Taxpayers residing in areas affected by natural disasters have the option to avail payment extensions for their taxes. The Internal Revenue Service (IRS) recently issued a statement reminding taxpayers about the upcoming deadline for making third-quarter estimated tax payments, which is September 16. Failure to make these payments or underpaying can result in penalties.

The IRS explained that taxes must be paid as income is earned or received throughout the year. This can be done through withholding or estimated tax payments. Specifically, taxpayers such as gig workers, sole proprietors, retirees, partners, and S corporation shareholders should make estimated tax payments if they expect to have a tax liability of $1,000 or more when they file their return.

However, the September 16 deadline does not apply to individuals who work, live, or have a business in a disaster region. These individuals automatically qualify for a delayed deadline. For residents of certain parts of Arkansas, Iowa, Mississippi, New Mexico, Oklahoma, Texas, and West Virginia, the deadline to make estimated tax payments is extended until November 1. Eligible citizens from Florida, Georgia, Kentucky, Minnesota, Missouri, North Carolina, Puerto Rico, South Carolina, South Dakota, Texas, Vermont, and the Virgin Islands have even more time, until February 3, 2025.

It’s important to note that taxpayers who underpay their estimated taxes will have to pay penalties. These penalties are imposed at a rate of 0.5 percent of unpaid taxes for each month the payment remains due, with a maximum penalty of 25 percent of unpaid taxes. Additionally, individuals who delay filing their taxes will be charged additional penalties. In such cases, the penalty is 5 percent of unpaid taxes per month until the return is filed, up to a maximum of 25 percent of the unpaid taxes.

However, the IRS does provide an option for taxpayers who underpaid their taxes due to unusual circumstances rather than wilful neglect. They can seek a penalty waiver. The IRS also noted that special rules apply to certain groups of taxpayers, such as farmers, fishermen, casualty and disaster victims, those who recently became disabled, recent retirees, and those who receive income unevenly throughout the year.

To ensure that taxpayers meet their estimated tax-payment obligations, they should generally pay at least 90 percent of the taxes owed on their 2024 returns or at least a minimum of 100 percent of their 2023 taxes. For employed individuals, the taxes withheld from their paychecks may be enough to meet these obligations. However, there may be cases where the employer does not withhold adequate taxes, leading employees to underpay estimated taxes and become subject to penalties.

To avoid this situation, taxpayers can use the IRS’s Tax Withholding Estimator. This tool helps calculate the appropriate amount that employers should withhold from paychecks. Taxpayers will need information from their pay stubs, other income details, and their most recent tax form to use the tool effectively.

