SEC Freezes Assets of Drive Planning LLC Amid Allegations of Ponzi Scheme

SEC Freezes Assets of Drive Planning LLC Amid Allegations of Ponzi Scheme

The Securities and Exchange Commission (SEC) has taken action against Atlanta-based Drive Planning LLC, freezing its assets and obtaining a court order for emergency relief. The SEC has accused the company of running a Ponzi scheme that impacted over 2,000 investors and misappropriated millions of dollars.

According to the SEC’s complaint filed on August 13th, Drive Planning and its CEO, Russell Todd Burkhalter, allegedly promised exorbitant returns to investors through their Real Estate Acceleration Loans (REAL) scheme. The scheme, which sold unregistered securities, claimed to offer 10 percent returns in just three months. By the end of June, over 2,000 investors had invested more than $300 million into the scheme.

However, instead of using the funds for real estate investments as promised, Burkhalter and his associates used the money to make Ponzi-like payments and fund Burkhalter’s extravagant lifestyle. The SEC alleges that Burkhalter bought a $3.1 million yacht, spent $4.6 million on private jets and luxury car services, and purchased a $2 million luxury condo. This misappropriation of funds is a classic characteristic of a Ponzi scheme.

Nekia Hackworth Jones, director of the SEC’s Atlanta Regional Office, emphasized the impact on everyday people who trusted Drive Planning and Burkhalter with their investments. The company gained the trust of investors by promising high returns but ultimately used new investor money to pay off existing investors, with Burkhalter pocketing millions for his lavish lifestyle.

To address these alleged violations, Judge Victoria Calvert of the U.S. District Court for the Northern District of Georgia granted the SEC’s motion for a preliminary injunction. The injunction freezes Drive Planning’s assets, appoints a receiver to oversee the company’s affairs, and provides other emergency relief. The SEC is seeking permanent injunctions, disgorgement of ill-gotten gains plus interest, civil penalties, and a prohibition against Burkhalter serving as an officer or director of a publicly traded company.

