Title: The Fed’s Push for Discount Window Borrowing: Destigmatizing and Ensuring Liquidity

Title: The Fed’s Push for Discount Window Borrowing: Destigmatizing and Ensuring Liquidity

Introduction:

The Federal Reserve has long been considered the lender of last resort, with the discount window available to struggling financial entities. However, in recent years, the Fed has been pushing for banks to borrow from the discount window even when they are not on the brink of failure. This move aims to destigmatize the use of the discount window and ensure that banks can access it ahead of significant liquidity demand.

The Importance of Discount Window Borrowing:

The discount window plays a crucial role in supporting the smooth flow of credit to households and businesses, maintaining liquidity and stability in the banking system, and implementing effective monetary policy, according to the Fed Board of Governors. To emphasize its significance, Fed officials, including Fed Gov. Lisa Cook and Vice Chair for Supervision Michael S. Barr, have championed discount window borrowing even in times of stability.

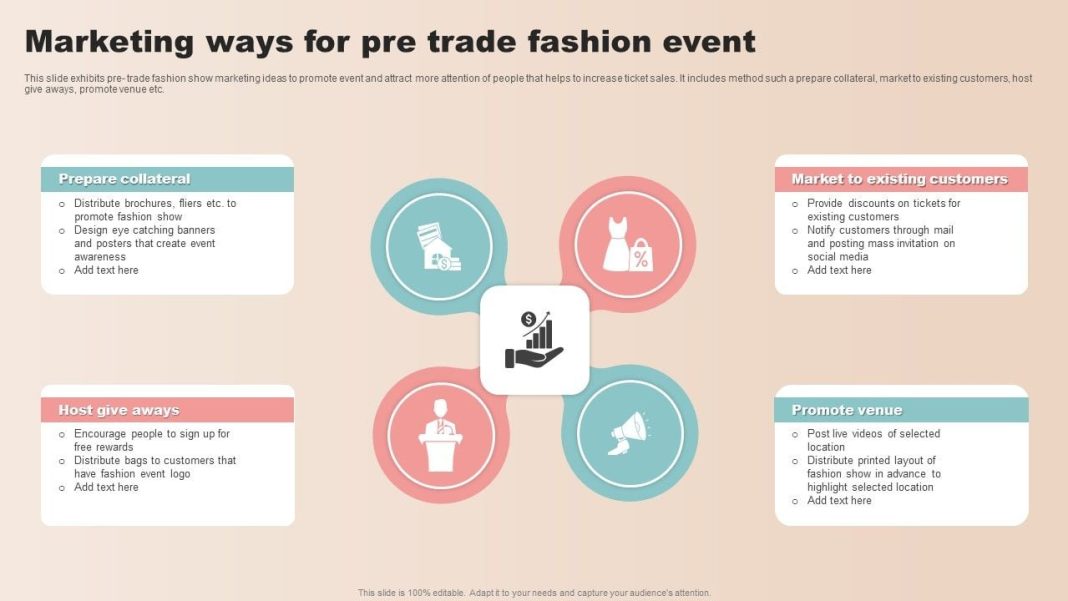

Pre-positioning Collateral and Operational Readiness:

To enhance preparedness for potential downturns, supervisors and regulators are encouraging banks to pre-position collateral. As a result, approximately $1 trillion has been pre-positioned so far. Recent Fed research reveals that the number of institutions signed up to use the facility increased by 9 percent in 2023 compared to the previous year, with a corresponding 11 percent increase in entities with collateral pledged.

Mitigating Stigma through Mandating Pre-positioning:

Fed officials, including Fed Gov. Michelle Bowman and Dallas Fed President Lorie Logan, have proposed exploring measures to mitigate the stigma associated with discount window borrowing. Bowman suggests that mandating pre-positioning collateral and periodic borrowing can help alleviate concerns. Logan adds that routine borrowing by every bank would make it clear that borrowing is not a negative signal.

Endorsements and Questions Raised:

The proposal to mandate banks’ pre-positioning at the discount window has garnered endorsements from various quarters. The Group of Thirty (G30), an international organization, published a study supporting strengthened lender-of-last-resort mechanisms. Former New York Fed chief William Dudley argues that pre-positioning would provide immediate liquidity during times of stress and shield uninsured depositors from risk. Stijn Claessens, the project director of the G30 Working Group, believes this reform would be the most important, feasible, and cost-effective.

However, some experts raise concerns about potential confusion between well-positioned banks and struggling institutions. Susan McLaughlin from the Yale School of Management questions whether the combination of a standing facility for adequately capitalized banks and one for weaker banks could create stigma by association.

Conclusion:

The Federal Reserve’s push to destigmatize discount window borrowing and ensure liquidity in the banking sector has gained momentum. By encouraging pre-positioning collateral and periodic borrowing, the Fed aims to normalize the use of the discount window even during stable periods. While some experts raise concerns about potential confusion and stigma, the overall focus remains on bolstering financial stability and increasing banks’ liquidity positions. As the banking sector heeds the Fed’s calls, discount window borrowing has seen a recent increase, emphasizing its continued relevance in providing essential support to banks and the economy.