Title: Macy’s, Target, and Home Depot Signal Caution Amidst Economic Uncertainty

Introduction:

Macy’s and Target, two major retailers, have recently announced cautious sales forecasts, indicating a potential slowdown in consumer spending. This comes at a time of inflation and economic uncertainty, raising concerns about the overall health of the economy. The downward revisions in sales projections reflect a more discerning consumer base and an increased need for discounts to drive purchases. This article will delve into the details of these forecasts and explore the underlying factors contributing to the cautious outlook. Additionally, we will examine how these predictions align with Home Depot’s recent announcement and the wider economic landscape.

The Impact of Inflation and Consumer Behavior:

Macy’s, in its second-quarter earnings report, revealed a decline in net sales and comp sales. This decline can be attributed to inflation-weary shoppers who are becoming more selective in their purchasing decisions. To incentivize sales, Macy’s has had to offer increased discounts. This shift in consumer behavior has prompted the company to lower its full-year sales forecast, projecting a decline from the previous fiscal year. The company also anticipates a decrease in comparable sales, indicating a challenging retail environment.

Target’s Resilience Amidst Softening Consumer Spending:

While Target has posted strong quarterly earnings and sales numbers, the company remains cautious about its outlook. The retailer reported a return to growth in comp sales and improving trends across discretionary categories. However, Target’s full-year sales forecast aligns with Macy’s cautious approach, suggesting that consumer spending may slow down in the latter half of the year. This measured outlook reflects ongoing economic uncertainties impacting consumer behavior and spending patterns.

Home Depot’s Similar Cautionary Stance:

Home Depot, a bellwether for consumer spending, echoes the concerns expressed by Macy’s and Target. The largest home-improvement retailer has revised its full-year comp sales forecast, citing continued uncertainty around consumer demand. This adjustment indicates a deeper slump than initially anticipated and aligns with the cautious outlook of other major retailers.

Survey Findings and Counterpoints:

A recent survey conducted by the Federal Reserve Bank of New York reveals that household spending expectations are at their lowest level since April 2021. These findings support the cautious sales forecasts from Macy’s, Target, and Home Depot. However, it is worth noting that July’s retail sales numbers, as reported by the Census Bureau, showed a significant increase. This seemingly contradicts the notion of an imminent consumer spending slump.

Understanding the Retail Sales Data:

