Oil Prices Rise as Crude Oil Demand Improves

Oil Prices Rise as Crude Oil Demand Improves

As the global economy continues its recovery from the COVID-19 pandemic, oil prices are on the rise. Benchmark U.S. crude oil for July delivery increased by $1.48 to reach $75.55 per barrel on Thursday, while Brent crude for August delivery rose $1.46 to $79.87 per barrel.

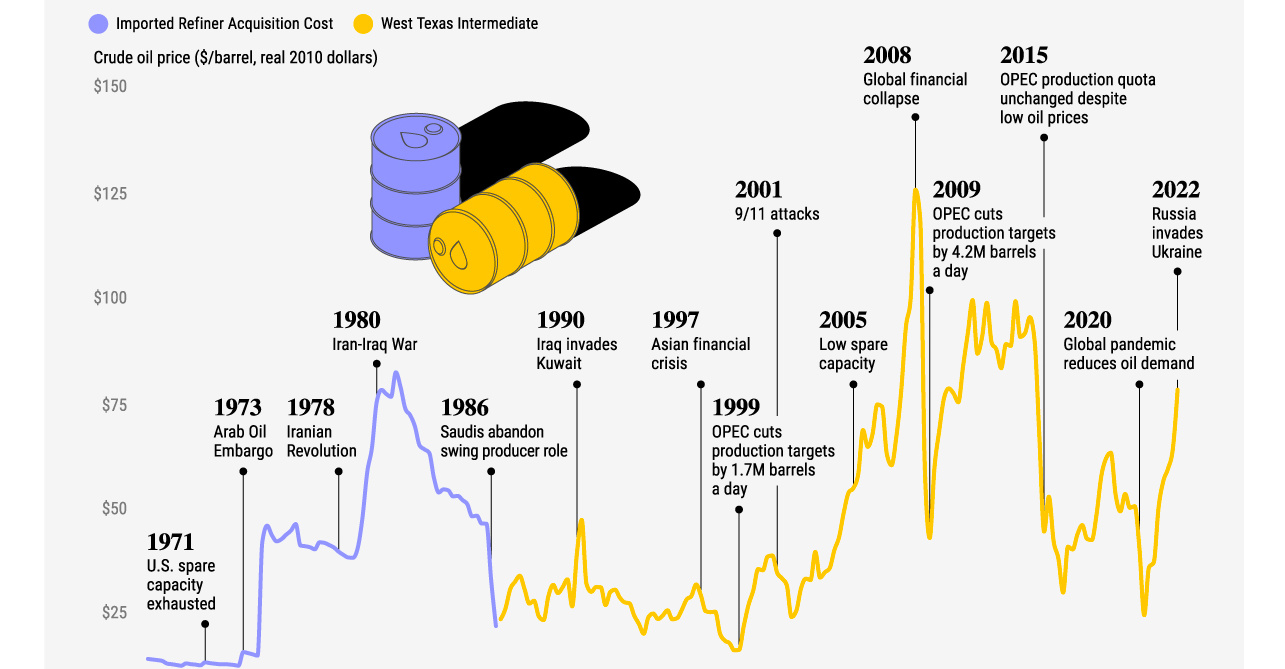

The increase in oil prices can be attributed to several factors. Firstly, there has been a significant increase in demand for crude oil as countries around the world gradually reopen their economies. This has led to a surge in travel and transportation activities, boosting the need for fuel.

Furthermore, the ongoing vaccination campaigns and declining COVID-19 cases have instilled confidence in consumers, encouraging them to resume their normal activities. This has further contributed to the rebound in oil demand.

In addition to increased demand, supply constraints have also played a role in driving up oil prices. The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have implemented production cuts to balance the market and prevent oversupply. These production cuts have effectively limited the availability of crude oil, putting upward pressure on prices.

The rise in oil prices has had an impact on related commodities as well. Wholesale gasoline for July delivery rose by 5 cents to reach $2.40 a gallon, while July heating oil increased by 6 cents to $2.36 a gallon. July natural gas also saw an increase of 6 cents, reaching $2.82 per 1,000 cubic feet.

Meanwhile, precious metals such as gold and silver have also experienced gains. Gold for August delivery rose by $15.40 to reach $2,390.90 per ounce, while silver for July delivery increased by $1.30 to $31.37 per ounce. July copper also saw a rise of 7 cents, reaching $4.68 per pound.

The weakening of the U.S. dollar against other major currencies has further contributed to the increase in commodity prices. The dollar fell to 155.69 yen from 156.12 Japanese yen, while the euro rose to $1.0892 from $1.0875.

It is important to note that while the rise in oil prices may be seen as a positive sign for oil-producing countries and companies, it can also have negative consequences for consumers. Higher oil prices often translate into increased costs for transportation, heating, and other goods and services that rely on oil.

In conclusion, the recent increase in oil prices can be attributed to factors such as rising demand, supply constraints, and a weaker U.S. dollar. As the global economy continues to recover, it is likely that oil prices will remain volatile, influenced by various economic and geopolitical factors.