Chinese Foreign Direct Investment (FDI) in Europe has undergone significant changes in recent years, with the United Kingdom (UK) losing its status as the top destination. According to a report by consultancy Rhodium Group and German think tank Mercator Institute for China Studies, the UK, Germany, and France were the leading recipients of Chinese FDI between 2000 and 2023. However, mergers have declined in recent years due to geopolitical shifts and economic challenges in China.

Chinese Foreign Direct Investment (FDI) in Europe has undergone significant changes in recent years, with the United Kingdom (UK) losing its status as the top destination. According to a report by consultancy Rhodium Group and German think tank Mercator Institute for China Studies, the UK, Germany, and France were the leading recipients of Chinese FDI between 2000 and 2023. However, mergers have declined in recent years due to geopolitical shifts and economic challenges in China.

The report highlights that while the UK attracted €75.6 billion (£64.4 billion) of Chinese FDI since 2000, Germany received €33.2 billion (£28.3 billion), and France received €21.9 billion (£18.7 billion). However, recent investments have focused on greenfield projects in central Europe, with Hungary surpassing the “Big Three” to become the top European destination for Chinese FDI in 2023.

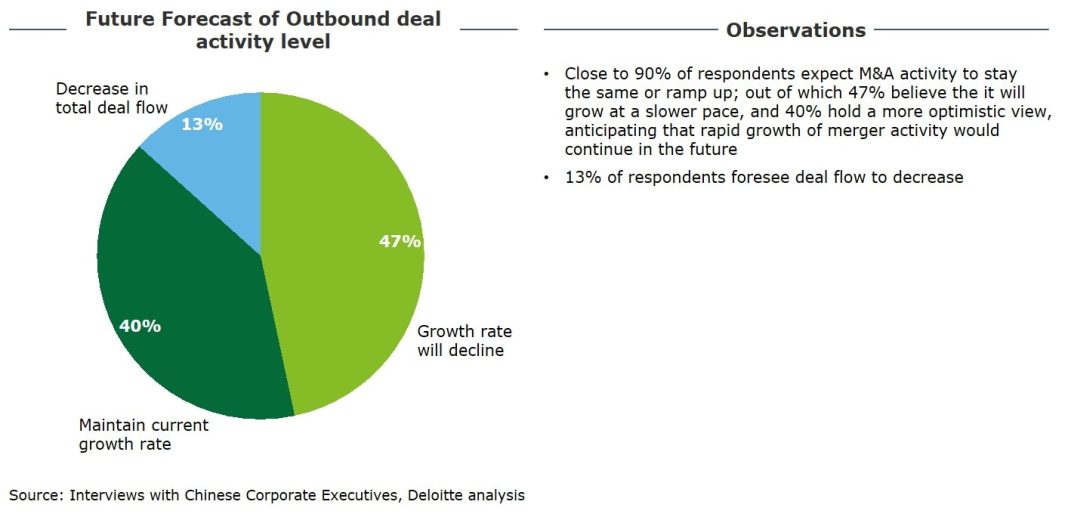

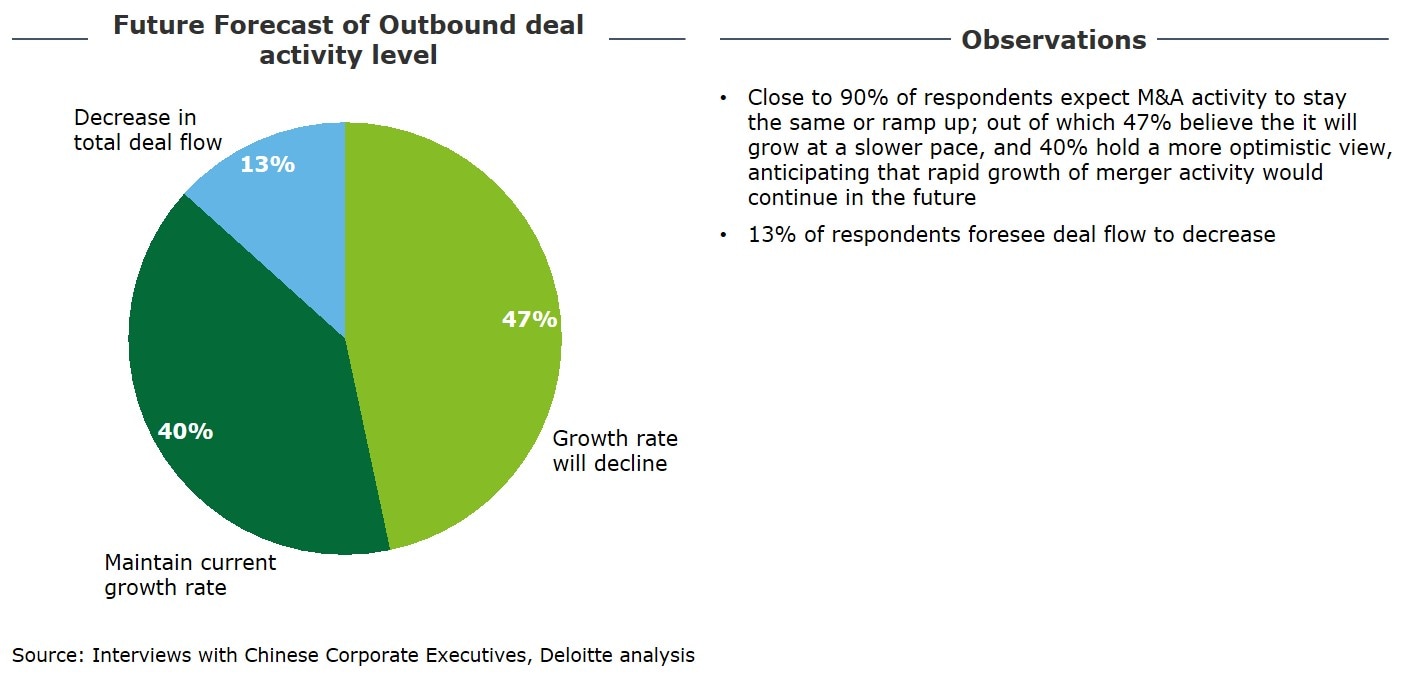

The decline in Chinese FDI in Europe is evident when considering the overall numbers. In 2023, Chinese FDI in Europe plummeted to €6.8 billion (£5.8 billion), the lowest level since 2010. This figure is significantly lower than the €7.1 billion (£6 billion) recorded in 2022 and the peak of €47.5 billion (£40.5 billion) in 2016. The decrease can be attributed to a decline in mergers and acquisitions (M&A), which previously accounted for the majority of Chinese investments in Europe.

The report suggests that China’s economic challenges, strict capital controls, and increased scrutiny of foreign investment contributed to the decline in M&A deals. However, despite the overall decline, greenfield electric vehicle (EV) projects have helped sustain Chinese FDI levels and have become dominant in recent years.

