Oil Prices Rise as Demand Outlook Improves

Oil Prices Rise as Demand Outlook Improves

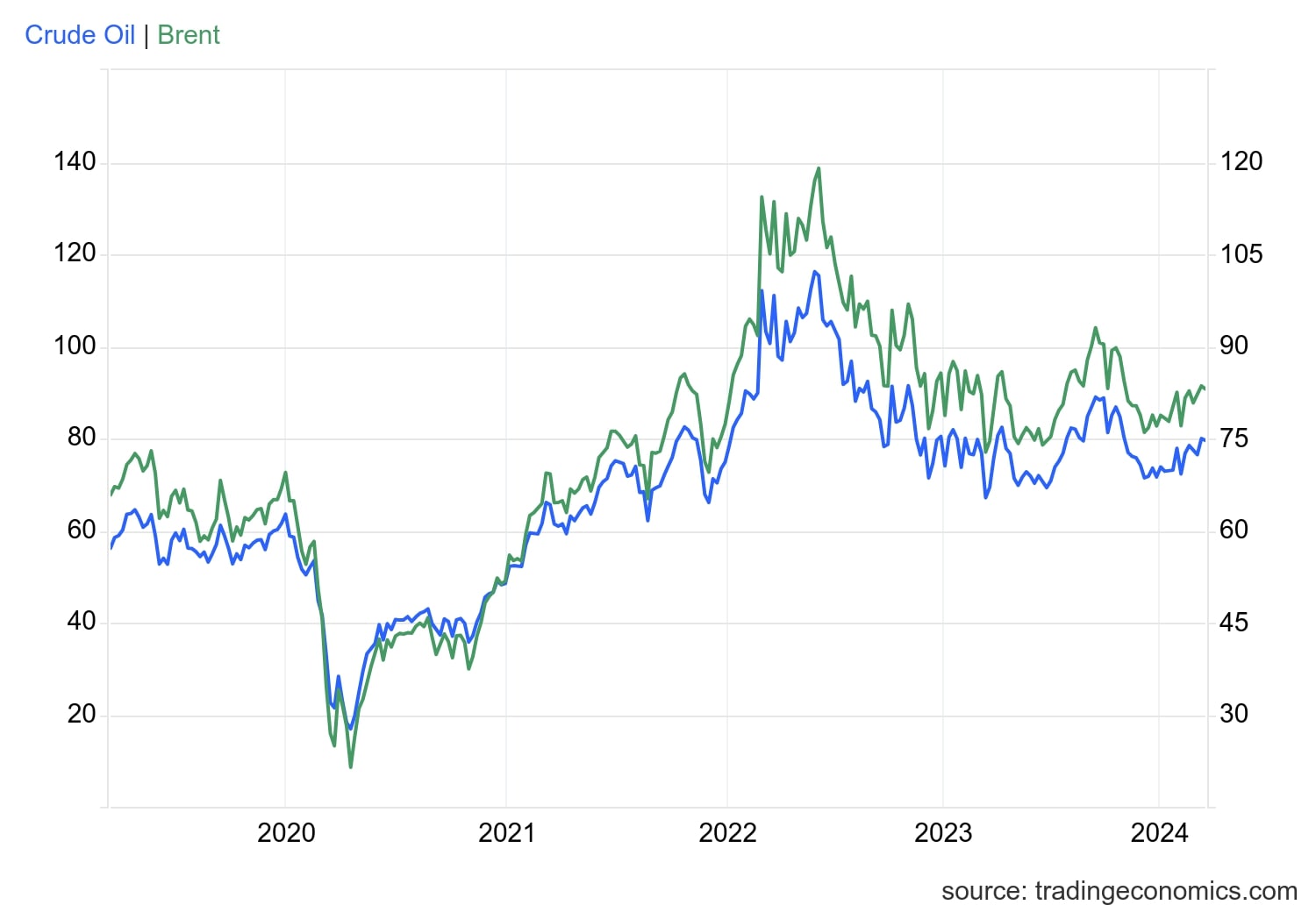

In a positive development for the oil industry, benchmark U.S. crude oil for June delivery rose 61 cents to $78.99 per barrel on Wednesday. This increase can be attributed to an improving demand outlook as countries around the world begin to recover from the economic impacts of the COVID-19 pandemic.

Similarly, Brent crude for July delivery also saw a rise, increasing by 42 cents to $83.58 per barrel. These price increases indicate a growing optimism among investors and traders about the future of the oil market.

Gasoline Prices Remain Stable

Despite the rise in oil prices, wholesale gasoline for June delivery remained relatively stable, falling only 1 cent to $2.53 a gallon. This stability suggests that the recent increase in oil prices has not yet translated into significant price hikes at the pump for consumers.

On the other hand, June heating oil saw a modest increase of 1 cent to $2.48 a gallon. This slight rise may be attributed to the overall trend of increasing oil prices.

Natural Gas Prices Experience a Dip

In contrast to oil prices, June natural gas fell 2 cents to $2.19 per 1,000 cubic feet. This decline in natural gas prices can be attributed to a number of factors, including an oversupply of natural gas in the market and lower demand due to milder weather conditions.

Precious Metals Show Mixed Results

Gold for June delivery experienced a small decrease of $1.90, reaching $2,322.30 per ounce. This decline can be seen as a correction after gold’s recent rally.

In contrast, silver for July delivery rose 6 cents to $27.60 per ounce, indicating a positive sentiment towards this precious metal.

Meanwhile, July copper fell 7 cents to $4.54 per pound, potentially influenced by concerns over global economic growth and demand.

Currency Market Update

In currency markets, the dollar saw a modest increase against the Japanese yen, rising to 155.63 yen from 154.76 Japanese yen. This indicates a strengthening of the U.S. dollar relative to the Japanese currency.

Conversely, the euro fell slightly against the dollar, dropping to $1.0746 from $1.0753. This decline in the euro can be attributed to various factors, including economic uncertainties in the Eurozone.

Conclusion

The recent rise in oil prices reflects a positive demand outlook as countries recover from the impact of the COVID-19 pandemic. However, the stability of gasoline prices suggests that these increases have not yet translated into significant price hikes at the pump for consumers.

Natural gas prices have experienced a dip due to oversupply and lower demand, while precious metals have shown mixed results with gold experiencing a small decrease and silver showing a slight increase.

Additionally, currency markets have seen the dollar strengthen against the Japanese yen, while the euro has weakened against the dollar. These currency movements reflect ongoing economic uncertainties in different regions.

Overall, these market dynamics indicate a delicate balance between supply and demand as economies continue to navigate the challenges posed by the pandemic and work towards a sustainable recovery.