Oil Prices Surge as Demand Rebounds

Oil Prices Surge as Demand Rebounds

Introduction:

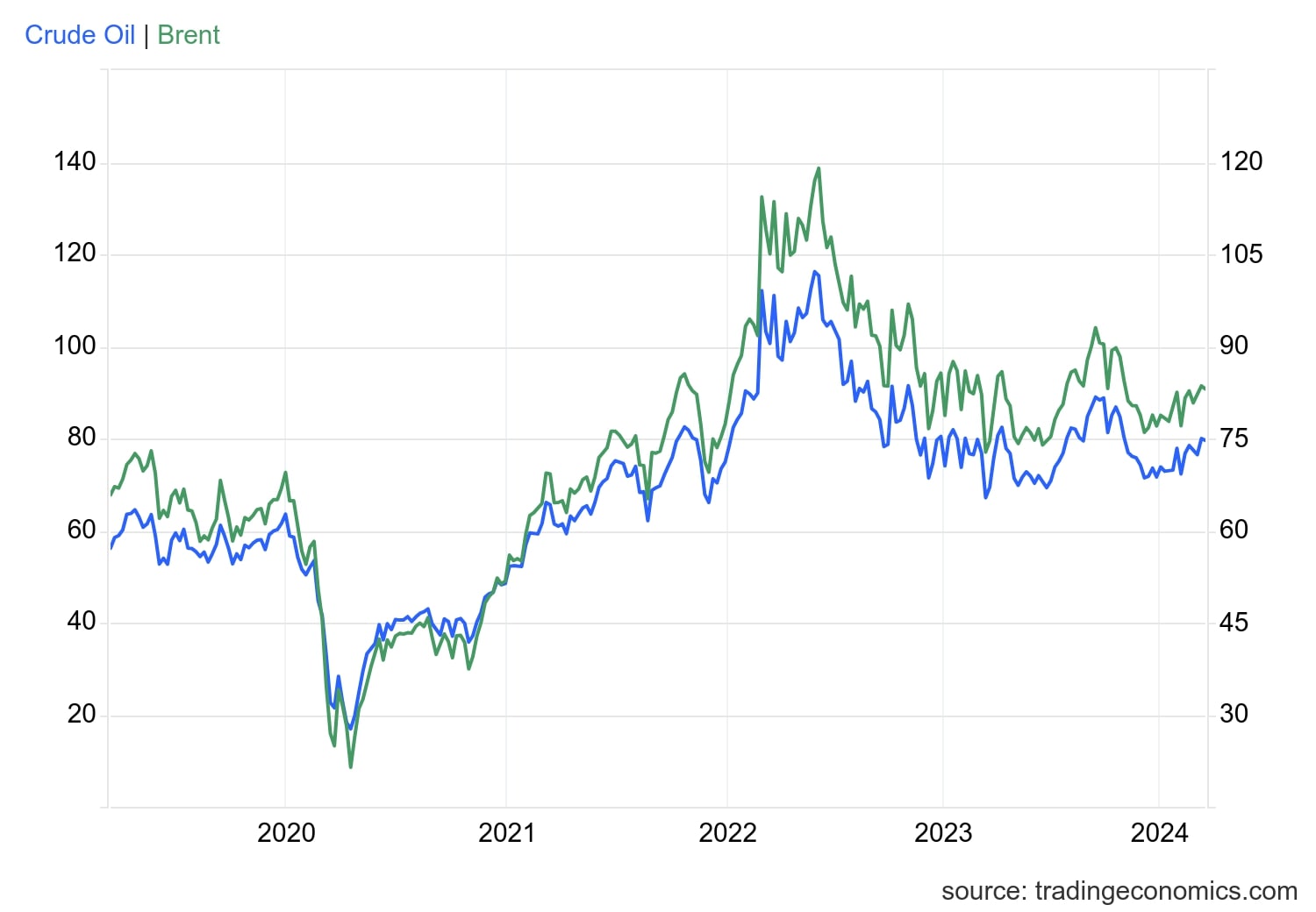

Oil prices saw a significant surge on Monday, driven by increasing demand as economies around the world continue to recover. Benchmark U.S. crude oil for July delivery rose by $2.21 to reach $77.74 per barrel, while Brent crude for August delivery increased by $2.01 to $81.63 per barrel.

Rising Demand Fuels Price Rally:

The recent price rally can be attributed to the rebound in global oil demand. As countries ease COVID-19 restrictions and economic activities resume, the need for energy has intensified. The International Energy Agency (IEA) predicts that global oil demand will increase by 5.4 million barrels per day in 2021, marking a significant recovery from the pandemic-induced slump.

Supply Concerns Support Prices:

In addition to growing demand, concerns over supply disruptions have also contributed to the surge in oil prices. Ongoing geopolitical tensions in key oil-producing regions, such as the Middle East and Africa, have raised concerns about potential disruptions to oil supplies. Any disruptions could further tighten the global oil market, pushing prices higher.

Gasoline and Heating Oil Prices Follow Suit:

The rally in oil prices has translated into higher prices for gasoline and heating oil as well. Wholesale gasoline for July delivery rose by 3 cents to $2.41 per gallon, while July heating oil increased by 6 cents to $2.41 per gallon. These price hikes reflect the increased cost of crude oil, which serves as the primary input for refining gasoline and heating oil.

Natural Gas Experiences Minor Dip:

While oil prices experienced a surge, natural gas prices saw a minor decline. July natural gas fell by 1 cent to $2.91 per 1,000 cubic feet. This dip can be attributed to factors such as mild weather conditions and an abundance of supply. However, experts believe that natural gas prices are likely to stabilize and potentially rise in the future as demand for cleaner energy sources increases.

Precious Metals Show Mixed Results:

In the precious metals market, gold and silver prices saw modest gains, while copper experienced a notable increase. Gold for August delivery rose by $2 to reach $2,327 per ounce, and silver for July delivery increased by 43 cents to $29.87 per ounce. July copper rose by 6 cents to $4.54 per pound. These price movements reflect a mix of factors, including inflation concerns, market volatility, and increased industrial demand for metals.

Currency Market Update:

In the currency market, the U.S. dollar strengthened against the Japanese yen but weakened against the euro. The dollar rose to 157.10 yen from 156.65 Japanese yen, indicating increased demand for the U.S. currency. On the other hand, the euro fell to $1.0762 from $1.0804, suggesting a relative strengthening of the dollar against the European currency.

Conclusion:

The surge in oil prices reflects a rebound in global demand as economies recover from the impact of the COVID-19 pandemic. Supply concerns and geopolitical tensions have also contributed to the price rally. While gasoline and heating oil prices have increased, natural gas prices have seen a minor dip. Precious metals have shown mixed results, and currency markets have experienced fluctuations as well. As the world continues to navigate the post-pandemic recovery, monitoring these market trends becomes crucial for investors and consumers alike.