Title: Wall Street Faces Worst Week Since April Amidst Global Technology Outage

Title: Wall Street Faces Worst Week Since April Amidst Global Technology Outage

Introduction:

U.S. stocks experienced a downward trend, marking Wall Street’s worst week since April. The S&P 500, Dow Jones Industrial Average, and Nasdaq composite all closed lower as businesses worldwide grappled with the fallout from a disruptive technology outage. This article examines the market’s performance, the cause of the global outage, and its implications for investors.

Market Performance:

The S&P 500 fell by 0.7 percent on Friday, making it the third consecutive decline since reaching a record high earlier in the week. The Dow Jones Industrial Average also suffered, sinking by 0.9 percent, while the Nasdaq composite lost 0.8 percent. These losses underscore the uncertainty and volatility currently plaguing the markets.

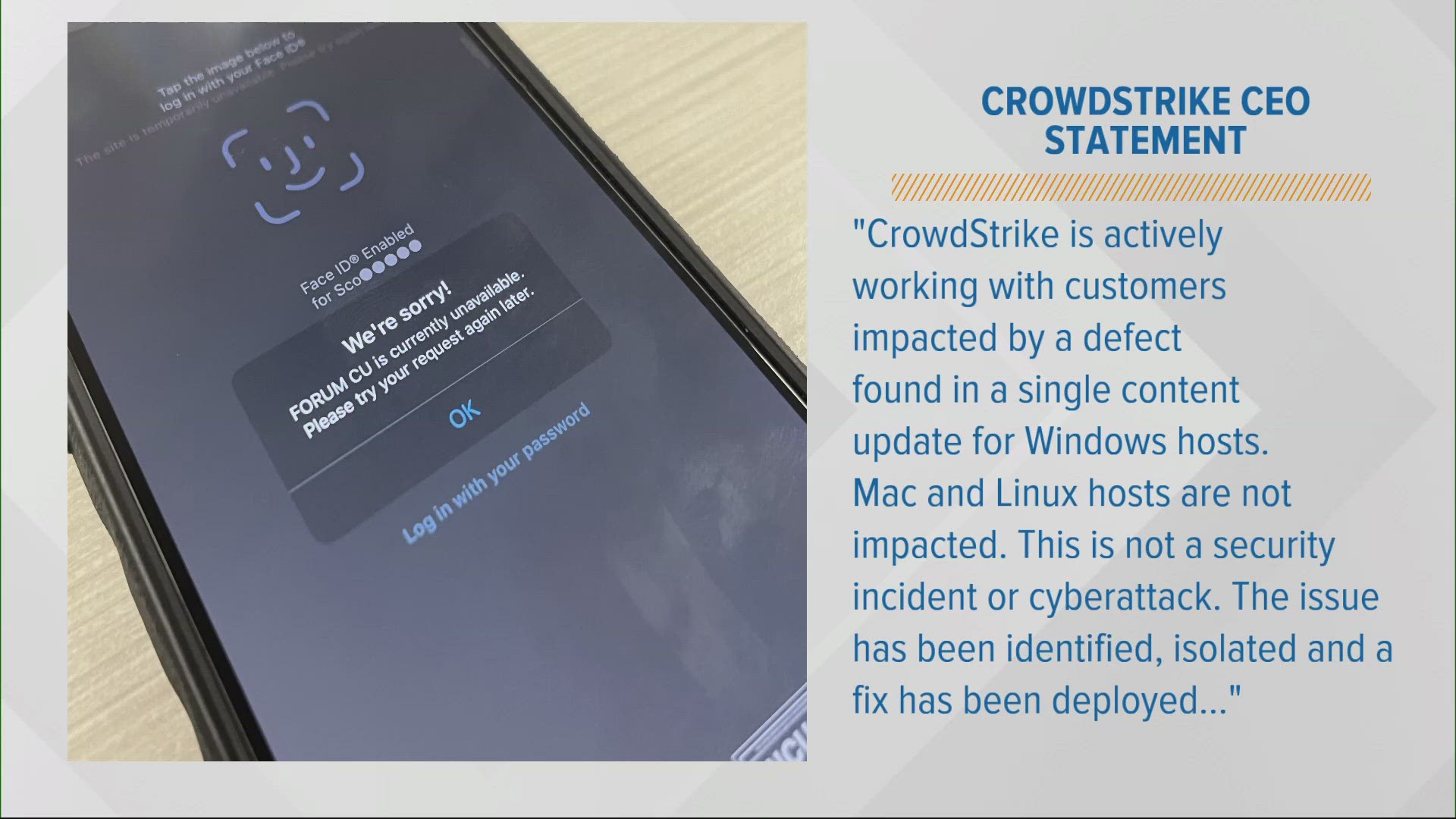

Global Technology Outage:

The disruption that triggered this decline was caused by a faulty update sent to computers running Microsoft Windows. CrowdStrike, a prominent cybersecurity firm, revealed that this issue was behind the global outage that impacted various sectors, including flights, banks, and medical offices. This incident highlights the vulnerability of our interconnected digital infrastructure and the need for robust cybersecurity measures.

Implications for Investors:

Investors are understandably concerned about the impact of this technology outage on their portfolios. While the market downturn may appear alarming, it is essential to evaluate the situation with a long-term perspective. It is crucial to remember that market fluctuations are a normal occurrence, and knee-jerk reactions can often lead to poor investment decisions.

Analyzing Market Performance:

1. S&P 500:

The S&P 500 has experienced a 2 percent decline for the week, reflecting a temporary setback. However, it is important to note that the index remains up 15.4 percent for the year, indicating overall positive growth. Investors should focus on the long-term trajectory rather than being deterred by short-term volatility.

2. Dow Jones Industrial Average:

Despite the recent losses, the Dow Jones Industrial Average has still managed to gain 0.7 percent for the week and 6.9 percent for the year. This performance underscores the resilience of blue-chip stocks and their ability to weather market turbulence.

3. Nasdaq Composite:

The Nasdaq composite has witnessed a more substantial decline, with a 3.6 percent drop for the week. However, it is important to highlight that the index has surged by 18.1 percent for the year, indicating its strength and potential for future growth.

4. Russell 2000:

The Russell 2000, which represents smaller companies, experienced a 0.6 percent decline for the week. However, it remains up by 1.7 percent for the year, illustrating the resilience of these companies in the face of market challenges.

Conclusion:

The recent market decline, fueled by a global technology outage, has caused Wall Street to endure its worst week since April. As businesses worldwide strive to mitigate the effects of this disruption, investors must maintain a long-term perspective and not succumb to knee-jerk reactions. While market volatility is inevitable, it is crucial to focus on the overall positive growth seen throughout the year. The incident serves as a reminder of the importance of robust cybersecurity measures in our interconnected digital landscape.