China’s housing sector has been struggling, leading the government to take measures to address the excess supply. One of the most significant actions taken is the provision of 300 billion yuan by Chinese banks to clean up the excess. However, this amount is far from sufficient considering the estimated 50 million excess properties in China. Even if we assume a conservative value of 100,000 yuan per unit, the outstanding amount would already be 5 trillion yuan. The 300 billion yuan provided by banks only accounts for 6 percent of the total outstanding amount.

China’s housing sector has been struggling, leading the government to take measures to address the excess supply. One of the most significant actions taken is the provision of 300 billion yuan by Chinese banks to clean up the excess. However, this amount is far from sufficient considering the estimated 50 million excess properties in China. Even if we assume a conservative value of 100,000 yuan per unit, the outstanding amount would already be 5 trillion yuan. The 300 billion yuan provided by banks only accounts for 6 percent of the total outstanding amount.

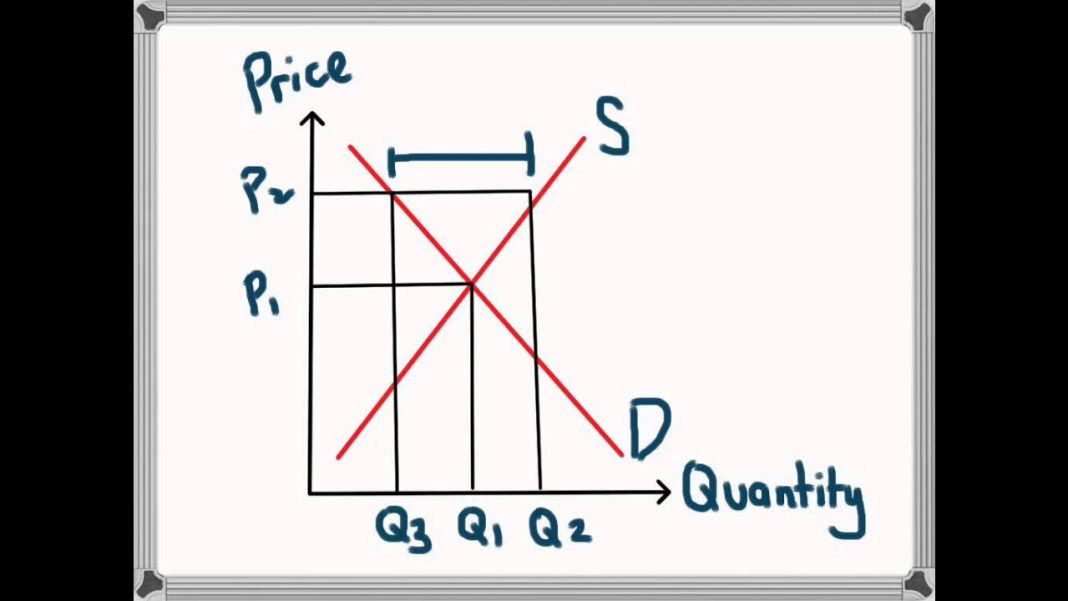

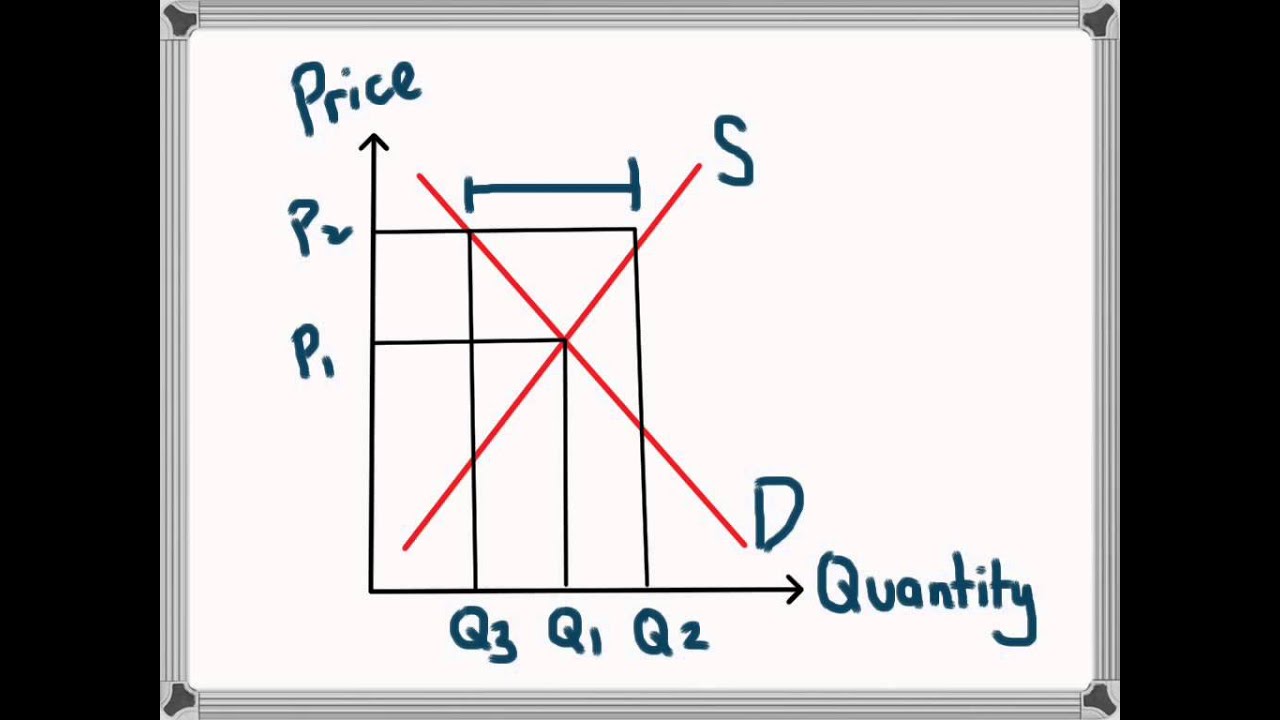

Furthermore, it is important to note that the funding for the rescue measures is not through central bank money creation, but through bank lending. This raises concerns about the likelihood of repayment, especially if the housing market does not recover soon. The spiral between asset-liability imbalance and price fall has already been established, indicating a challenging situation for banks in terms of bad debt. If the market bottoms out and turns bullish, there may not be a need for rescue measures. This suggests that the official view on the housing market is still pessimistic.

