Oil Prices Fall to Six-Month Lows on Oversupply and Demand Concerns

Beijing, China – Oil prices continued to decline on Wednesday, reaching six-month lows due to concerns over oversupply and weakening demand. Brent crude futures for February dropped by 0.45 percent to $72.91 a barrel, while U.S. West Texas Intermediate crude futures for January fell by 0.42 percent to $68.32 a barrel.

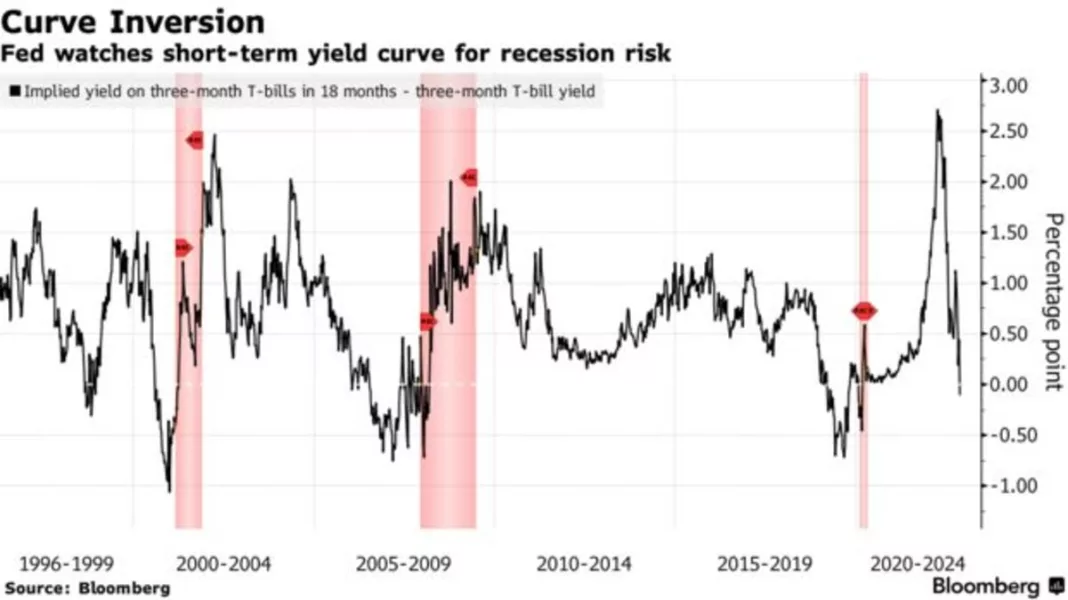

The market experienced a setback during overnight trading as stronger-than-expected U.S. inflation data for November indicated that the Federal Reserve is unlikely to cut interest rates early next year. This raised concerns about reduced consumption, further pressuring oil prices.

Adding to the oversupply worries, ANZ analysts reported a significant increase in weekly average Russian crude exports, reaching the highest level since July. This development casts doubt on the effectiveness of the recent output cut agreement made by the Organization of the Petroleum Exporting Countries and its allies (OPEC+).

Additionally, the U.S. Energy Information Administration revised its supply forecast for 2023, projecting an increase of 300,000 barrels per day to 12.93 million barrels per day. This bearish outlook suggests that oil prices are on track to decline for an eighth consecutive week.

The outcome of the U.S. central bank’s policy meeting, concluding later today, will play a crucial role in determining market direction. Analyst Tina Teng from CMC Markets stated that a more hawkish stance by the Federal Reserve could lead to further drops in crude prices.

While it is widely expected that the Fed will maintain interest rates, investors will closely monitor officials’ views on the economy and future interest rate changes. Market strategist Yeap Jun Rong from IG highlighted that markets have already factored in “aggressive rate cuts” for 2024. Any disappointment in this regard could strengthen the U.S. dollar and negatively impact the risk environment, resulting in lower oil prices.

DBS analyst Suvro Sarkar believes that the discussions at the policy meeting are unlikely to yield surprises. However, he anticipates a potential recovery in oil prices through a “relief rally” following the meeting.

In other news, the United Nations passed a resolution calling for a ceasefire in Gaza. President Joe Biden warned that Israel’s civilian casualties were causing a loss of international support. Furthermore, shipping costs through the Red Sea are rising due to increased attacks by Iran-aligned Houthis in Yemen on ships believed to be connected to Israel.

Lastly, nearly 200 nations reached an agreement at the COP28 conference to begin reducing global fossil fuel consumption. This move aims to send a signal to investors in oil and other fossil fuels.