The operating costs of family offices have risen significantly due to the competition for talent within the industry. According to the J.P. Morgan Private Bank Global Family Office Report, the average cost to operate a family office is now around $3.2 million per year. While the expenses vary depending on the assets managed by the family office, there is a general increase in costs as family offices grow in size and number.

The operating costs of family offices have risen significantly due to the competition for talent within the industry. According to the J.P. Morgan Private Bank Global Family Office Report, the average cost to operate a family office is now around $3.2 million per year. While the expenses vary depending on the assets managed by the family office, there is a general increase in costs as family offices grow in size and number.

One of the main reasons for the rising costs is the war for talent within family offices. These offices are now directly competing with private equity firms, hedge funds, and banks to attract and retain top talent. As a result, staffing expenses have become the biggest cost for family offices. In the past five years, the number of family offices has tripled, leading to a surge in demand for senior talent.

Smaller family offices, managing less than $500 million in assets, spend an average of $1.5 million per year on operating costs. Family offices with assets between $500 million and $1 billion spend an average of $2.7 million, while those with assets above $1 billion spend an average of $6.1 million. Some family offices even spend more than $10 million per year on operations.

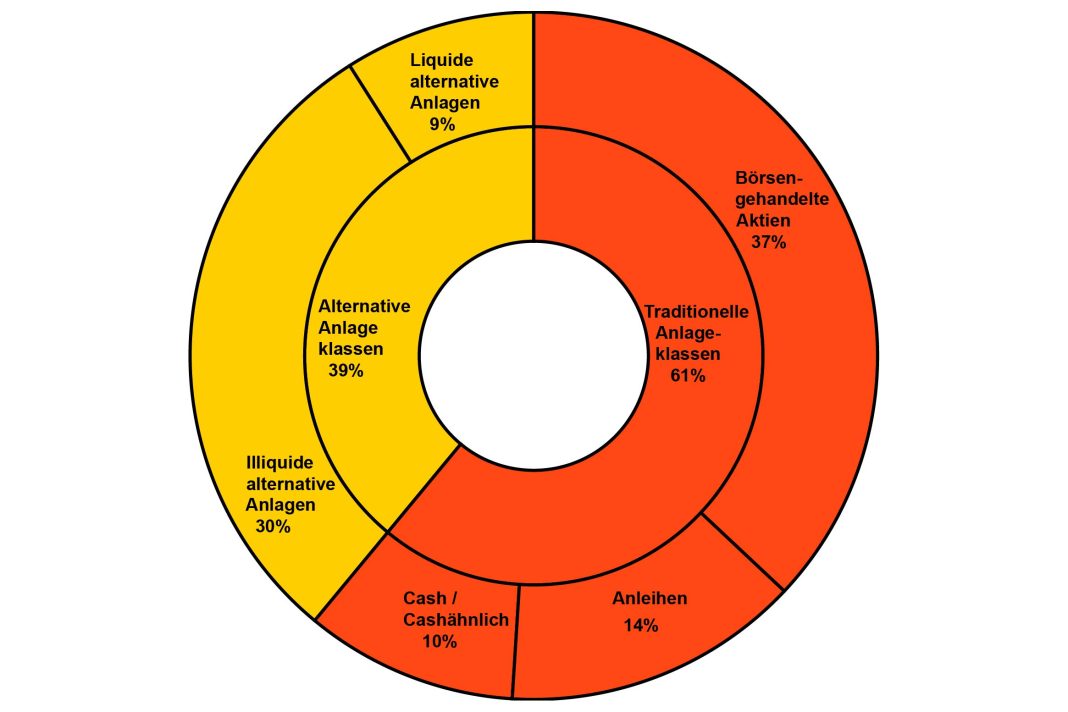

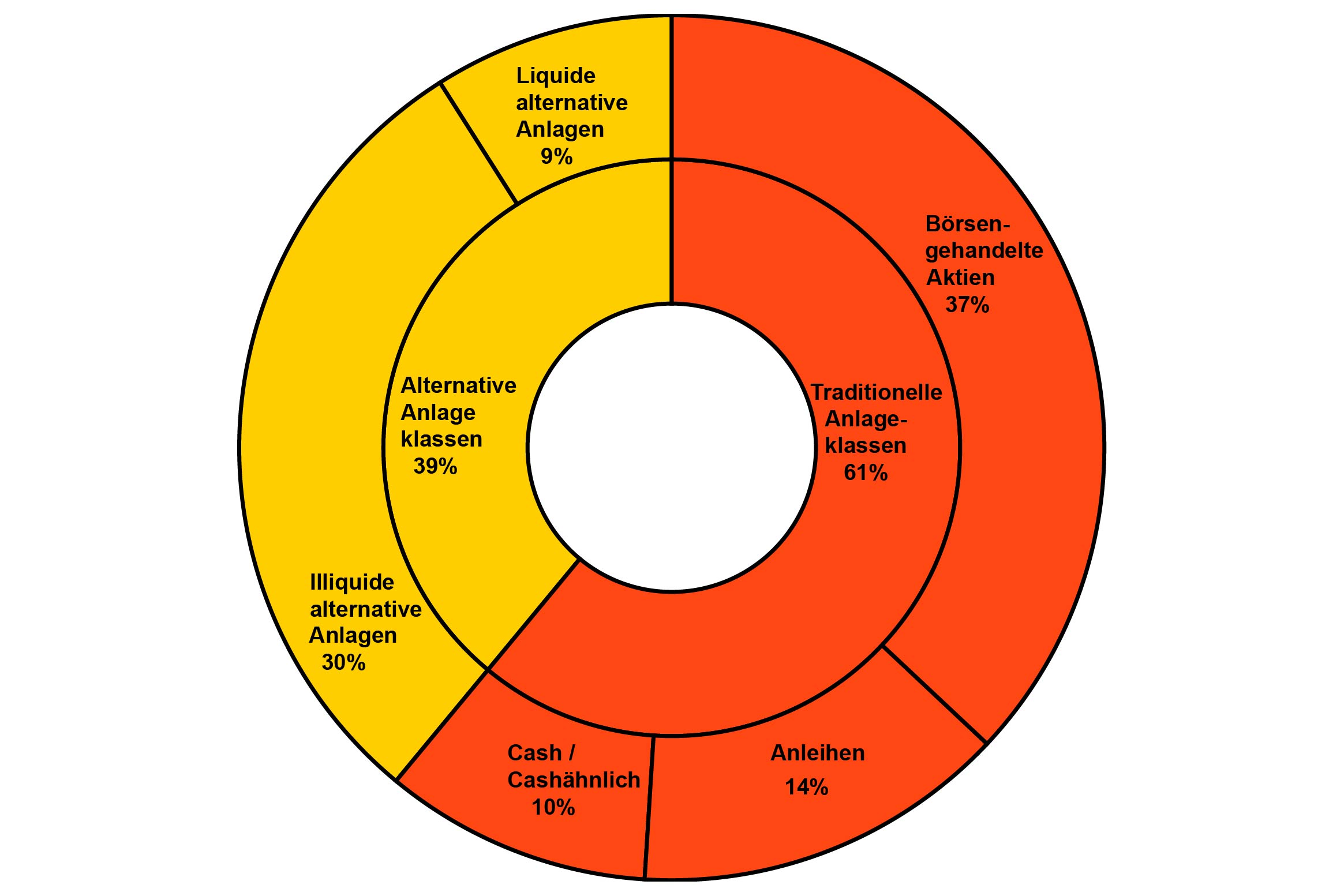

In addition to the competition for talent, family offices are also increasing their investments in alternative assets such as private equity, venture capital, real estate, and hedge funds. According to the J.P. Morgan survey, U.S. family offices allocate more than 45% of their portfolios to alternatives, compared to 26% for stocks. This shift into alternatives puts family offices in direct competition with large private equity firms and venture capital firms for top talent.

To attract and retain talent, family offices are offering higher compensation packages. According to a survey conducted by Botoff Consulting, 57% of family offices plan to hire more staff in 2024, and nearly half are planning to give raises of 5% or more to their existing staff. Overall, family office pay has increased by 10% to 20% since 2019.

Chief investment officers at family offices with less than $1 billion in assets receive an average compensation of about $1 million, while those overseeing more than $10 billion receive just under $2 million. Family offices are also adding long-term incentive plans, such as deferred compensation, to sweeten the compensation packages.

The competition with private equity firms is particularly challenging for family offices. While they can’t compete at a senior level with the big private equity firms, family offices are recruiting midlevel managers from these firms and offering them better pay, more authority, and access to deals. Family offices are even providing a share of the profit when a private company is sold, similar to what private equity firms offer.

Overall, family offices have transformed over the past decade from being seen as retirement destinations to becoming attractive places to work for top talent. They now offer competitive compensation, access to wealthy individuals and their networks, and the opportunity to have a significant impact in a smaller organization.

As family offices continue to grow in size and number, it is likely that operating costs will continue to rise. The competition for talent shows no signs of slowing down, and family offices will need to adapt their recruitment and compensation strategies to stay competitive in the market.