Study Reveals Overwhelming Dominance of Left-Wing Shareholder Proposals

Study Reveals Overwhelming Dominance of Left-Wing Shareholder Proposals

A recent study conducted by Consumers’ Research has found that left-wing activists, supported by government agencies like the Securities and Exchange Commission (SEC), overwhelmingly dominate the campaign to influence corporations on political and social issues. The study analyzed shareholder proposals submitted under Rule 14a-8 between 2018 and 2022 and discovered that there were 1,063 left-leaning proposals compared to only 87 conservative proposals. This translates to a rate of over 12 liberal-aligned proposals for every conservative-aligned proposal.

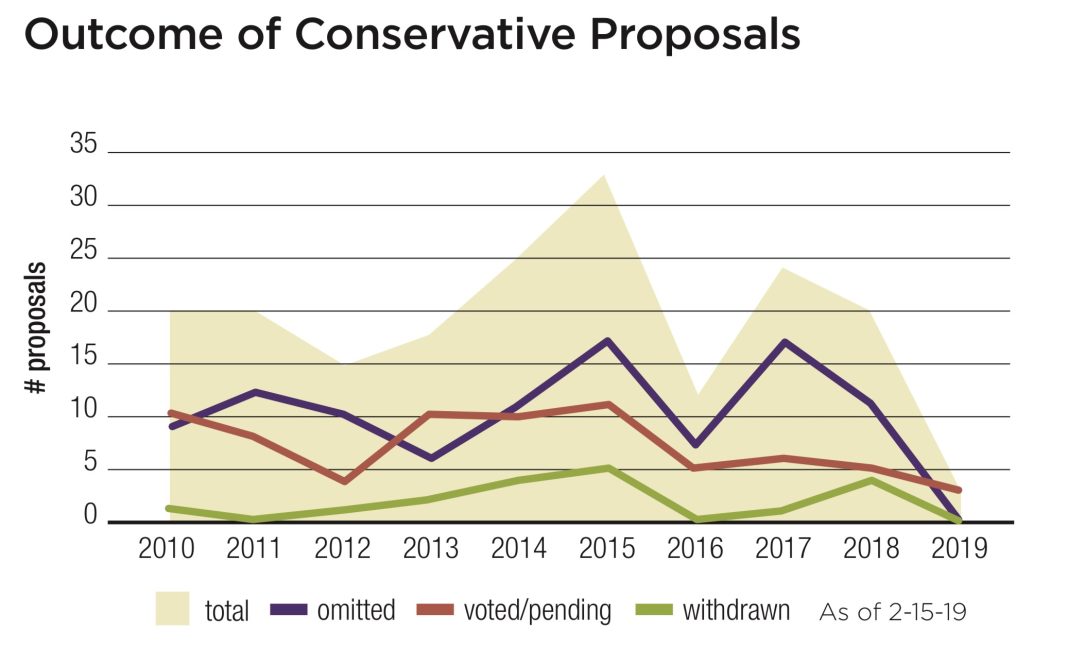

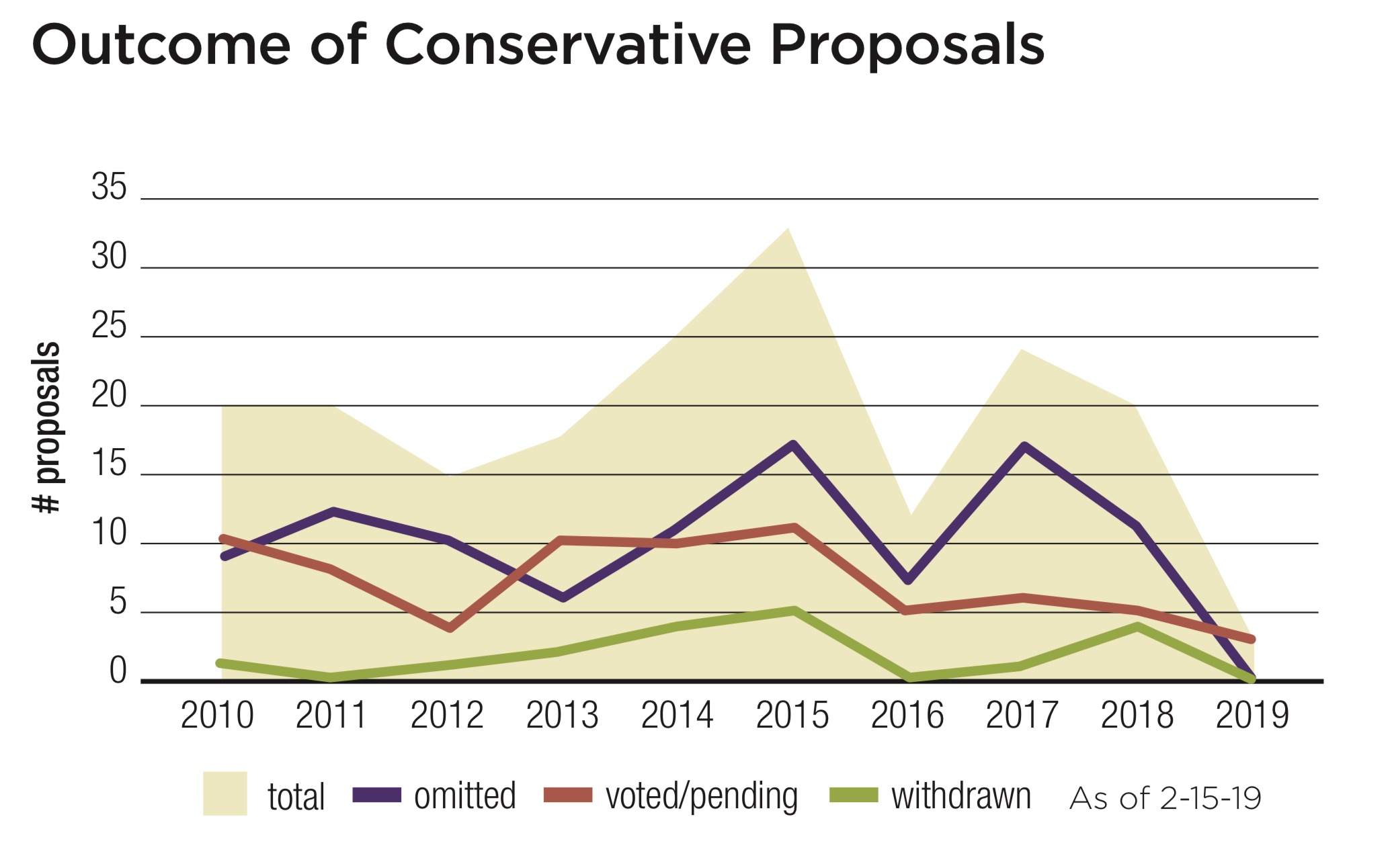

Contradicting earlier reports that highlighted the rise of conservative investors seeking to address woke culture in corporations, the study shows that conservative shareholders are largely absent from the shareholder proposal process. Scott Shepard, director of the Free Enterprise Project, a conservative organization that files shareholder resolutions and lawsuits, stated that while they have been able to file a few more proposals in recent years, the majority of proposals still come from left-wing ESG (environmental, social, and governance) outfits. He also noted that about 90% of social and environmental proposals still originate from the left, although this percentage has decreased slightly in recent years.

The Rise of the ESG Movement

The ESG movement, born out of a United Nations initiative in 2004, aims to align private companies with the UN’s 17 Sustainable Development Goals. This movement has given rise to an entire industry comprising ESG fund managers, credit rating agencies, consultants, NGOs, and government regulators. Their goal is to pressure companies to adopt sustainable practices, advocate for social and racial equity, and support political campaigns such as gun control and transgender rights.

The Success of ESG Pressure Campaigns

The ESG campaign has been successful in aligning corporate executives with its goals. A report by Ernst and Young states that sustainability has become crucial for companies as they position themselves for the future. The ESG industry is also backed by significant financial resources, with funds supporting the movement surpassing $30 billion and projected to exceed $40 billion by 2030.

