Warren Accuses Federal Reserve Chair of Favoring Financial Industry in Proposed Banking Regulations

Warren Accuses Federal Reserve Chair of Favoring Financial Industry in Proposed Banking Regulations

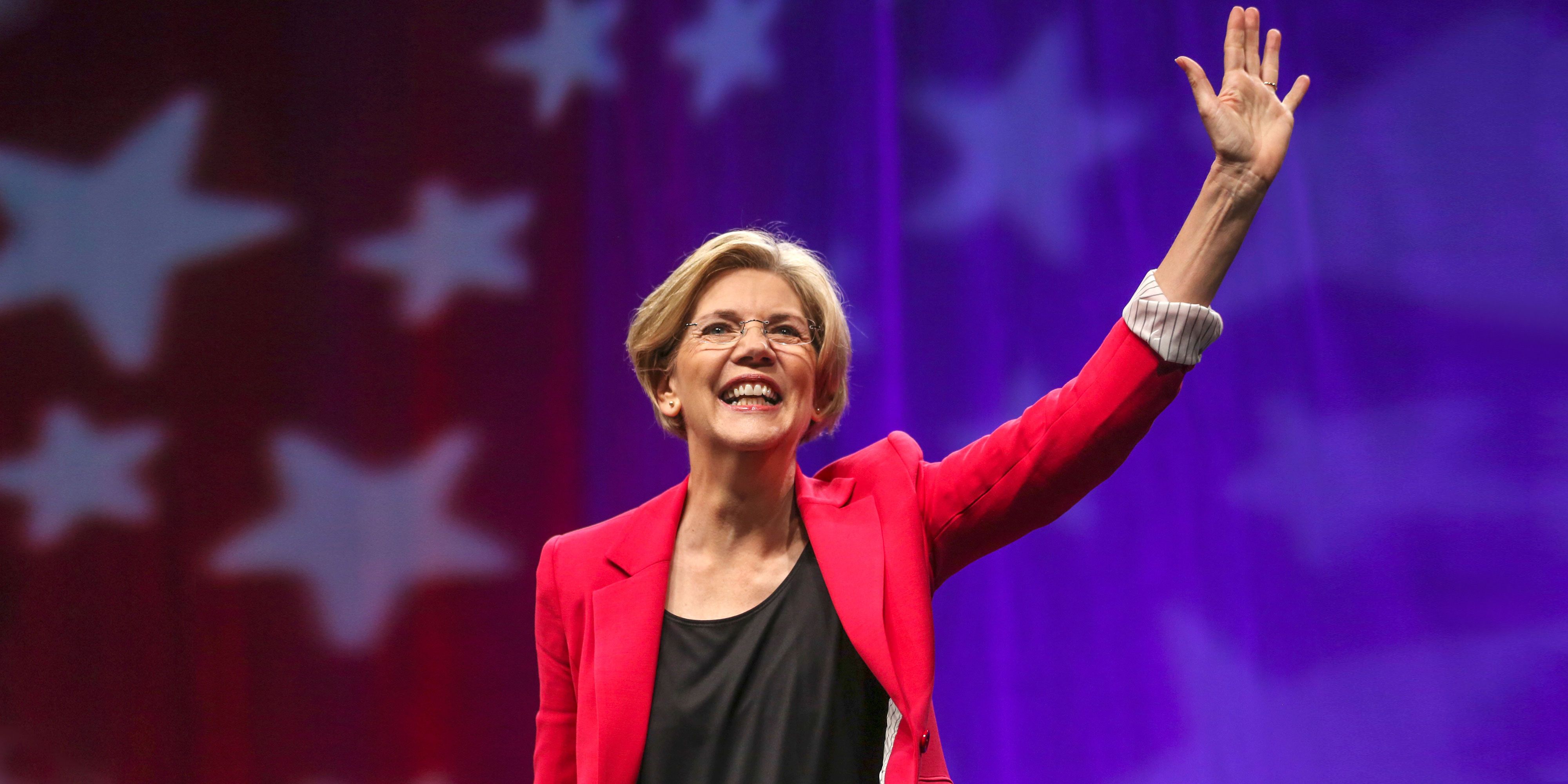

In a scathing letter obtained by CNBC, Senator Elizabeth Warren accused Federal Reserve Chair Jerome Powell of bowing to pressure from the financial industry and seeking to weaken proposed regulations aimed at increasing the capital requirements for large American banks. The regulations, known as the Basel III Endgame, were unveiled last year by three U.S. banking regulators, including the Federal Reserve, as part of an effort to strengthen the banking system in response to the 2008 global financial crisis.

Warren expressed her disappointment in reports suggesting that Powell was advocating for slashing in half the proposed increase in capital required under the Basel III Endgame. She criticized Powell for personally intervening after meetings with big bank CEOs and accused him of delaying and watering down the rules. According to Warren, these regulations are critical and long overdue, especially as the banking system faces risks from the weak commercial real estate market and other economic threats.

The proposed rules have faced significant opposition from bank CEOs and lobbying groups, who argue that the increases are overly aggressive and would restrict lending. JPMorgan Chase CEO Jamie Dimon reportedly played a key role in coordinating efforts to weaken the rules and urged CEOs to appeal directly to Powell. Warren pointed out that it now appears that Powell is doing the bidding of the banking industry and rewarding them for their extensive lobbying.

The senator further criticized Powell for regulatory rollbacks under his leadership, which she believes allowed the regional banking crisis of 2023 to happen and enriched Wall Street figures like Jamie Dimon. Warren called on Powell to allow a Federal Reserve Board vote on the original, tougher Basel proposal by the end of the month. However, with the window for finalizing and approving the rules closing ahead of the November elections, analysts speculate that the proposal may be delayed or even scrapped if President Donald Trump is reelected.

Warren emphasized that instead of succumbing to pressure from industry insiders, Powell should prioritize his responsibilities and allow the Board to convene for a vote on a 16% capital increase, as determined by global regulators, to prevent another financial crisis. The senator’s letter has prompted a response from the Federal Reserve, with a spokesperson stating that they have received the letter and plan to respond.

In light of these developments, investors should closely monitor the progress of the proposed regulations and their potential impact on the banking industry. The outcome of the upcoming elections will undoubtedly play a crucial role in determining the fate of these rules. Additionally, it remains to be seen how Powell will respond to Warren’s accusations and whether he will take action to address concerns raised by both sides of the debate.

Overall, this clash between Senator Warren and Chair Powell highlights the contentious nature of banking regulations and the influence of the financial industry on policy decisions. It underscores the need for a careful balance between promoting economic growth and ensuring the stability and security of the financial system. As the future of banking regulations hangs in the balance, stakeholders must closely follow developments and engage in constructive dialogue to achieve a regulatory framework that safeguards against future crises while fostering a healthy and prosperous economy.