Hungary emerged as a major destination for Chinese FDI due to significant investments in battery plants by companies such as CATL and Huayou Cobalt, totaling €8.7 billion (£7.4 billion). In 2023, Hungary attracted 44.1 percent of all Chinese FDI in Europe, surpassing the UK, Germany, and France. These three countries accounted for 35.3 percent of Europe’s Chinese FDI in the same year.

Apart from EV projects, sectors such as healthcare, consumer products, entertainment, and information and communication technology (ICT) have continued to attract Chinese investment. Between 2021 and 2023, these sectors received an average annual investment of €3.1 billion (£2.6 billion). On the other hand, transport, real estate, and the financial and business sectors experienced significant declines in investment values.

The report highlights that the healthcare, consumer, and ICT sectors now absorb approximately 70 percent of non-EV-related Chinese FDI in Europe. This marks a doubling of their share from 35 percent in 2014 to 2023. However, the authors anticipate increased scrutiny of Chinese investment in the healthcare sector due to investigations by the European Union (EU) into China’s procurement of medical devices and the European Commission’s recognition of biotech as a critical technology for Europe’s economic security strategy.

In the UK, the implementation of the National Security and Investment Act 2021 has resulted in increased government interventions to protect national security interests. Around half of the two dozen interventions made by the UK government were aimed at limiting or blocking Chinese takeovers of British infrastructure or dual-use manufacturers.

In conclusion, while the UK has historically been the top destination for Chinese FDI in Europe, recent trends indicate a shift towards greenfield EV projects in central Europe, with Hungary emerging as a prominent recipient. The decline in overall Chinese FDI in Europe can be attributed to a decrease in mergers and acquisitions, driven by China’s economic challenges and increased scrutiny of foreign investment. Sectors such as healthcare, consumer products, and ICT continue to attract Chinese investment, but the healthcare sector may face heightened scrutiny in the future. The implementation of the National Security and Investment Act 2021 in the UK has led to increased government interventions to safeguard national security interests.