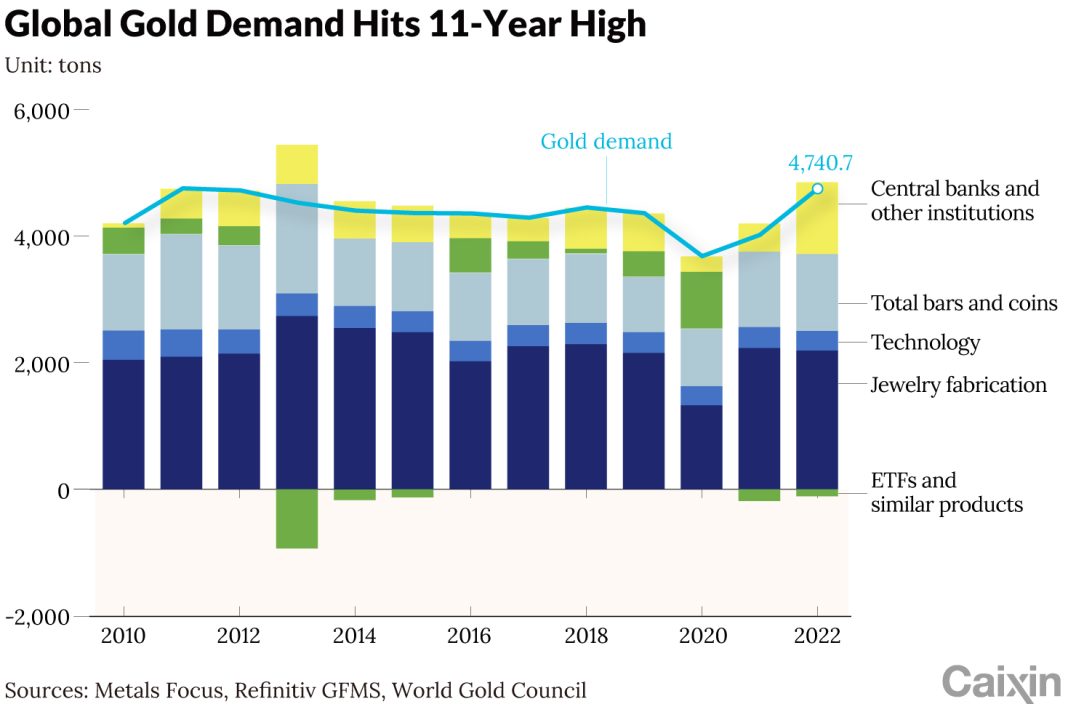

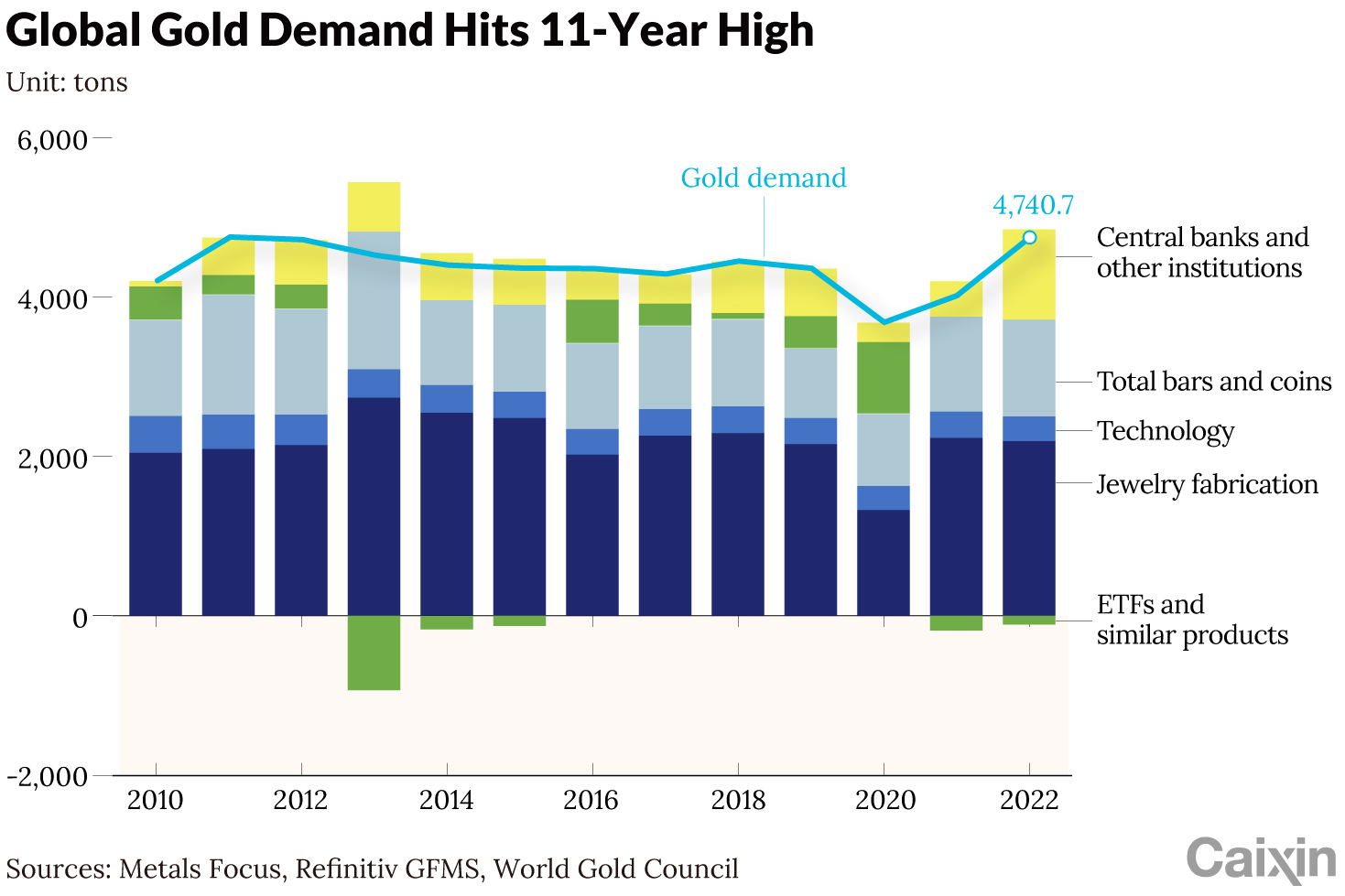

The demand for gold continues to be strong on a global scale, especially in Asia. Investors are increasingly turning to precious metals like gold and silver as a way to protect their portfolios against inflation, geopolitical tensions, and other risk factors that could destabilize the dollar. Peter Cardillo, the chief market economist at Spartan Capital Securities, emphasizes the importance of including gold in investment strategies due to its role as a hedge against economic uncertainties. He believes that owning gold makes sense in the current climate, particularly as a safeguard against geopolitical issues, inflation, and market volatility.

The demand for gold continues to be strong on a global scale, especially in Asia. Investors are increasingly turning to precious metals like gold and silver as a way to protect their portfolios against inflation, geopolitical tensions, and other risk factors that could destabilize the dollar. Peter Cardillo, the chief market economist at Spartan Capital Securities, emphasizes the importance of including gold in investment strategies due to its role as a hedge against economic uncertainties. He believes that owning gold makes sense in the current climate, particularly as a safeguard against geopolitical issues, inflation, and market volatility.

Cardillo suggests that while now may not be the optimal time to buy gold at its current levels, investors who don’t have gold in their portfolios should consider taking a position. For those who are already invested, he recommends holding onto their gold rather than buying more at the moment. He advises allocating a minimum of 5 percent and a maximum of 10 percent of one’s portfolio to gold, depending on the overall size of their investments.

The demand for gold remains robust, especially in Asia, with significant buying activity reported in China. This strong retail interest is seen as a positive factor for gold prices, as it often supports price stability and growth even amid potential market fluctuations.

