The next frontier for the ad market is shifting from traditional TV to screens near points of sale, such as those found in retail stores and gas stations. Retail and consumer product companies like Amazon, Walmart, and Kroger are investing billions of dollars in advertising through their retail media networks. According to eMarketer, global retail media ad spending is projected to more than double from $114.18 billion in 2023 to $233.89 billion in 2027. Retail media is also expected to represent a larger percentage of digital advertising spending, growing from 18.9% in 2023 to 25.7% in 2027.

The next frontier for the ad market is shifting from traditional TV to screens near points of sale, such as those found in retail stores and gas stations. Retail and consumer product companies like Amazon, Walmart, and Kroger are investing billions of dollars in advertising through their retail media networks. According to eMarketer, global retail media ad spending is projected to more than double from $114.18 billion in 2023 to $233.89 billion in 2027. Retail media is also expected to represent a larger percentage of digital advertising spending, growing from 18.9% in 2023 to 25.7% in 2027.

Brands are now more open-minded about where they can find their target audiences. Sean McCaffrey, the president and CEO of GSTV, an on-the-go media network with over 29,000 screens at refueling points, states that brands are no longer focused on buying a specific amount of TV, social, or digital ads. Instead, they are focused on buying growth and outcomes for their businesses. Mark Boidman, head of media and entertainment investment banking at Solomon Partners, describes screens near points of sale as the “new TV for mass reach advertising” and emphasizes the importance of reaching customers in stores or through apps.

Retail media networks offer various advertising opportunities, including in-store displays, websites, mobile apps, streaming services, smart TVs, and social media. These platforms provide advertisers with valuable first-party data, allowing them to optimize their exposure. For example, Walmart turns its approximately 170,000 digital screens in its U.S. stores into advertising opportunities. Advertisers can target consumers looking to spend by placing their ads in relevant areas of the store.

