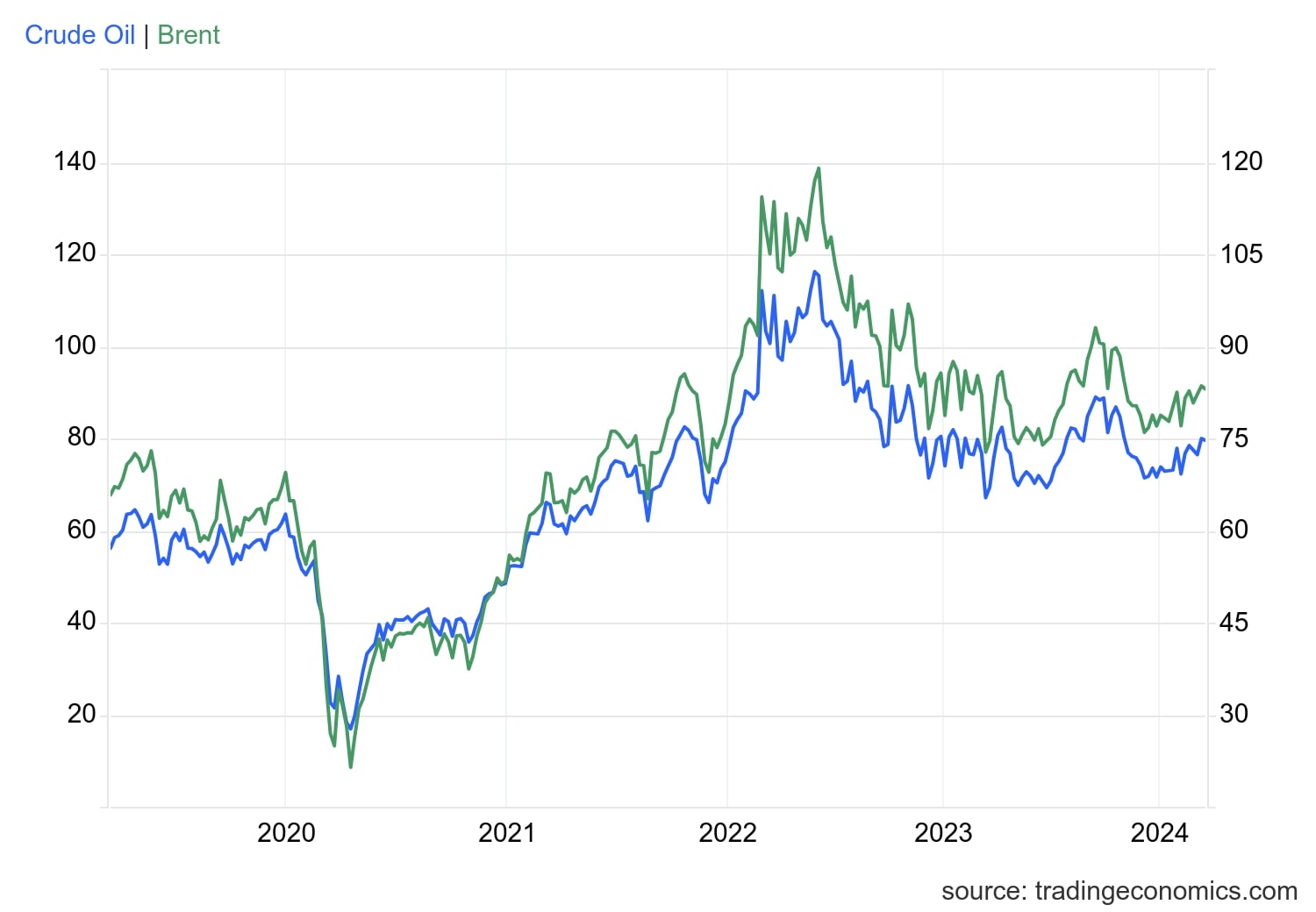

Oil prices continued to climb on Wednesday, with benchmark U.S. crude oil for June delivery rising by 61 cents to reach $78.63 per barrel. This increase was fueled by a rise in demand as economies across the globe began to recover from the impacts of the COVID-19 pandemic. Brent crude for July delivery also saw a rise of 37 cents, reaching $82.75 per barrel.

Oil prices continued to climb on Wednesday, with benchmark U.S. crude oil for June delivery rising by 61 cents to reach $78.63 per barrel. This increase was fueled by a rise in demand as economies across the globe began to recover from the impacts of the COVID-19 pandemic. Brent crude for July delivery also saw a rise of 37 cents, reaching $82.75 per barrel.

The surge in oil prices can be attributed to several factors. Firstly, as vaccination rates increase and travel restrictions ease, there has been a significant rebound in global oil demand. This trend is particularly evident in countries such as the United States and China, where economic activity has been picking up pace.

Furthermore, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have been implementing production cuts to balance the market and prevent oversupply. This has effectively limited the availability of oil in the market, leading to higher prices.

In addition to the rise in oil prices, other commodities also experienced notable increases. Wholesale gasoline for June delivery rose by 4 cents to reach $2.50 per gallon, while gold for June delivery saw a substantial increase of $35, reaching $2,394.90 per ounce. Silver and copper also experienced gains, with silver rising by $1.03 to $29.73 per ounce and copper increasing by 3 cents to $4.92 per pound.

The fluctuation in currency exchange rates also played a role in the movement of commodity prices. The dollar fell against the Japanese yen, dropping from 156.45 yen to 154.92 yen. On the other hand, the euro rose against the dollar, climbing from $1.0820 to $1.0878.

It is important to note that while the rise in oil prices may indicate a positive outlook for the global economy, there are still uncertainties that could impact the market. Factors such as geopolitical tensions, supply disruptions, and changes in government policies can all have significant effects on oil prices.

Investors and consumers alike should carefully monitor these developments and consider diversifying their portfolios to mitigate potential risks. Consulting with financial advisors or experts in the field can provide valuable insights and guidance in navigating the volatile energy market.

In conclusion, the recent increase in oil prices, along with gains in other commodities, can be attributed to a combination of factors including rising demand, production cuts by OPEC+, and currency fluctuations. While this may signal a positive trajectory for the global economy, it is essential to stay informed and cautious in order to make well-informed financial decisions.