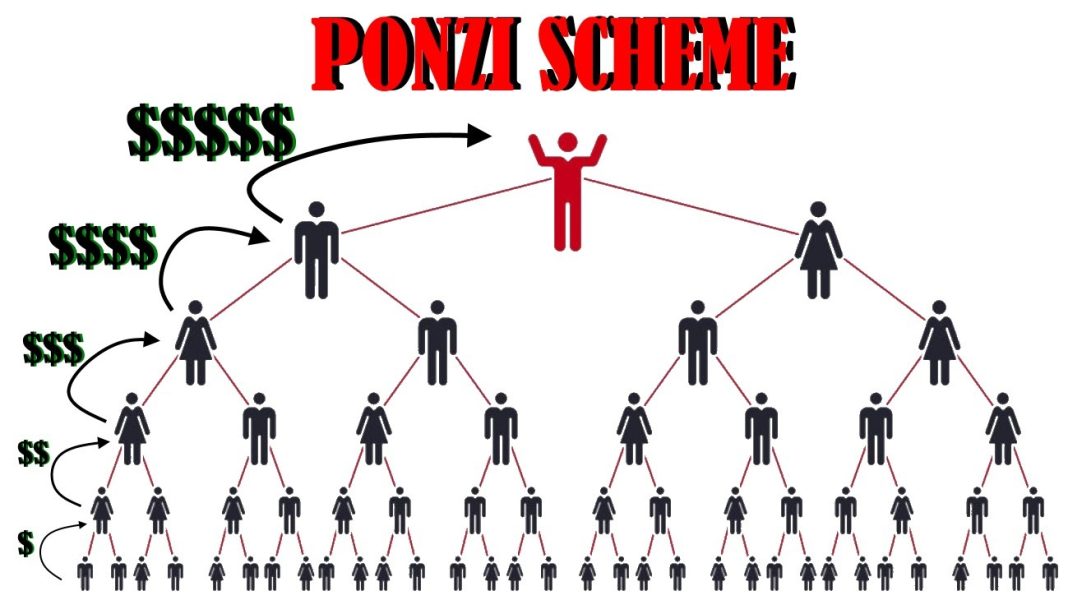

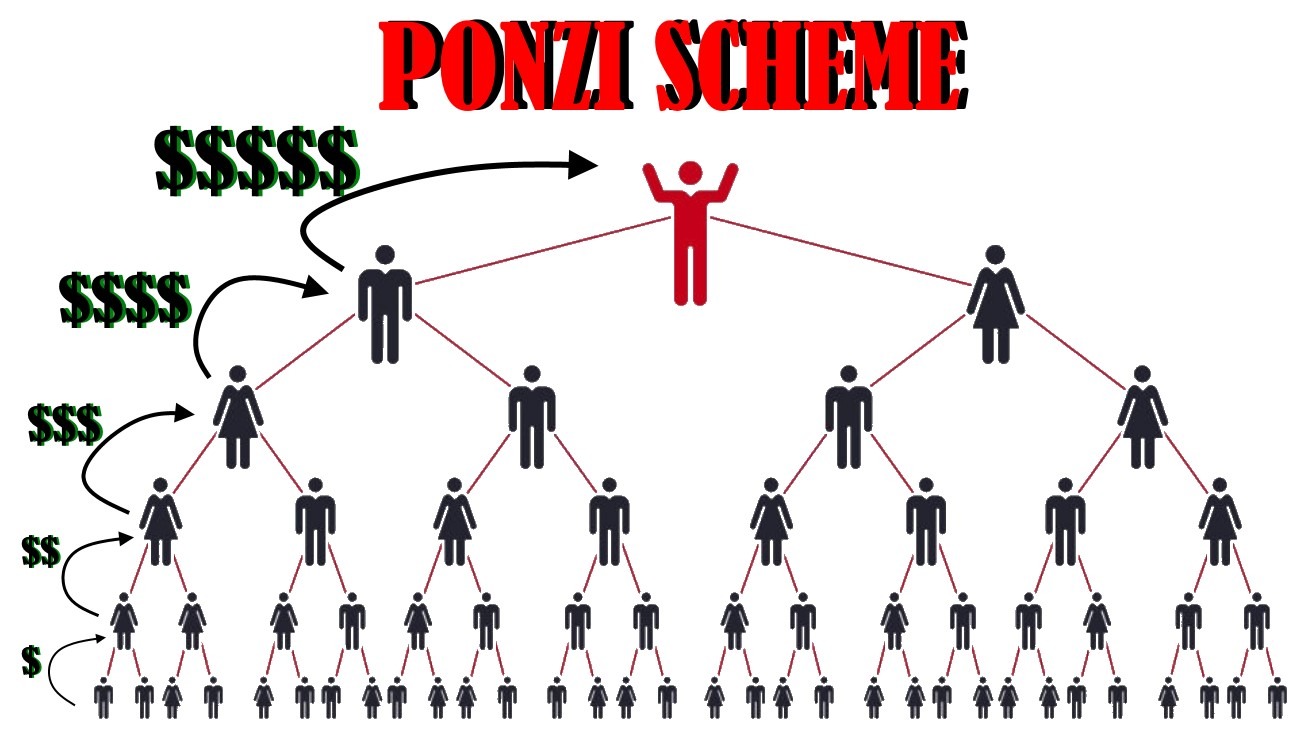

This case highlights the importance of due diligence and skepticism when considering investment opportunities. Ponzi schemes can be enticing with their promises of high returns, but they often rely on the recruitment of new investors to sustain the payouts. By using recent studies and expert quotes, we can further explore the warning signs and red flags that investors should be aware of to protect themselves from falling victim to such schemes.

According to a study by the North American Securities Administrators Association (NASAA), there are several common characteristics of Ponzi schemes. These include consistent high returns with little to no risk, secretive or complex strategies, unregistered investments, and a reliance on new investor money to pay existing investors. The REAL scheme exhibited many of these characteristics, offering high returns within a short timeframe and selling unregistered securities.

Experts also emphasize the importance of conducting thorough research and due diligence before investing. Financial advisor and author, Benjamin Graham, famously said, “The intelligent investor is a realist who sells to optimists and buys from pessimists.” By taking a cautious and skeptical approach, investors can protect themselves from falling victim to fraudulent schemes.

In conclusion, the SEC’s freezing of Drive Planning LLC’s assets and allegations of a Ponzi scheme serve as a reminder of the need for caution and due diligence in the investment world. Investors must be aware of the warning signs and red flags associated with such schemes to protect themselves and their hard-earned money. By staying informed and seeking advice from trusted financial professionals, individuals can make more informed investment decisions and avoid falling victim to fraudulent schemes.