The devastating effects of inflation over the past three years have taken a toll on households and businesses operating on narrow margins. Despite being repeatedly assured that inflation was transitory and not a major concern, it is now clear that this was never the case. In fact, the loss of purchasing power experienced by the dollar over the past three years is more severe than anything seen since the late 1970s.

The devastating effects of inflation over the past three years have taken a toll on households and businesses operating on narrow margins. Despite being repeatedly assured that inflation was transitory and not a major concern, it is now clear that this was never the case. In fact, the loss of purchasing power experienced by the dollar over the past three years is more severe than anything seen since the late 1970s.

To put this into perspective, it took several decades for the dollar to lose a quarter of its value in previous instances of inflation. However, in just three short years, the current inflation has led to a similar loss. It’s important to note that these numbers are likely underestimated as they fail to account for factors such as interest rates, rent, health insurance costs, and the impact of shrinkflation, quality changes, and hidden fees.

The erosion of purchasing power has significant consequences for living standards. It means that individuals and families must work harder, struggle to make ends meet, and find it difficult to get ahead financially. Additionally, it discourages saving and rewards spending, which goes against the principles of financial prudence.

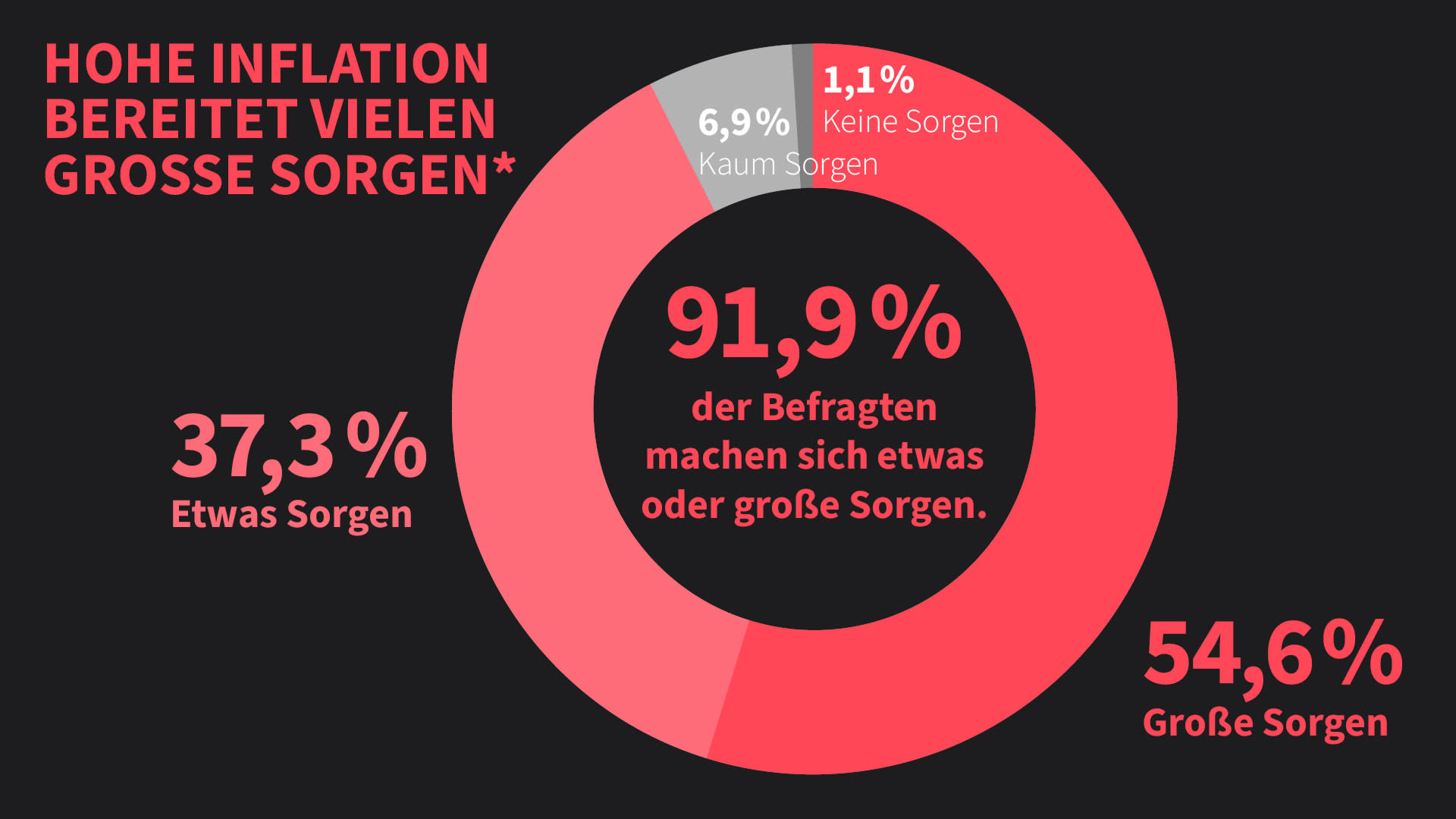

This rapid loss of purchasing power within such a short timeframe has had a detrimental impact on economic structures. It has also left individuals feeling uncertain about whether they are getting a good deal or being overcharged when shopping. Inflation transforms the once-enjoyable experience of shopping into a tedious and frustrating task. For many people, it is downright terrifying as they struggle to keep up with rising prices.

Inflation can be likened to being in a foreign country with an unfamiliar currency. The prices quoted feel detached from any context that is familiar to us. This disorientation and uncertainty can lead to social and cultural upheaval. While we are not currently experiencing extreme hyperinflation on the level of Weimar in 1922, we are witnessing some of its effects. It was the inflation of the 1970s that led to the shift from one-income households to two-income households, and now there is a growing trend towards three-income households.

From the perspective of a business manager, inflation presents numerous challenges. The costs of goods and services needed for business operations are constantly increasing, putting pressure on profit margins. Additionally, employees are demanding higher wages due to their own financial struggles and the availability of job opportunities elsewhere. Well-established and well-funded businesses are better equipped to navigate these challenges compared to those operating on thin margins or reliant on credit.

Small businesses have faced a series of setbacks in recent years, starting with forced closures due to the pandemic, followed by capacity restrictions, supply chain disruptions, and mask mandates. The threat of mandatory vaccinations for employees has only added to their difficulties. Inflation compounds these challenges by driving up costs across the board.

Businesses must find ways to absorb the impact of inflation while also striving to keep prices reasonable for consumers. No business wants to raise prices and risk alienating customers. Some have resorted to reducing product sizes or quality, or introducing hidden fees. For example, many restaurants have increased prices for alcoholic beverages, knowing that customers are less likely to scrutinize those costs. However, these strategies are not sustainable solutions and can lead to customer dissatisfaction.

Prices play a vital role in our economy as they convey important information and guide rational decision-making. Without stable prices, economic rationality is compromised, making it difficult for producers and consumers to make informed choices. Price controls and other forms of government intervention distort the price system, leading to economic inefficiency and reduced productivity.

The current inflationary pressures, combined with the disruptions caused by the pandemic, have dealt a severe blow to the U.S. economy. The consequences will be felt for years to come. It is essential to recognize the importance of stable prices and the role they play in promoting economic prosperity. Failure to address inflationary pressures will only further undermine our economic vitality.