Housing affordability continues to be a pressing issue in the United States, as revealed by the latest report from the U.S. Census Bureau. The report indicates that rental costs in the country last year outpaced the rise in home values for the first time since 2011. This alarming trend has led nearly half of the country’s renter households to be classified as “cost-burdened,” meaning they spend more than 30 percent of their income on housing.

The Census Bureau’s American Community Survey for 2023, released on September 12, highlights the significant increase in rental costs. The median gross rent, which includes both rent and utilities, rose by 3.8 percent, reaching $1,406 per month. In contrast, median home values only saw a 1.8 percent increase. This represents the largest real increase in rental costs, adjusted for inflation, in the past 12 years.

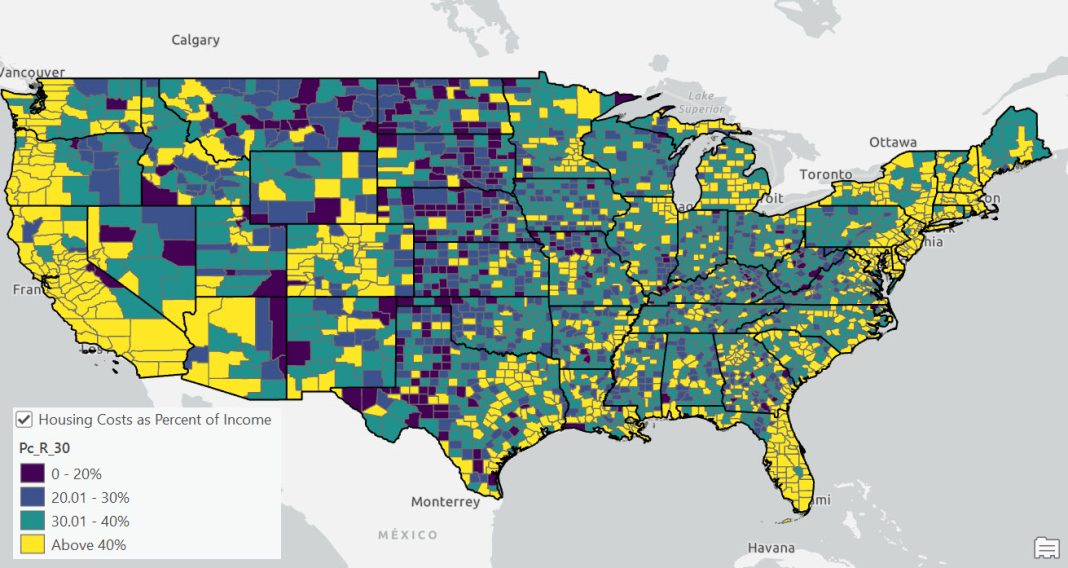

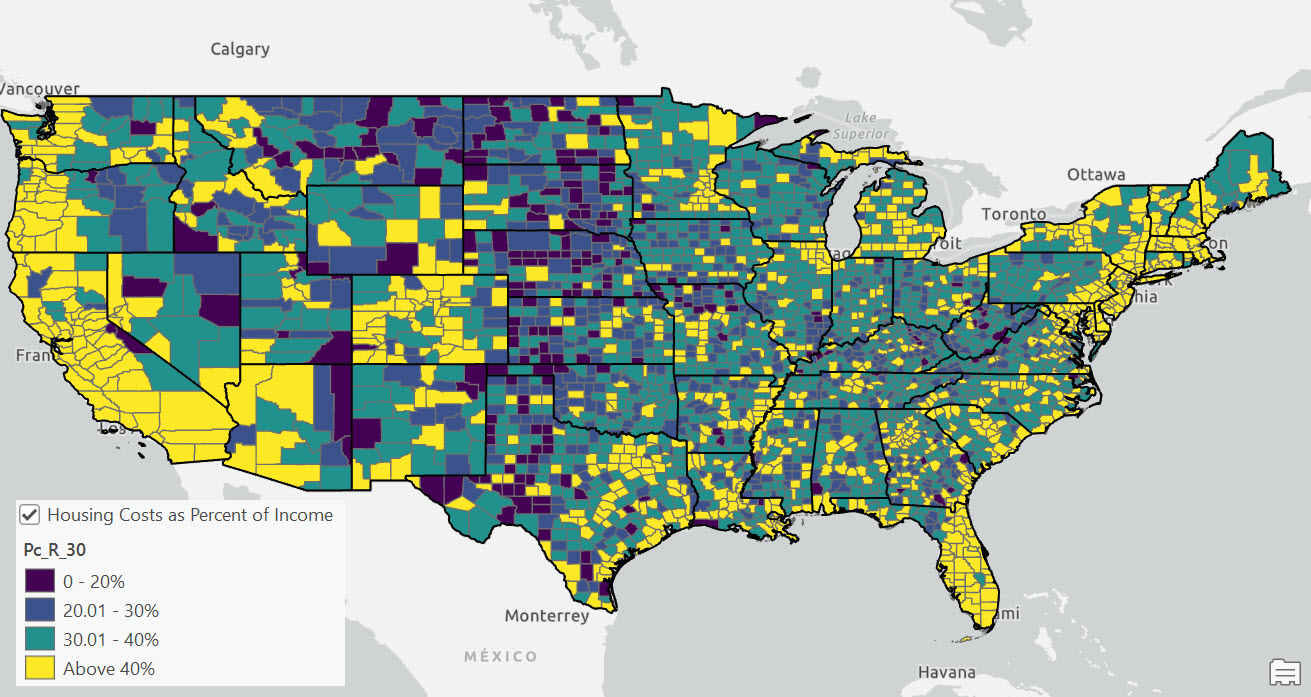

The report further reveals that 49.7 percent of America’s renters, equivalent to over 21 million households, are burdened by housing costs. The U.S. Department of Housing and Urban Development (HUD) considers renters spending more than 30 percent of their income on housing to be “cost-burdened.”

However, some experts argue that the 30-percent rule is too simplistic and fails to reflect the true extent of housing affordability issues. They suggest that a “severe” housing cost burden occurs when households spend more than 50 percent of their income on housing.

Despite the concerning statistics, the Census Bureau report also highlights a stability in the percentage of renter income devoted to housing costs. On average, this percentage remained at 31 percent last year, unchanged from 2022. Experts attribute this stability to the fact that renter incomes have generally kept pace with rising rent or that more higher-income households are choosing to rent.

