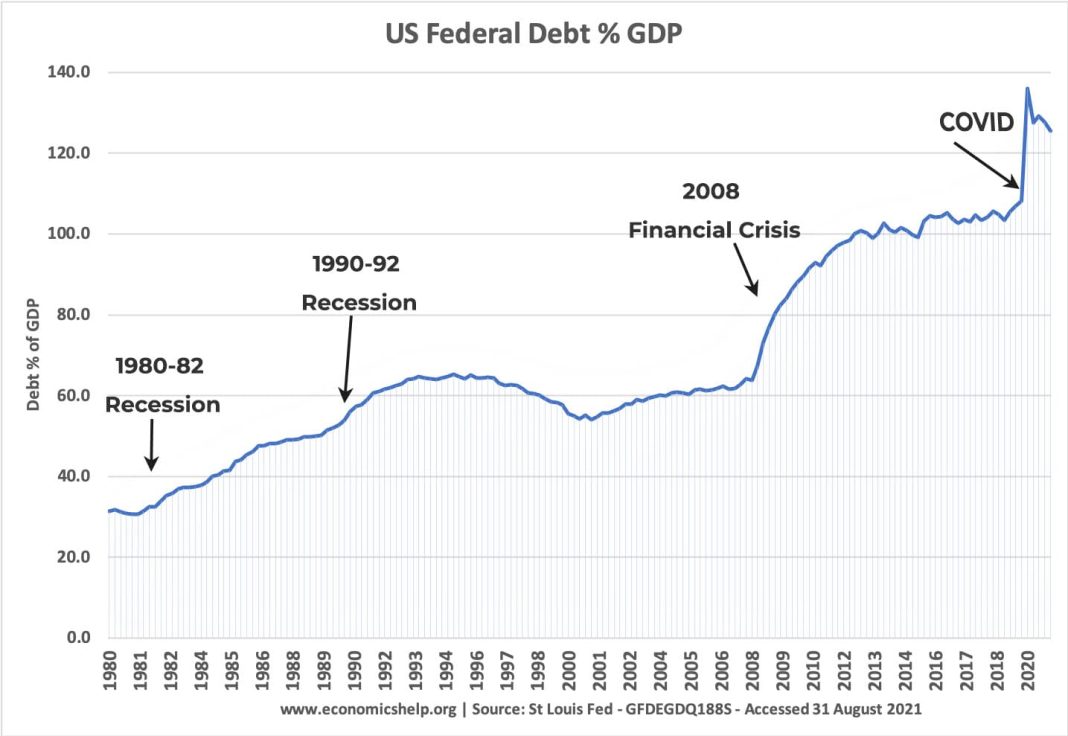

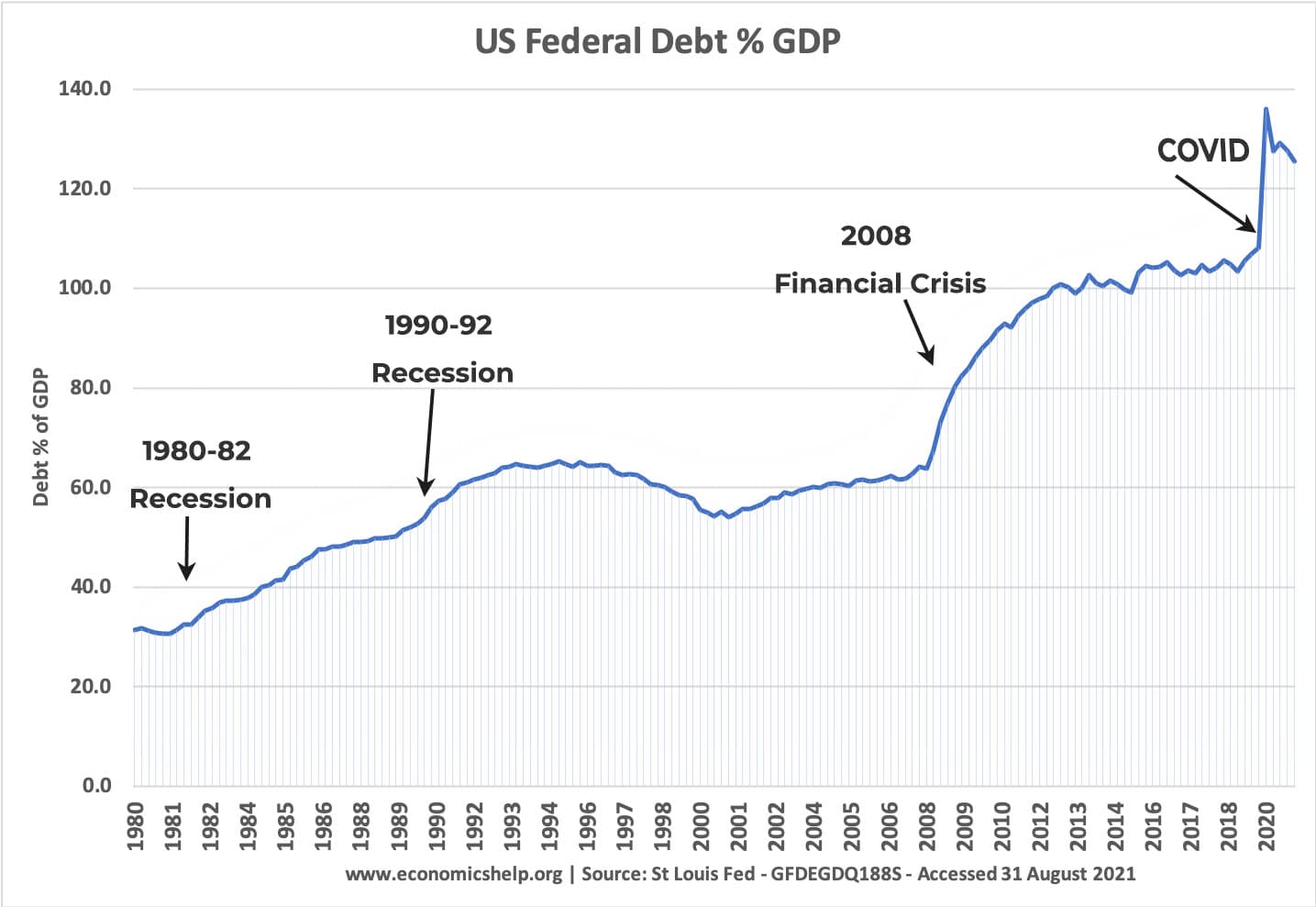

Furthermore, the CBO predicts that federal outlays will reach $6.8 trillion in the current fiscal year, with revenues forecasted at $4.9 trillion. The nonpartisan budget watchdog also projects that debt held by the public will represent 99 percent of the gross domestic product (GDP) by 2034.

In terms of the broader U.S. economy, the CBO expects real GDP growth to be 2 percent in 2024 and 2025, slowing to 1.9 percent in 2026. Inflation is also anticipated to moderate, with the Consumer Price Index (CPI) slowing to 3 percent in 2024, 2.3 percent in 2025, and 2.2 percent in 2026.

The labor market is predicted to cool off in the coming years, with slower employment creation and a higher unemployment rate. Additionally, interest rates are projected to gradually fall over the next few years, with the Federal Reserve’s benchmark federal funds rate dropping to 4.8 percent next year and declining to 3.8 percent by 2026.

The federal government will not see a budget deficit below $1 trillion over the next decade, according to the CBO’s newest report. By 2034, the deficit is estimated to reach $2.8 trillion, accounting for nearly 7 percent of the GDP. The CBO director, Phillip Swagel, highlights that deficits would be even higher if not for immigration, which is projected to lower deficits by a net total of $0.9 trillion over the 2024-2034 period.

The national debt is expected to exceed $50 trillion in the next 10 years, representing more than 122 percent of the GDP. While revenues are projected to top $5 trillion next year and exceed $7.4 trillion by 2034, federal spending will climb even higher. It is estimated that federal spending will reach $7 trillion in 2025 and surpass $10.3 trillion in the next decade.

One concerning aspect is the projected increase in net interest payments, which are expected to reach $1 trillion a year and account for one-sixth of all federal spending. They will represent more than 4 percent of the GDP, double the average from 1974 to 2023. The CBO states that interest costs will exceed outlays for defense and nondefense programs and activities, becoming the highest in relation to GDP since at least 1940.

The CBO assumes that former President Donald Trump’s tax cuts will expire at the end of next year. However, they forecast that revenue growth as a percentage of GDP will remain relatively flat after 2027. The White House has used the CBO’s updated numbers to argue that the Trump tax cuts will contribute to ballooning national debt and budget deficits in the coming years.

Despite the CBO’s projections, the Committee for a Responsible Federal Budget is urging the presumptive 2024 presidential candidates to present plans to address the national debt. They highlight that interest payments on the national debt will soon surpass any previous levels in history, emphasizing the need for a change in course.

In conclusion, the CBO’s updated outlook paints a challenging financial picture for the U.S. government. With increasing budget deficits, rising national debt, and interest payments exceeding spending in crucial areas, it is clear that action needs to be taken to address these issues. The CBO’s projections underscore the importance of long-term fiscal responsibility and the need for informed decision-making to ensure a sustainable economic future.