U.S. Jobless Benefits Claims Rise, But Continuing Claims Fall

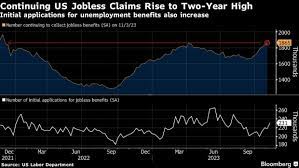

U.S. applications for jobless benefits experienced a slight increase last week, while the number of individuals collecting unemployment benefits decreased after reaching a two-year high. This article examines the latest data from the Labor Department and provides insights into the current state of the job market in the United States.

Jobless Benefits Claims Increase, but Remain in Line with Expectations

According to the Labor Department’s report on Thursday, unemployment benefits claims rose by 1,000 to 220,000 for the week ending December 2. This figure aligns with analyst expectations and indicates a relatively stable trend in jobless claims.

Continuing Claims Show Signs of Improvement

The number of individuals collecting unemployment benefits decreased to 1.86 million for the week ending November 25, marking a decline of 64,000 compared to the previous week. This decrease in continuing claims is significant as it is only the second time in 11 weeks that such a decline has been observed.

Challenges in Finding New Work Contribute to Rising Continuing Claims

Analysts suggest that the rise in continuing claims can be attributed to the difficulties faced by those who are already unemployed in finding new job opportunities. This observation aligns with a recent government report indicating a decrease in job openings, with U.S. employers posting the fewest job openings since March 2021.

Slower Hiring Pace Reflects Economic Recovery

The hiring pace has slowed down compared to the rapid growth observed in 2021 and 2022 when the economy rebounded from the COVID-19 recession. In previous years, employers added a record number of jobs per month, but this year, job gains have decreased to an average of 190,000 per month over the past five months.

Forecast for November Jobs Report

Analysts predict that the U.S. private non-farm job gains will reach approximately 173,000 when the government releases its November jobs report on Friday. This report will provide further insights into the current state of the job market and its impact on the economy.

Federal Reserve’s Efforts to Manage Economic Growth

The Federal Reserve has raised its benchmark interest rate 11 times since March 2022 in an attempt to slow down the economy and control inflation, which reached a four-decade high last year. Despite these measures, the job market and economic growth have remained resilient, defying expectations of a recession.

Moving Average of Jobless Claims Shows Slight Increase

The four-week moving average of jobless claim applications, which helps smooth out weekly volatility, increased by 500 to 220,750. This slight increase suggests some ongoing challenges in the job market, but it remains within a relatively stable range.

Conclusion:

The latest data on jobless benefits claims in the United States indicates a slight increase in applications but a decrease in continuing claims. While challenges in finding new work persist, the job market and economic growth have shown resilience. The upcoming November jobs report will provide further insights into the state of the U.S. job market and its impact on the overall economy.