Interestingly, homeowners faced a lower median housing cost as a percentage of income compared to renters. Homeowners with a mortgage spent 21.1 percent of their income on housing, while those without a mortgage spent 11.5 percent.

The Census Bureau report also sheds light on another significant expense for homeowners—property insurance. In 2023, more than 5.4 million homeowners in the United States paid $4,000 or more for homeowner’s insurance. Florida had the highest number of such households.

While the increase in rental costs and burden on renters were not uniform across the country, some states experienced significant rises in the share of renter incomes devoted to housing. Arizona saw a 6.5 percent increase in rental costs, while Florida and Georgia recorded 8.2 percent and 6 percent increases, respectively. On the other hand, six states, including Illinois, Kansas, Minnesota, New Mexico, New York, and West Virginia, saw a decrease in the share of renters’ incomes spent on rent.

Higher rent burdens not only make it difficult for individuals to afford other necessities like food and transportation but also hinder their ability to save for a down payment, making first-time homeownership even more elusive.

Overall, the Census Bureau’s report highlights the growing housing affordability crisis in the United States, particularly for renters. Though some stability in the percentage of renter income devoted to housing costs is observed, the burden remains significant. It is crucial for policymakers and stakeholders to address this issue to ensure that housing becomes more accessible and affordable for all Americans.