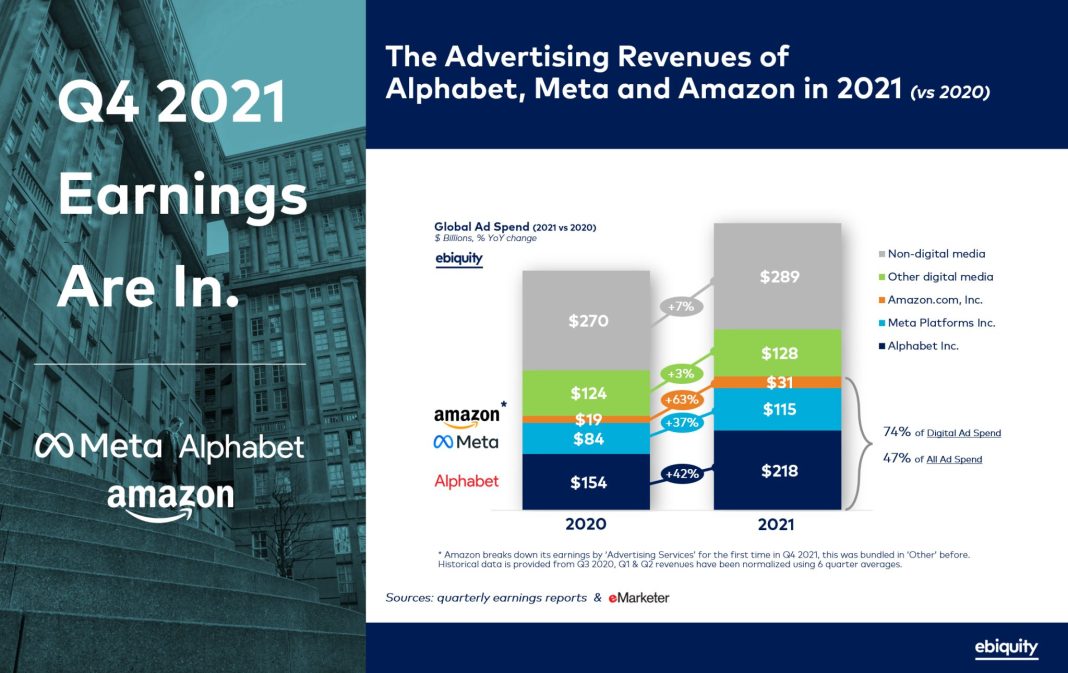

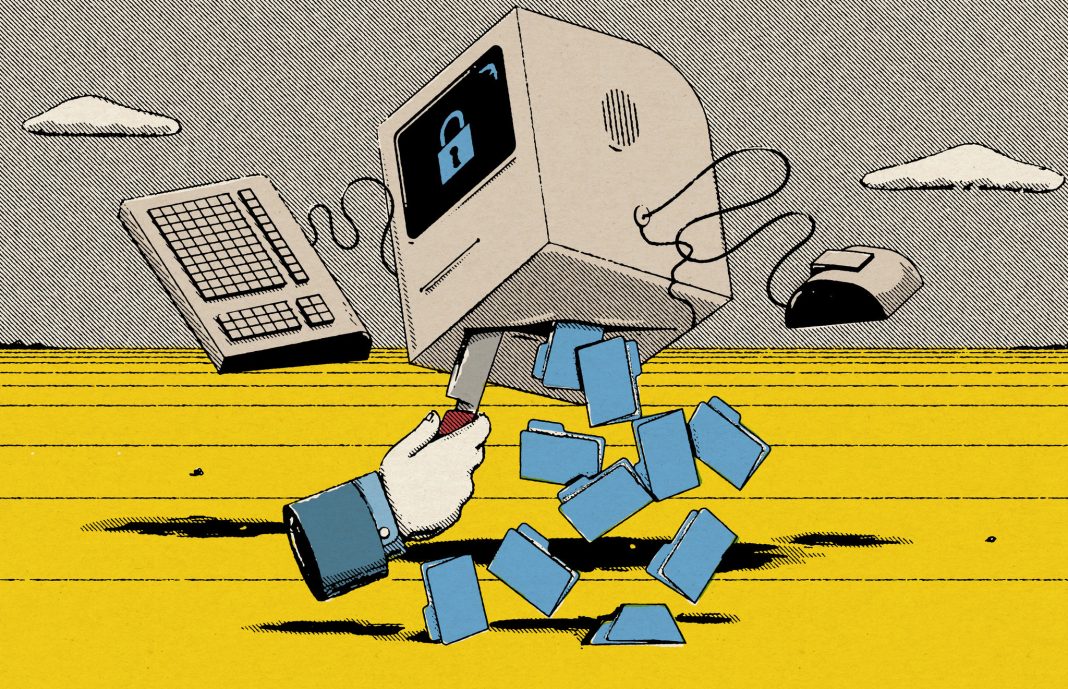

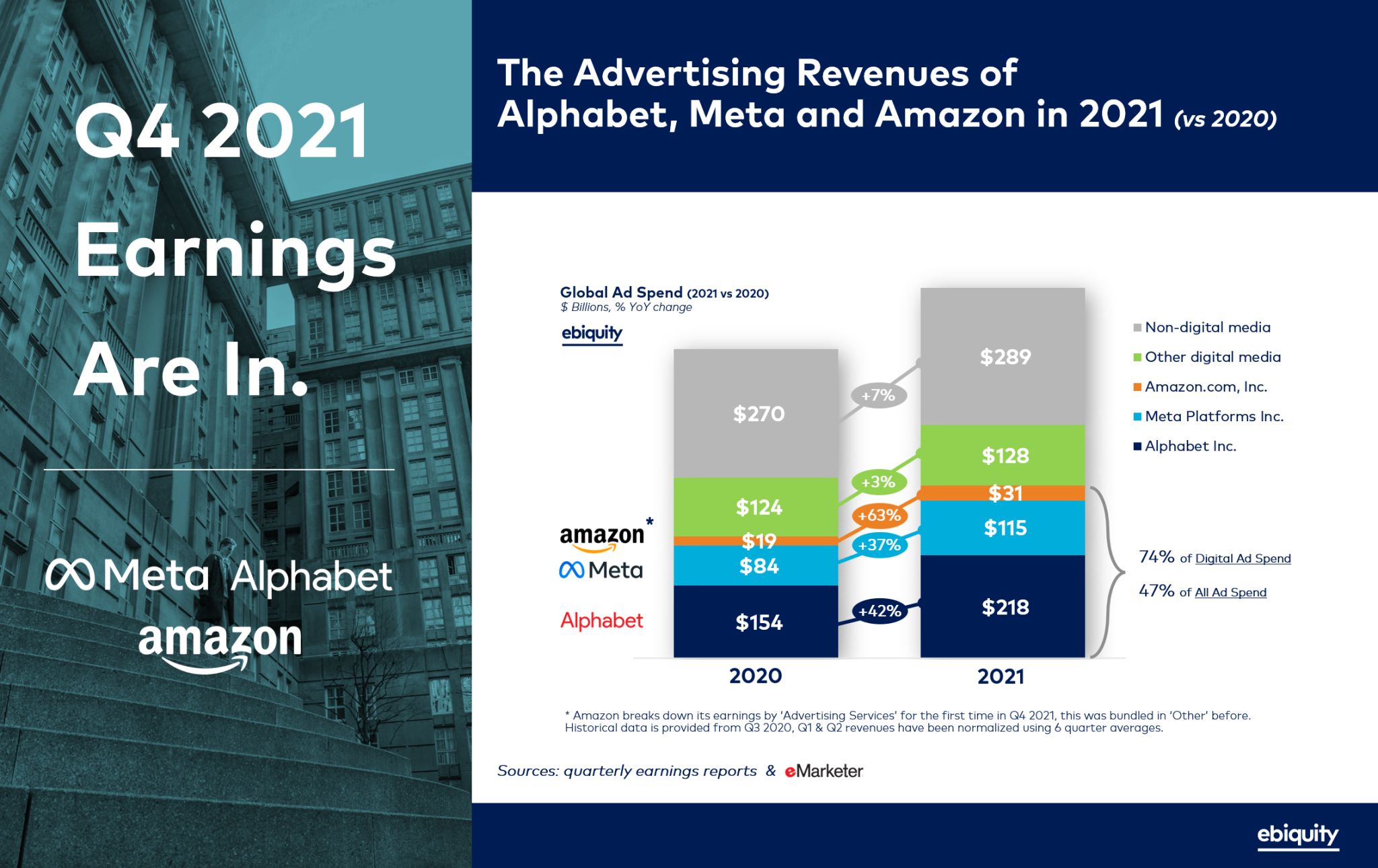

Amazon is considered the biggest retail media network in the U.S., with a roughly 75% share of retail media ad revenue. Other top networks include Walmart, Instacart, eBay, and Etsy. The shift toward retail media comes as advertisers face privacy changes in the tech industry. Google has started restricting the use of cookies, which track the online activity of users for targeted advertising. Advertisers are now navigating this transition and looking for alternative ways to reach their target audiences.

The rise of retail media ads coincides with major shifts in the media landscape. Pay-TV customer numbers and traditional TV viewership continue to decline as more viewers turn to streaming platforms. While ad buying in digital and streaming is rebounding, traditional TV still lags behind. Media giants like Disney, Warner Bros. Discovery, and NBCUniversal have seen declines in ad revenue for their traditional TV networks but growth in streaming ad revenue.

Kate Scott-Dawkins, GroupM’s global president of business intelligence, notes that linear TV advertising is still declining, and ad revenue has shifted from print and radio to TV and now toward digital over the past decade. Retail media revenue has grown significantly, from less than $1 billion in the U.S. a decade ago to a projected $42 billion this year. However, Scott-Dawkins points out that brand advertising budgets may not directly shift from traditional TV to on-site retail advertising. Instead, traditional TV revenue may move to smart TVs, driven by the data on customer spending habits provided by retailers.

In conclusion, the ad market is experiencing a significant shift from traditional TV to screens near points of sale. Retail media networks owned by companies like Amazon and Walmart are attracting billions of dollars in advertising. These networks offer various advertising opportunities and valuable first-party data. Advertisers are adapting to privacy changes in the tech industry while also exploring alternative ways to reach their target audiences. The rise of retail media ads coincides with declines in traditional TV viewership and ad revenue. The future of advertising lies in a multi-channel approach that includes TV, social media, e-commerce, and digital platforms.