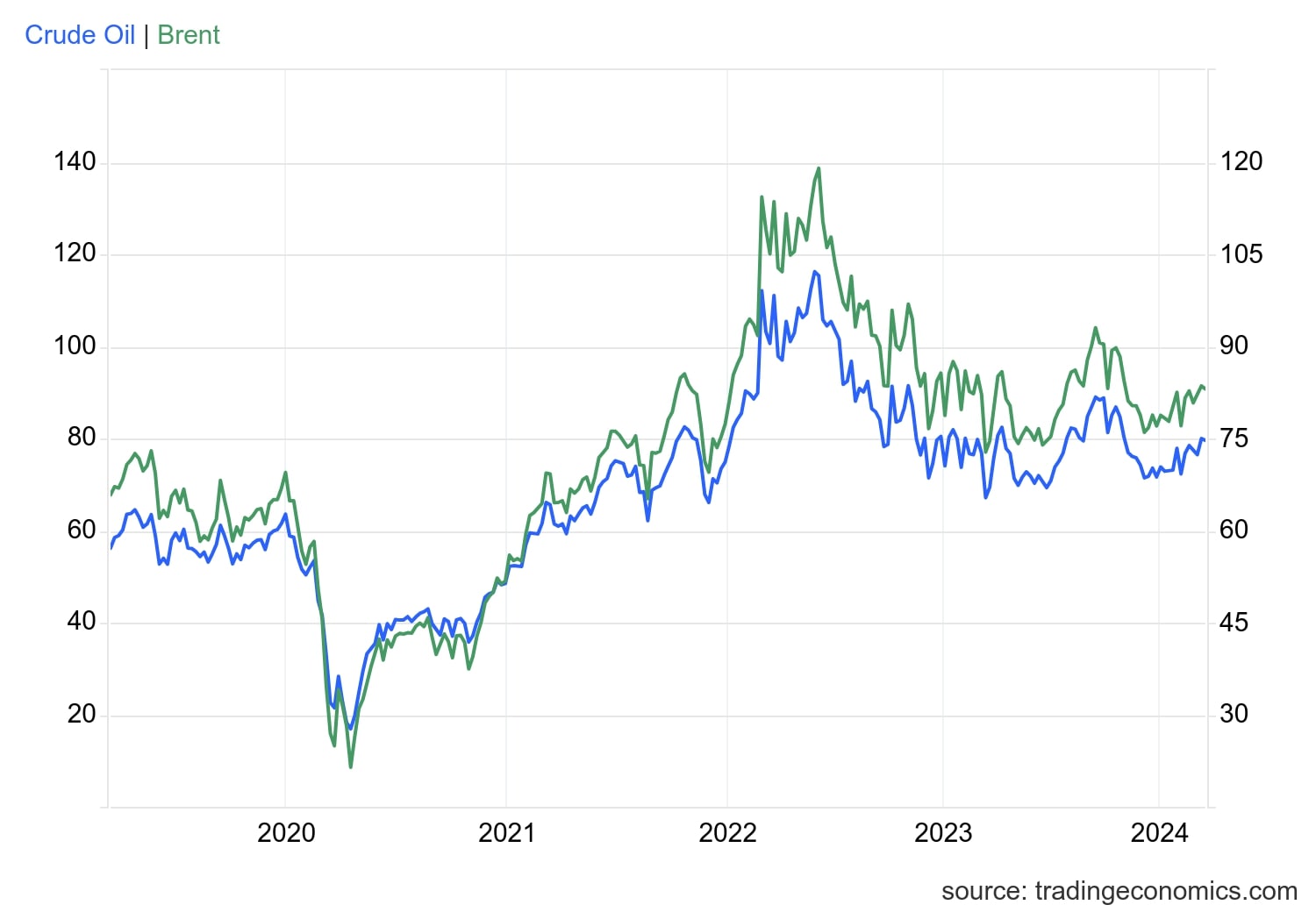

Oil prices experienced a slight dip on Tuesday, with benchmark U.S. crude oil for June delivery falling 10 cents to $78.38 per barrel. Similarly, Brent crude for July delivery dropped 17 cents to $83.16 per barrel. These fluctuations reflect ongoing volatility in the energy market, which is influenced by a variety of factors.

Oil prices experienced a slight dip on Tuesday, with benchmark U.S. crude oil for June delivery falling 10 cents to $78.38 per barrel. Similarly, Brent crude for July delivery dropped 17 cents to $83.16 per barrel. These fluctuations reflect ongoing volatility in the energy market, which is influenced by a variety of factors.

One of the key drivers of oil prices is supply and demand dynamics. As economies around the world continue to recover from the impact of the COVID-19 pandemic, the demand for oil has been steadily increasing. However, concerns over rising inflation and potential interest rate hikes have led to a decrease in investor confidence, resulting in a slight decline in oil prices.

Another factor influencing oil prices is geopolitical tensions. Any disruption in the supply chain or political instability in major oil-producing regions can have a significant impact on prices. For example, conflicts in the Middle East or disruptions to oil production in countries like Libya or Venezuela can lead to supply shortages and subsequently drive up prices.

Furthermore, fluctuations in the value of the U.S. dollar also play a role in determining oil prices. As the dollar strengthens against other currencies, such as the yen or the euro, oil becomes more expensive for countries using those currencies. Conversely, a weaker dollar can make oil more affordable and lead to increased demand.

In addition to oil, other commodities such as gold, silver, and copper also experienced price changes on Tuesday. Gold for June delivery fell $7 to $2,324.20 per ounce, while silver for July delivery dropped 7 cents to $27.54 per ounce. July copper fell 1 cent to $4.61 per pound. These fluctuations can be attributed to various factors, including investor sentiment, economic data, and global market trends.

It is important to note that commodity prices are subject to volatility and can be influenced by a multitude of factors. Investors and traders should exercise caution when making financial decisions based on short-term price movements. Consulting with a financial advisor or conducting thorough research can help individuals make informed choices aligned with their investment goals.

In conclusion, oil prices experienced a slight decline on Tuesday, reflecting ongoing volatility in the energy market. Factors such as supply and demand dynamics, geopolitical tensions, and fluctuations in the value of the U.S. dollar all contribute to these price changes. It is crucial for investors to stay informed and consider a range of factors before making any investment decisions.