The Impact of Inflation on Household Wealth

The Impact of Inflation on Household Wealth

As the cost of living continues to rise, new research suggests that the gains in household wealth over the past few years have been nearly erased by rampant price inflation. The Wall Street Journal recently analyzed changes in U.S. household net worth during the presidencies of Joe Biden and Donald Trump. The data from the Federal Reserve Bank of St. Louis revealed that while nominal household net worth increased by 19 percent during Biden’s first three years in office, real net worth only rose by 0.7 percent when adjusted for inflation. In comparison, Trump saw a 23 percent increase in nominal net worth and a 16 percent increase in real net worth during his first 36 months in the White House.

The Wealth Effect and Its Undermining

The wealth effect is a phenomenon in which consumers tend to spend more when their wealth increases, leading to a more positive attitude toward the economy. However, Merrill Matthews, a resident scholar at the Institute for Policy Innovation, argues that Biden’s policies have undermined this effect. Despite rising stock market and home prices, negative factors such as climbing interest rates and inflation have dampened consumer confidence and made them uncertain about the future. This uncertainty may make them more open to a change in leadership.

Inflation: A Tale of Two Presidents

When comparing the inflation rates under Biden and Trump, there is a clear divergence. Under Biden, the annual inflation rate reached 9.1 percent in June 2022, the highest in 40 years, with the consumer price index (CPI) surging by 19.5 percent overall. In contrast, Trump’s presidency saw much lower inflation rates, with the annual rate never exceeding 2.4 percent.

The Inflation Controversy

President Biden has faced criticism for claiming that inflation was at 9 percent when he entered office. White House officials have defended this statement by pointing to the factors that led to the inflation spike, such as disruptions in global supply chains caused by the pandemic. They argue that these factors were already in place when Biden took office. However, experts have pointed out that the annual growth in core inflation, excluding food and energy sectors, was between 3 percent and 4.5 percent during the April to June period in 2021.

Digging Into Household Wealth

The Federal Reserve reported that household wealth reached a record high of $156.2 trillion at the end of 2023, thanks to surging equities and growing property values. The gains in wealth were widespread across different types of families, with median net worth increasing by 37 percent from 2019 to 2022. These gains were largely driven by the Fed’s response to the pandemic, which included slashing interest rates and allowing consumers to lower their borrowing costs. However, the increase in net worth has not been equal, with the top 10 percent possessing a median net worth of close to $3 million, while the bottom 25 percent only have a net worth of nearly $4,000.