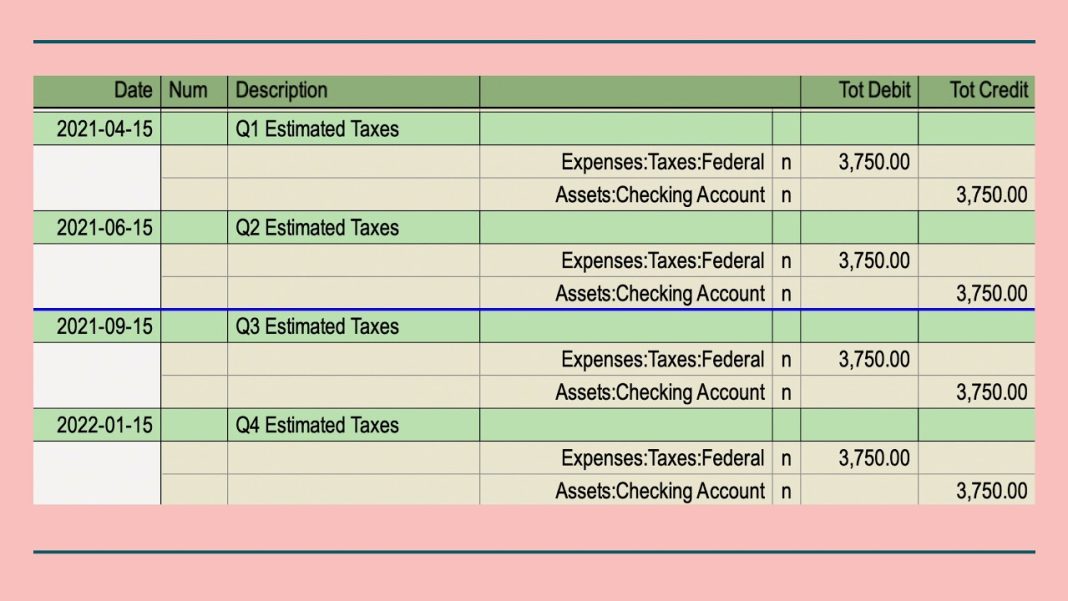

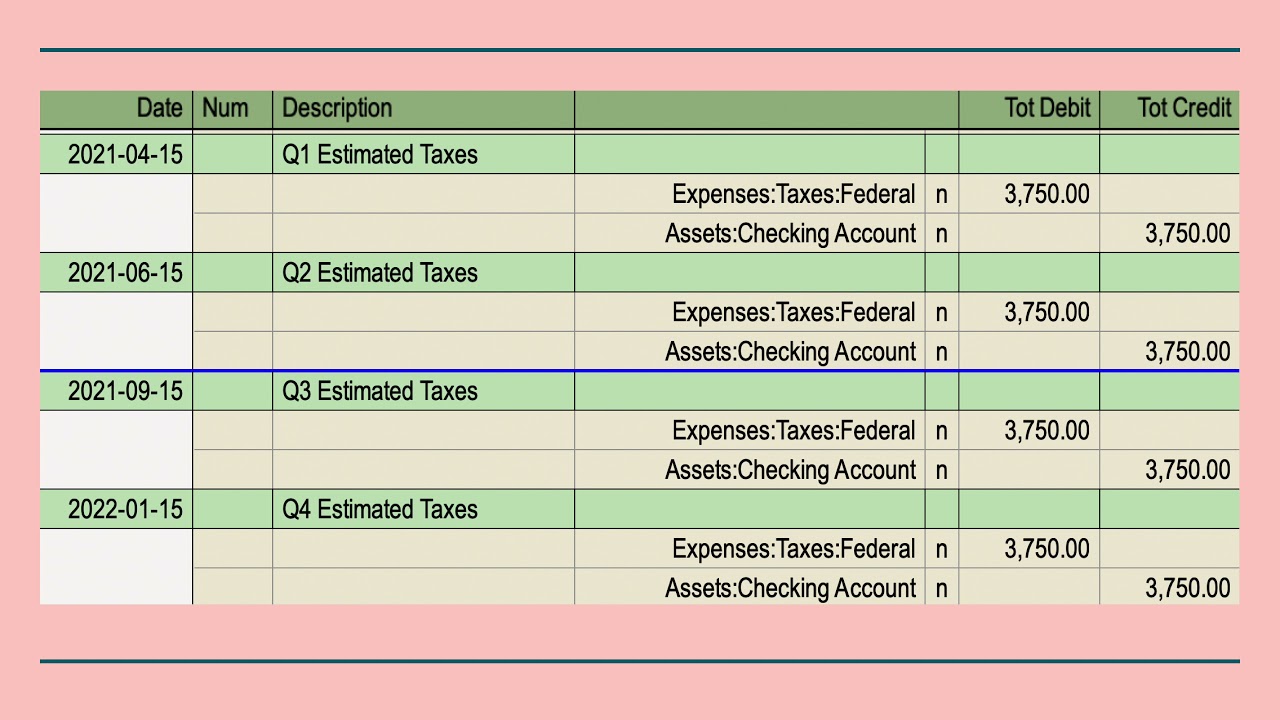

The IRS offers another tool that taxpayers can use to determine if they are required to make estimated tax payments. These payments can be made online through an IRS Online Account or using IRS Direct Pay. The acceptable payment methods include checking or savings accounts, debit cards, credit cards, and digital wallets. The IRS recommends making electronic payments as they are the easiest, fastest, and most secure way to make estimated tax payments.

In situations where taxpayers are unable to pay their taxes in full by the deadline, they can apply for a payment plan. If approved by the IRS, they can pay the balance in monthly installments.

Lastly, the IRS reminded individuals who received money through payment apps, online marketplaces, or payment cards that they may receive Form 1099-K for these transactions. This applies to people involved in the sales of goods and services online. The IRS emphasized that taxpayers must report their income, unless it is excluded by law, regardless of whether they receive a Form 1099-K or any other third-party reporting document. The 1099-K reporting threshold for third-party reporting does not change what counts as income or how tax is calculated.

In conclusion, taxpayers residing in disaster-affected areas have the option to avail payment extensions for their taxes. It is crucial to meet estimated tax-payment obligations to avoid penalties. The IRS provides tools and resources to help taxpayers calculate the appropriate amount of taxes to be withheld and make online payments. Additionally, taxpayers who face financial difficulties can apply for payment plans. It is important to report all income, regardless of whether a Form 1099-K is received. By following these guidelines, taxpayers can fulfill their tax obligations effectively and avoid unnecessary penalties.