Addressing concerns about potential government confiscation of gold, similar to what happened in 1933 under President Franklin D. Roosevelt, Cardillo acknowledges that while there is still some risk, it is relatively low in today’s context. He points out that the current demand for gold worldwide, especially in Asia, is strong. In past instances, individuals have found ways to protect their assets by moving them internationally, and there’s always a market for gold. While you may not be able to sell it at the desired price during extreme scenarios, there will always be buyers for gold.

Daby Benjaminé Carreras, another financial expert, adds that gold is actually money and can be accepted anywhere in the world. He explains that people have historically shipped their gold outside of the United States during times of potential confiscation. Carreras is also very bullish on gold and even more so on silver. He predicts a supercycle for silver and gold, referring to an extended period of growth and rising prices in the financial market.

Carreras advises investors to consider adding gold and silver to their portfolios, emphasizing the mistake of not owning these assets in the current economic climate. He recommends looking into companies with mining operations in key regions such as Nevada, Arizona, Mexico, Peru, and Brazil. Carreras tracks data through various means, including filings, press releases, reports on mineral projects, and assessments.

He also highlights global economic and geopolitical factors that could influence the precious metals market. He mentions China’s decreasing support for its supply chains and rising shipping costs, which are changing the dynamics of global trade. Additionally, potential changes in currency classifications by countries like Russia could further impact the value and demand for gold and silver.

In conclusion, the demand for gold remains strong globally, especially in Asia. Experts like Peter Cardillo and Daby Benjaminé Carreras emphasize the importance of including gold and silver in investment portfolios as a hedge against economic uncertainties. They recommend allocating a percentage of one’s portfolio to these precious metals and suggest considering companies with mining operations in key regions. While concerns about potential government confiscation exist, the experts believe the risk is relatively low, and there will always be a market for gold. They predict a supercycle for silver and gold and highlight global economic and geopolitical factors that could influence the precious metals market. Overall, owning gold and silver in the current economic climate is seen as a wise decision.