Market Analysis: Bad News is Good News as Stocks Rise Despite Economic Concerns

Market Analysis: Bad News is Good News as Stocks Rise Despite Economic Concerns

Introduction:

In May, the market seems to be following the mantra of “Bad News is Good News.” Despite a plunge in consumer confidence, slowing job growth, and decelerating wage gains, the stock market has been on the rise. This article explores the factors contributing to this trend and provides insights into key market news items.

Treasury Rates and Stock Market Rally:

Last week, Treasury rates remained low following a successful refinancing of T-bills, notes, and bonds. The $25 billion auction of 30-year Treasury bonds was well received, leading to a decline in Treasury yields and triggering a stock market rally. This indicates that investors still have faith in the government’s ability to manage its debt.

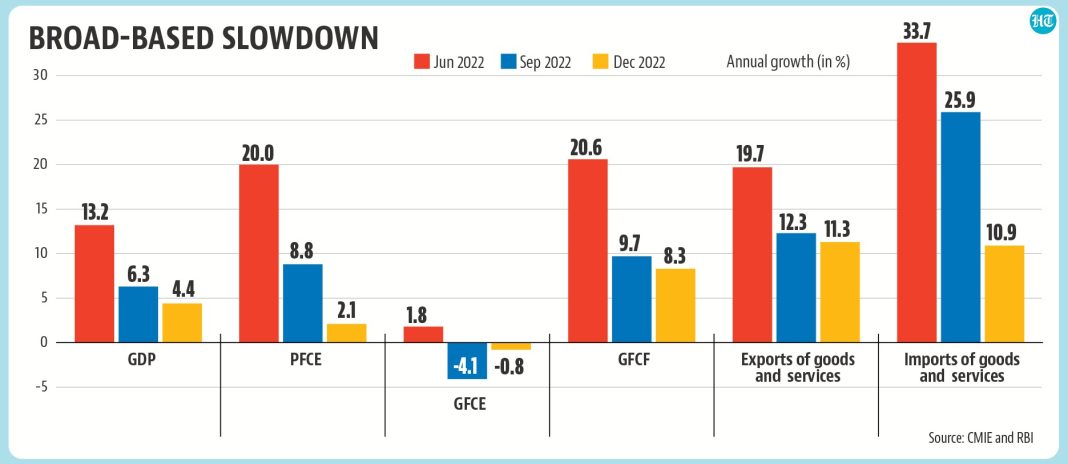

Atlanta Fed’s Upward GDP Revision:

Despite the dismal economic data that caused Treasury yields to decline, the Atlanta Fed raised its second-quarter GDP estimate to a 4.2% annual pace, up from its previous estimate of 3.3%. The primary reasons cited for this upward revision were a revision in real personal expenditure growth and real private domestic investment. However, this revision raises questions about the expectations for a big replenishment in inventories to achieve such strong GDP growth.

Inflation Concerns and Energy Prices:

The Producer Price Index (PPI) rose 0.5% in April and 2.2% in the past 12 months, with energy prices being the primary inflation catalyst. Approximately 75% of the rise in wholesale goods prices was due to a 5.4% increase in wholesale gasoline prices. This poses a challenge for the Federal Reserve as energy prices are largely inelastic, meaning they have limited control over them.

Consumer Price Index and Retail Sales:

The Consumer Price Index (CPI) is expected to announce a 0.4% increase, with particular attention on shelter costs. Higher shelter costs have been a concern, and any relief in this area would be welcomed. Retail sales will also be announced, and a weak report is anticipated by Wall Street to lower bond yields and encourage the Fed to cut key interest rates.

Biden Administration’s Tariffs and Inflation:

The Biden Administration has increased tariffs on Chinese electric vehicles (EVs) as a political move to gain support in key swing states like Michigan. While the 102.5% tariff on EVs is largely symbolic due to China’s limited presence in the US market, other tariff increases on lithium-ion batteries, steel, aluminum, semiconductors, solar cells, ship-to-shore cranes, and medical syringes are expected to contribute to higher prices and fuel inflation.

EV Market Woes and Ford’s Strategy:

Ford’s recent decision to cut orders from battery suppliers reflects the challenges in the EV market. The company is experiencing losses of up to $100,000 per vehicle and is reducing EV spending by $12 billion. However, Ford is still investing in the development of smaller EVs that will be more affordable. Other automakers like Volkswagen are also exploring partnerships to build cheaper EVs. The EV market remains uncertain, but cost-effective solutions are being pursued.

Russian-Ukrainian Conflict and Energy Stocks:

The ongoing conflict between Russia and Ukraine has raised concerns in the energy market. Russia’s advances come at a high cost in terms of casualties, while Ukraine is running out of troops. If Ukraine resorts to sabotaging Russian Arctic oil pipelines, crude oil prices could soar. Despite these concerns, energy stocks have shown resilience in the current market environment, making them an attractive investment option.

Tech Stocks and Market Performance:

Tech stocks, represented by the Magnificent 7 index, have seen a slight decline of 1.3% in the last week. Investors have been trimming overperforming tech stocks and adding to underperforming ones. The market breadth has improved, with the Russell 2000 leading in performance. Momentum remains positive but has slowed as the indexes recover from the April pullback.

Conclusion:

Despite concerns over economic indicators and inflationary pressures, the stock market has continued to rise. The market’s response to bad news can be attributed to expectations of the Federal Reserve cutting key interest rates. However, the impact of tariffs, the state of the EV market, geopolitical conflicts, and the performance of different sectors should be closely monitored to make informed investment decisions.