Introduction:

Introduction:

Maintaining a balanced portfolio is essential for successful investing. It involves considering risk, returns, and diversification. As we age, our tolerance for risk changes, and our investment strategy should adapt accordingly. Rebalancing is a crucial aspect of portfolio management and should be done periodically to ensure that the portfolio remains aligned with our goals. Let’s explore the key factors to consider when balancing a portfolio and the strategies to implement.

Risk and Return:

Balancing risk and return is a fundamental principle of investing. When we are young, we can afford to take more risks as we have time to recover from potential losses. However, as we get older, preserving our principal becomes a priority. Therefore, our willingness to tolerate risk decreases with age. It’s important to reassess our risk tolerance as we go through different stages of life.

Returns are influenced by various factors such as interest rates and market conditions. Interest rates fluctuate over time, impacting the performance of bonds. Stocks can also experience volatility due to market speculation. It is crucial to stay informed about these changes and adjust our portfolio accordingly to optimize returns.

The Role of Diversification:

Diversification is a strategy that involves buying different types of investments to reduce overall risk and volatility. It spreads our investments across various assets that don’t typically move in the same direction or magnitude. This minimizes the possibility of any single investment negatively impacting the portfolio. However, it’s important to note that diversification may limit the upside potential as well.

Designing Your Asset Allocation:

Creating an initial asset allocation is a crucial step in portfolio management. This involves deciding how much of your portfolio should be allocated to different asset classes, such as stocks and bonds. The Rule of 110 is a helpful guideline for determining asset allocation. Subtracting your age from 110 provides the percentage of your portfolio that should be allocated to stocks, with the remainder going to bonds. As you age, the bond allocation should increase for safety and cash flow during retirement.

When to Rebalance Your Portfolio:

There are two approaches to rebalancing a portfolio. One is based on timing, such as a yearly schedule. The other involves rebalancing when the portfolio becomes unbalanced and deviates from the desired asset allocation. It’s crucial to resist emotional reactions driven by fear or greed while rebalancing. Selling assets during market downturns or buying when the market is overvalued goes against the principle of buying low and selling high.

Avoiding Common Traps:

During market downturns, the temptation to sell investments can be strong. However, sticking to the long-term strategy and resisting emotional reactions is vital. Rebalancing during market downturns involves selling bonds to buy stocks at lower prices. This helps restore the balance in the portfolio and takes advantage of discounted stock prices.

Diversification Considerations:

