Banking regulators have recently raised concerns about the resolution plans of four of the largest American lenders. The Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) found weaknesses in the so-called “living wills” of Citigroup, JPMorgan Chase, Goldman Sachs, and Bank of America. These living wills are essentially plans for unwinding these massive financial institutions in the event of distress or failure.

Banking regulators have recently raised concerns about the resolution plans of four of the largest American lenders. The Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) found weaknesses in the so-called “living wills” of Citigroup, JPMorgan Chase, Goldman Sachs, and Bank of America. These living wills are essentially plans for unwinding these massive financial institutions in the event of distress or failure.

One major area of concern was the banks’ plans to unwind their massive derivatives portfolios. Derivatives are complex financial contracts tied to various assets, such as stocks, bonds, currencies, or interest rates. When regulators asked Citigroup to test its ability to unwind its contracts using different scenarios than those chosen by the bank, the firm fell short. This issue seemed to have affected all the banks that struggled with the examination.

According to regulators, Citigroup’s capability to unwind its derivatives portfolio under different conditions was found to have “material limitations.” The FDIC even classified Citigroup’s deficiency as more serious than those of the other banks, suggesting that its plan would not allow for an orderly resolution under U.S. bankruptcy code. However, the Federal Reserve did not fully agree with the FDIC’s assessment, resulting in a less-severe “shortcoming” grade for Citigroup overall.

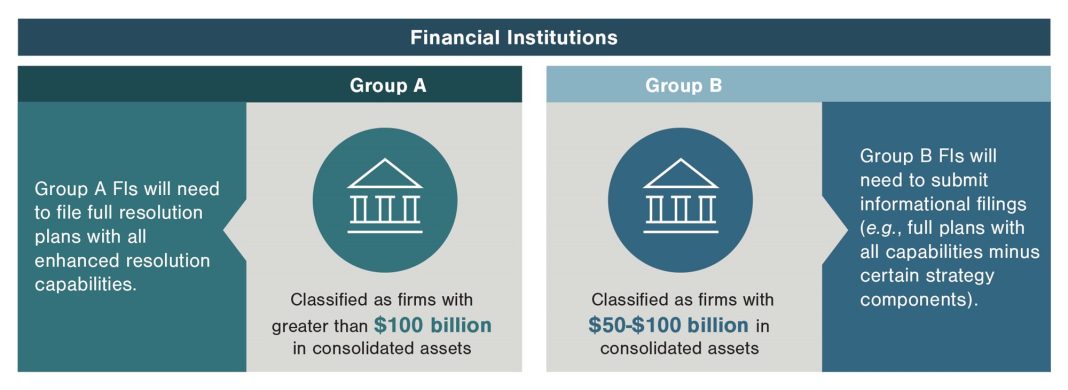

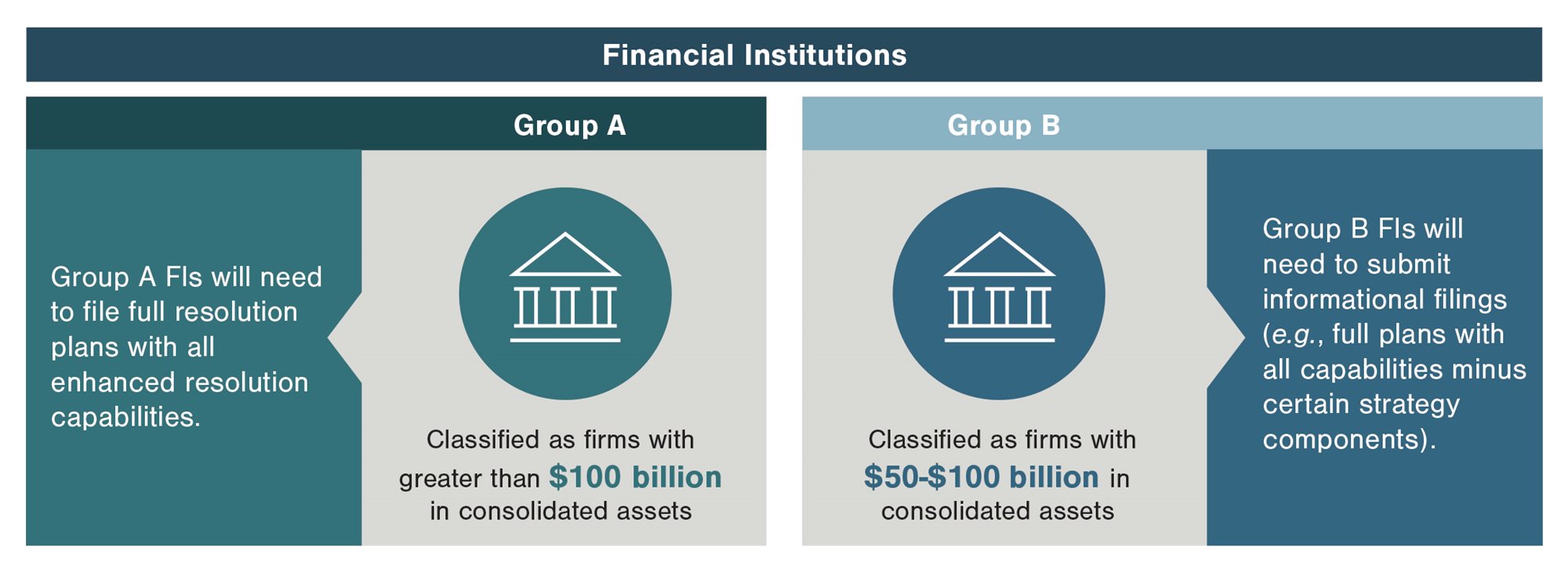

These living wills are a crucial regulatory exercise that originated after the 2008 global financial crisis. Every two years, the largest U.S. banks must submit their plans to credibly unwind themselves in case of a catastrophe. Banks that are found to have weaknesses must address them in subsequent living will submissions.

While JPMorgan, Goldman Sachs, and Bank of America also had shortcomings in their plans, Citigroup’s deficiency was seen as more severe. In response to the regulators’ findings, Citigroup stated that they are fully committed to addressing the identified issues and have made substantial progress on their transformation. The bank expressed confidence that it can be resolved without an adverse systemic impact or the need for taxpayer funds.

Overall, these concerns raised by regulators highlight the importance of robust resolution plans for financial institutions. The ability to unwind massive portfolios, especially in times of distress, is crucial for maintaining stability in the financial system. By identifying weaknesses and deficiencies, regulators can push banks to address these issues and strengthen their living wills, ultimately reducing the risk of a future financial crisis.