Major players in the financial sector, including BlackRock, State Street, and Vanguard, have joined the ESG movement and are actively involved in supporting ESG initiatives. These institutions, along with proxy agents Institutional Shareholder Services (ISS) and Glass Lewis, which control 90% of the shareholder advisory market, can exert significant influence over shareholder votes.

SEC’s Role and Allegations of Bias

According to the Consumers’ Research report, the SEC, responsible for overseeing shareholder voting under the Securities Exchange Act of 1934, has shown bias in favor of left-wing proposals. A recent SEC staff legal bulletin curtailed management’s ability to reject shareholder resolutions, particularly on social justice issues. Following the implementation of this bulletin, the number of proposals, especially related to ESG, rose significantly.

Conservatives argue that the SEC’s bias goes beyond the numbers presented in the report. Will Hild, CEO of Consumers’ Research, believes that the SEC lacks credibility as a fair arbiter for shareholders. He points out that many left-wing proposals are rejected by the SEC because they violate the law, while conservative proposals focus on value for shareholders.

The Impact on Shareholders and Corporations

While some aspects of the ESG agenda have put companies at risk of legal action, employee lawsuits, and consumer boycotts, its advocates cite studies suggesting that these policies benefit shareholders. However, conservative shareholders maintain that their goal is not to push corporations to adopt right-wing causes but rather to keep them out of politics altogether. They argue that it is a violation of fiduciary duty for companies to engage in political and social issues unrelated to their business purpose.

Conclusion

The study by Consumers’ Research highlights the overwhelming dominance of left-wing shareholder proposals and the limited involvement of conservative investors in influencing corporations on political and social issues. The ESG movement has successfully aligned corporate executives with its goals, backed by significant financial resources and support from major institutions. The SEC’s role in overseeing shareholder voting has come under scrutiny, with allegations of bias in favor of left-wing proposals. Conservative shareholders aim to steer corporations away from politics and focus on their fiduciary obligations. The debate surrounding shareholder proposals and their impact on shareholders and corporations continues, with both sides presenting their arguments.