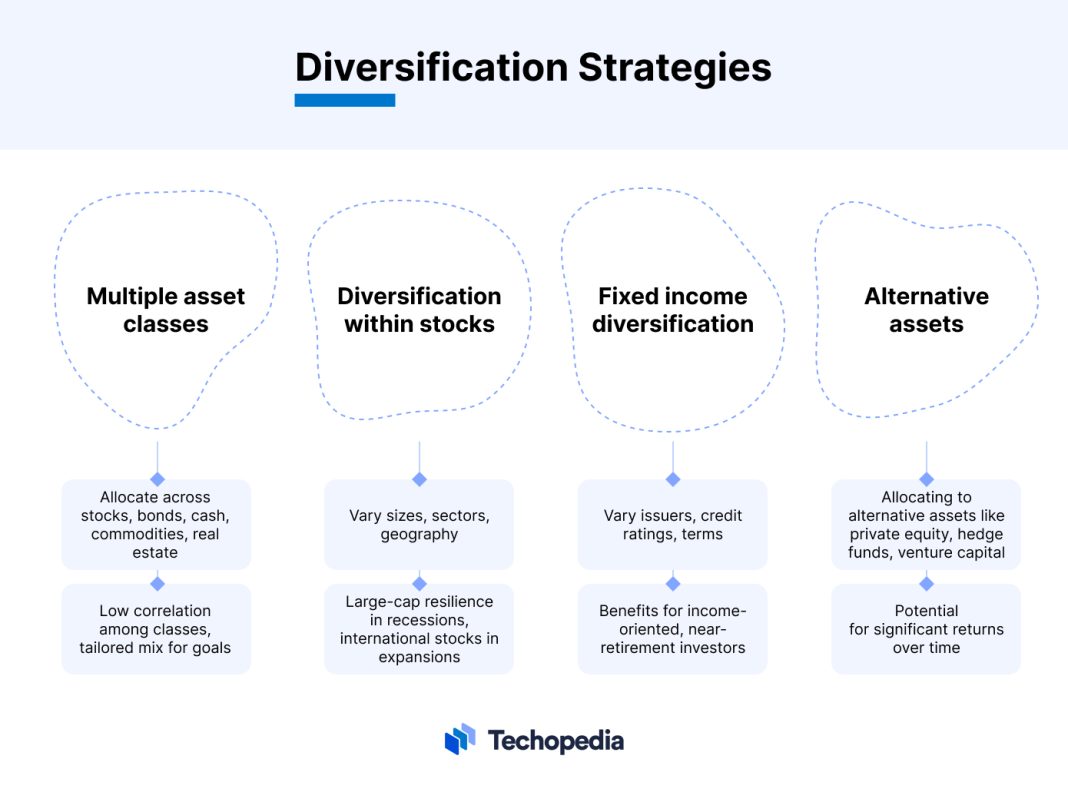

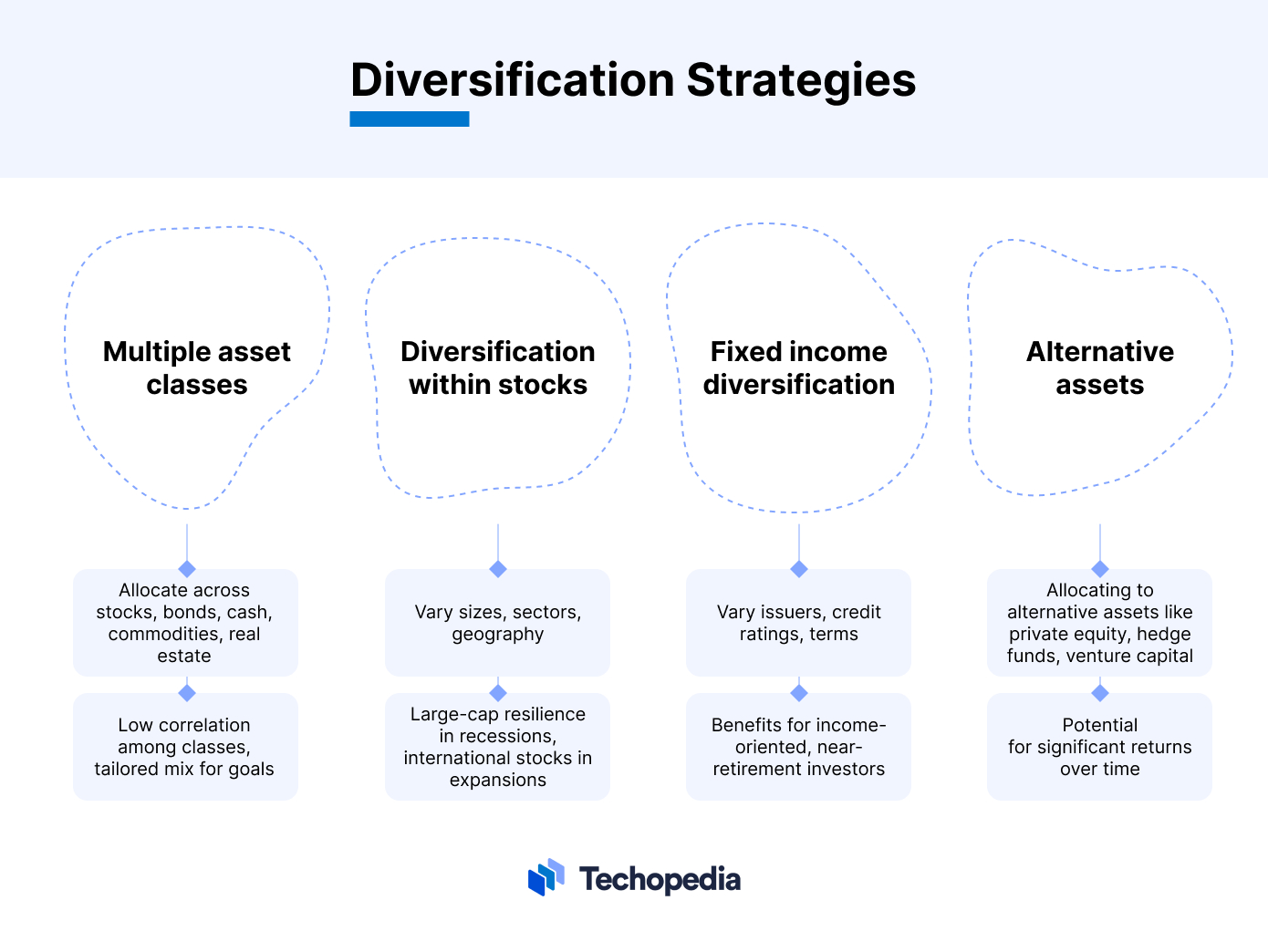

Diversification goes beyond broad categories like stocks, bonds, and cash. It involves considering various factors such as asset classes, company size, industries, geographic locations, and investing styles. By diversifying across these dimensions, we can further reduce risk and potentially enhance returns.

Portfolio Rebalancing Strategies:

Rebalancing a portfolio involves buying and selling investments to restore the original asset allocation mix. Different strategies can be employed to achieve this. Regularly analyzing new investments and adjusting the portfolio is one approach. Additionally, if most of your assets are in a single account, it becomes easier to rebalance. However, transaction costs and potential tax implications should be taken into account.

Disadvantages of Rebalancing:

While rebalancing is essential, it does come with some disadvantages. Transaction costs can reduce net income, and selling securities that are increasing in value may mean missing out on potential gains. Rebalancing requires knowledge and experience to reduce exposure to risk effectively. Additionally, short-term capital gains taxes may apply to stocks held and sold within one year. Nevertheless, these challenges can be overcome with practice and proper planning.

Conclusion:

Balancing a portfolio is a continuous process that requires diligent monitoring and adjustment. By considering risk, returns, and diversification, we can create an investment strategy that aligns with our goals. Rebalancing should be done periodically to ensure the portfolio remains on track. It is important to resist emotional reactions and stick to the long-term plan, even during market fluctuations. With careful consideration and strategic implementation, investors can achieve a well-balanced portfolio that maximizes returns while managing risk effectively.