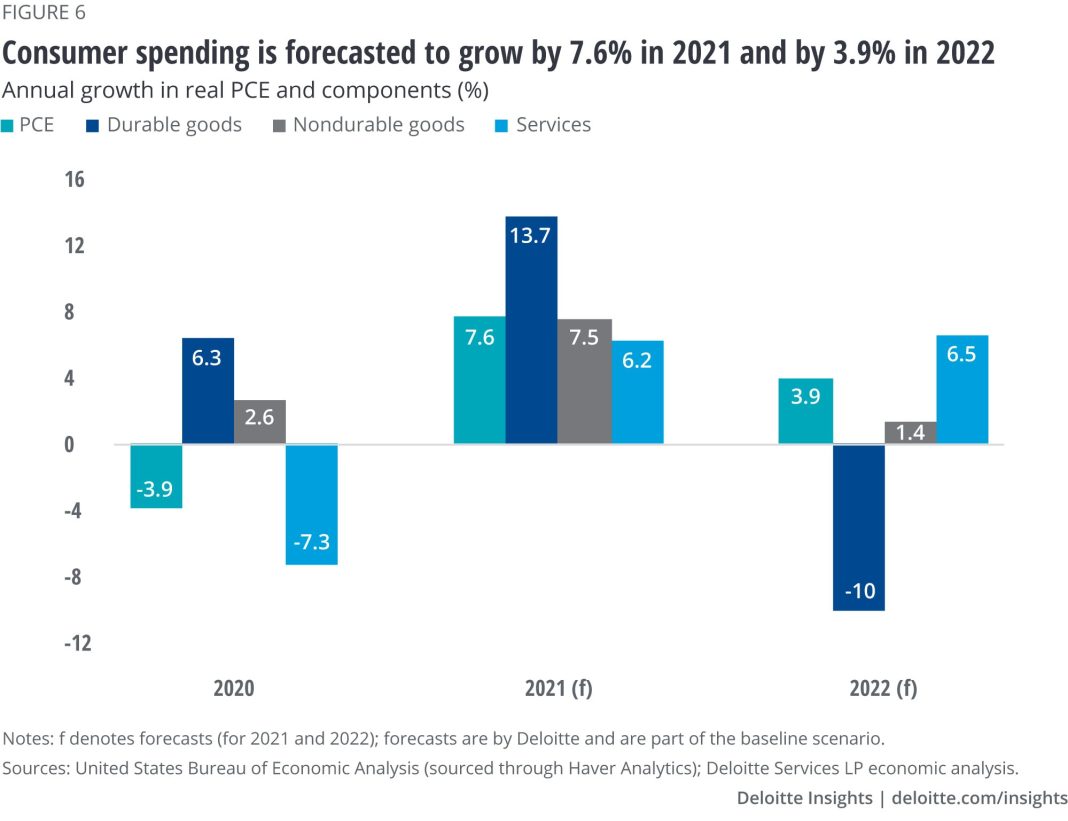

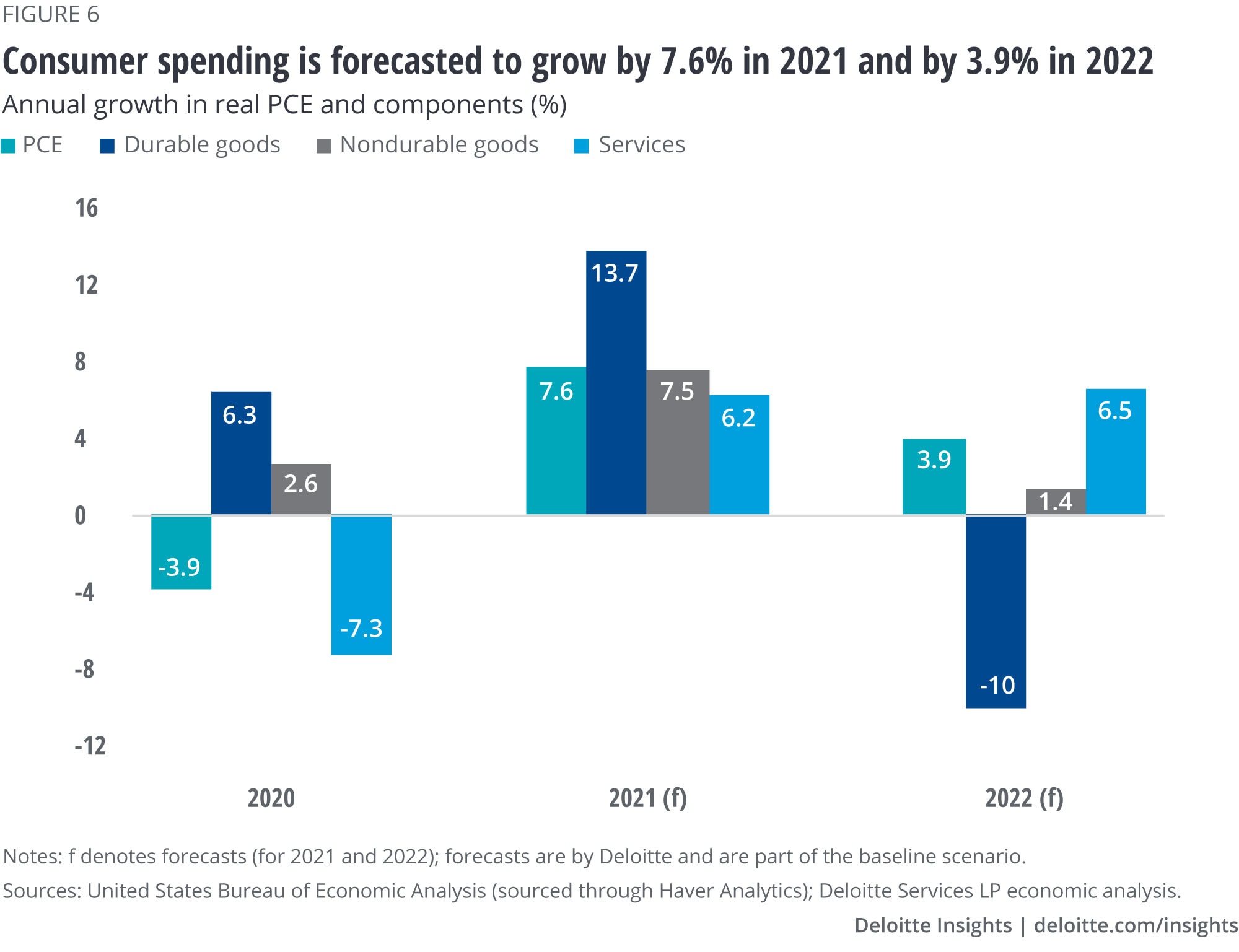

Consumer Spending and the Economy

Bank economists argue that the increase in household wealth has supported consumer spending, which in turn has boosted the broader economy. However, there are concerns about whether this trend will continue. A report from the Brookings Institution suggests that accumulated household wealth has begun to dissipate, forcing households to choose between reducing their spending or increasing their debt burdens. Household debt has been increasing, delinquency rates are rising, and the personal savings rate is plummeting. These factors may lead to a slowdown in consumer spending and have an adverse effect on the economy.

Consumer Sentiment and Economic Outlook

Current economic conditions, including high inflation and mounting debt, have had an impact on consumer sentiment. A Bankrate survey found that 89 percent of Americans do not consider themselves financially successful, and 27 percent believe they will never achieve financial success. The University of Michigan’s Consumer Sentiment Index also reached a six-month low as people expressed concerns about inflation, unemployment, and interest rates moving in an unfavorable direction in the coming year.

In conclusion, while household wealth has increased in recent years, rampant price inflation has nearly erased these gains. Negative factors such as climbing interest rates and inflation have undermined the wealth effect and made consumers uncertain about the future. The divergence in inflation rates between Biden and Trump’s presidencies has also sparked controversy. The increase in household wealth has supported consumer spending and the broader economy, but there are concerns about its sustainability. Current economic conditions have affected consumer sentiment and raised worries about the future direction of the economy.