It is worth noting that banks do not create money out of nothing. Potential bad debt from bank lending would ultimately result in losses for deposit clients, affecting everyone. While it may seem that the total outstanding bank deposit is sufficient to cover all housing debt, negative equity is not limited to real estate developers but also affects general households. Households with outstanding mortgages are also at risk of bankruptcy. The level of risk depends on the gearing ratio, which can vary greatly among developers and households. In some cases, households may have higher leverage than safe developers.

The decision to use bank deposits to rescue developers shifts the risks towards households. While the bankruptcy of a developer can lead to visible bad debts and unemployment, the widespread bankruptcy of households should not be overlooked. Recent economic figures indicate that consumption demand is weak compared to sectors like production, suggesting a correlation with the housing bust. However, there is a mystery surrounding this comparison when looking at official figures.

A chart comparing China’s real residential housing prices with real GDP growth rates reveals an interesting discrepancy. Despite both indicators showing similar directions, there has been a significant gap in levels in recent years. This raises two possibilities for interpretation. One possibility is that the GDP numbers are inflated or inaccurate. There have been discussions about the reliability of China’s GDP figures, especially when PMI began to contract while GDP growth remained high. Another possibility is that there has been a significant boost in building and construction leveraging to artificially inflate the GDP number. Both factors may be at play.

Considering all these factors, it can be argued that China is already in a deep recession, regardless of the official figures. The challenges in the housing sector, coupled with the potential risks to households and the discrepancies in economic indicators, paint a concerning picture for China’s economy. The government’s rescue measures may provide temporary relief, but addressing the underlying issues and promoting sustainable growth will require more comprehensive strategies.