Analyzing the fiscal situation under different presidents can be a complex task, but it is essential to evaluate the economic impact of their policies. When examining the fiscal data during former President Trump’s tenure, it is crucial to consider the period until February 2020, before the COVID-19 pandemic disrupted the global economy.

Analyzing the fiscal situation under different presidents can be a complex task, but it is essential to evaluate the economic impact of their policies. When examining the fiscal data during former President Trump’s tenure, it is crucial to consider the period until February 2020, before the COVID-19 pandemic disrupted the global economy.

Looking at the Federal receipts and outlays data from the U.S. Treasury, we observe interesting trends. In the first 2⅓ years of office, the year-over-year (YoY) growth of Federal receipts remained relatively stable, fluctuating between minus 3 percent and 3 percent. However, after this period, until just before the outbreak of COVID-19, the growth rate surged to over 6 percent. On the other hand, Federal outlays experienced growth below but close to 5 percent in the first two years or so. Subsequently, it fluctuated between 5 percent and 10 percent. These patterns may be attributed to the overall performance of the economy, as real GDP YoY growth accelerated from 1.9 percent in Q1 to 3.2 percent in Q4 of 2019.

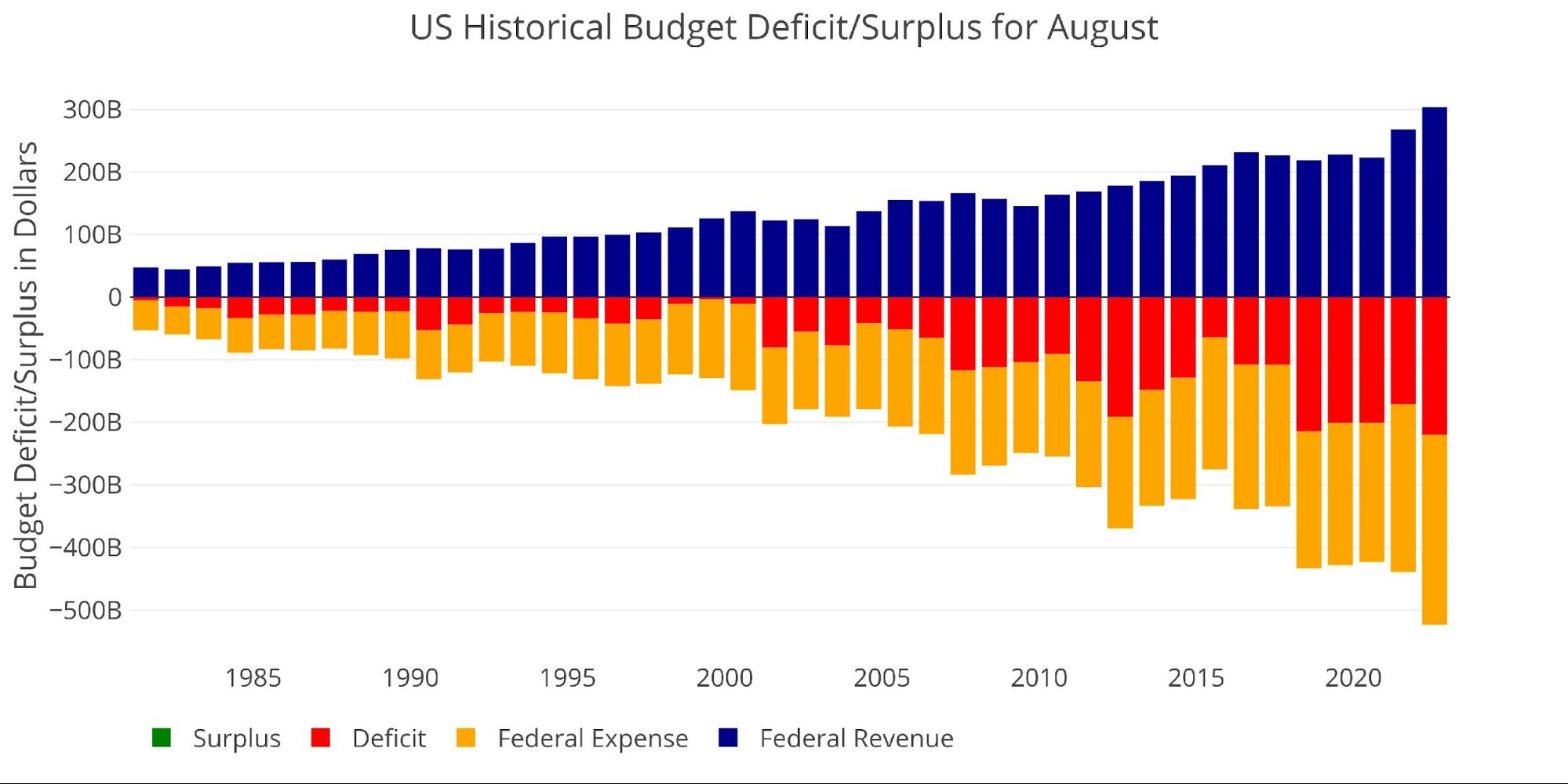

Contrasting this with President Biden’s recent years in office, we find a similar fiscal situation. While it is challenging to conduct a year-over-year analysis due to abnormal figures during the COVID-19 period and subsequent base effects, we can examine the monthly deficits. Over the past two years, the monthly deficit often exceeded 200 billion U.S. dollars, even though the impact of COVID-19 should have subsided by then. This was noticeably higher than the deficits during former President Trump’s time in office from 2017 to 2019.

These findings suggest that fiscal deficits may not be solely related to who is in office, but rather influenced by economic factors. However, when we delve into the data, the correlation becomes less clear. When analyzing the annual real GDP, Federal receipts, and outlays, we observe that correlations between GDP and receipts/outlays were more apparent during times of World Wars or Great Depressions. In the postwar to pre-COVID-19 era, these correlations were significantly lower. This discrepancy can be attributed to countercyclical fiscal policies, which aim to offset the economic fluctuations and stabilize the fiscal situation. Additionally, inflation also plays a role, as it influences deficits growth inversely when it is high.

Considering all these factors, it becomes evident that modeling the fiscal situation requires a comprehensive framework. It is essential to avoid politicizing the topic of fiscal, as it is primarily an economic matter concerned with income and expenditure. While the evidence of former President Trump’s fiscal expansionary policies remains unclear, it is crucial to focus on the economic aspects rather than making it a partisan issue.

In conclusion, the fiscal situation during different presidential tenures cannot be solely attributed to the individuals in office. Economic factors, such as GDP growth, countercyclical fiscal policies, and inflation, play significant roles. Analyzing the data in a broader historical context provides a more accurate understanding of the fiscal dynamics. By reframing the discussion in economic terms, we can gain valuable insights and avoid unnecessary politicization of the topic.