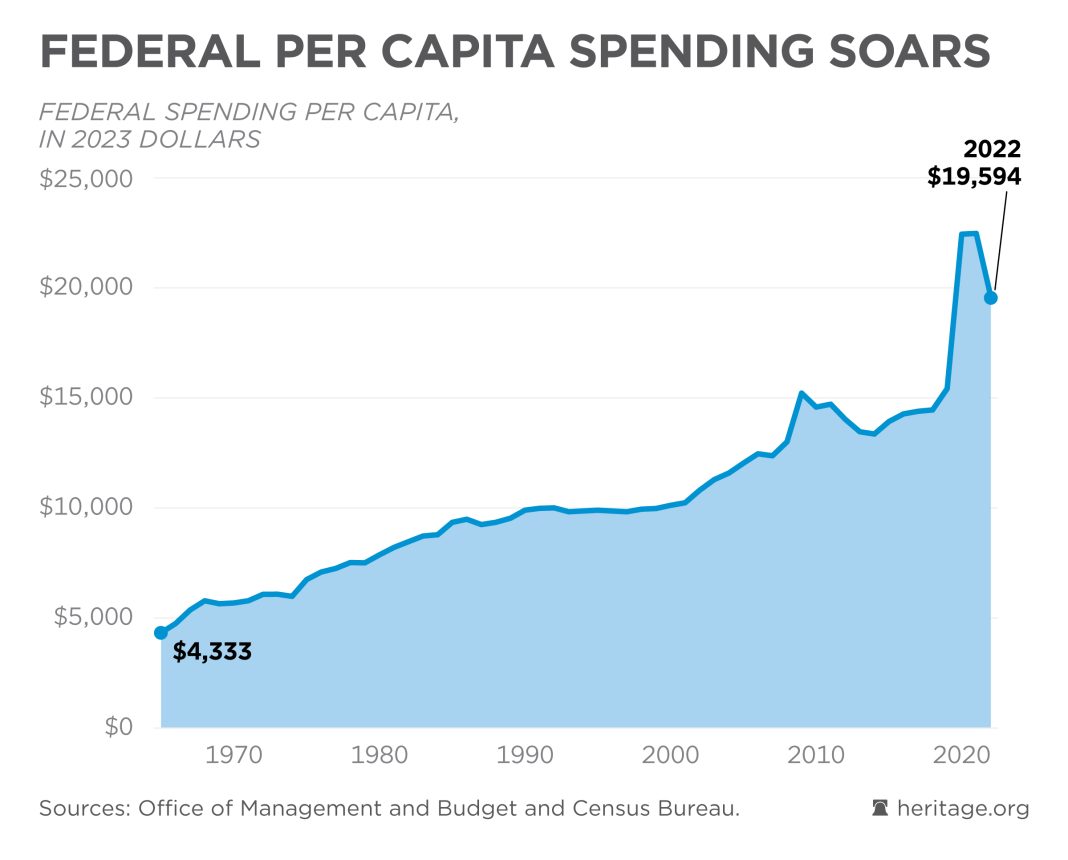

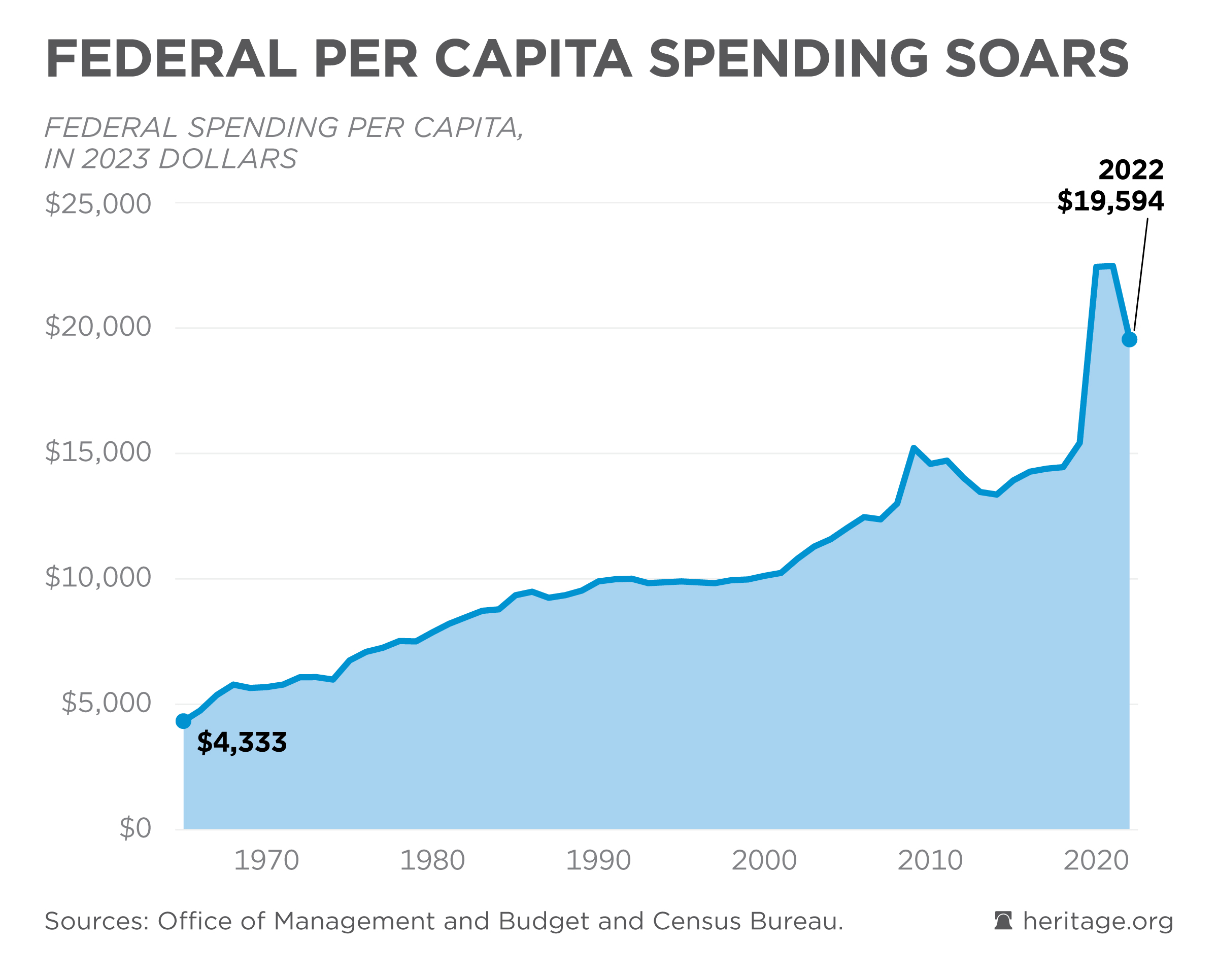

Experts argue that the reported retail sales numbers are nominal figures that do not account for inflation. Economist E.J. Antoni suggests that consumers are spending more on fewer, higher-priced items, which may be a result of inflation rather than increased demand. This analysis sheds light on the potential discrepancy between the strong retail sales data and the underlying economic realities.

Conclusion:

Macy’s and Target’s cautious sales forecasts, along with Home Depot’s revised outlook, indicate concerns about a potential slowdown in consumer spending. Inflation and economic uncertainties have led to a shift in consumer behavior, with shoppers becoming more selective and price-conscious. While July’s retail sales data appears positive on the surface, experts argue that inflation may be the driving force behind these numbers. As consumers grapple with rising prices, retailers must navigate a challenging retail landscape and adapt their strategies accordingly.