Growth and Acquisition: Hydrow Takes the Lead in the Fitness Market

Growth and Acquisition: Hydrow Takes the Lead in the Fitness Market

Connected fitness company Hydrow has been making waves in the industry with its impressive sales growth and recent acquisition of strength training company Speede Fitness. As gymgoers shift their focus from cardio exercises to weight training, Hydrow is capitalizing on this trend to expand its offerings and solidify its position as a leader in the fitness market.

Hydrow, known for its high-end connected rowing machines that range from $1,700 to $4,000, has garnered significant support from private equity investors such as Constitution Capital and L Catterton. In addition, professional athletes like Travis Kelce and celebrities like Justin Timberlake have also invested in the company. With over $300 million in funding, Hydrow is well-positioned to make strategic moves in the fitness industry.

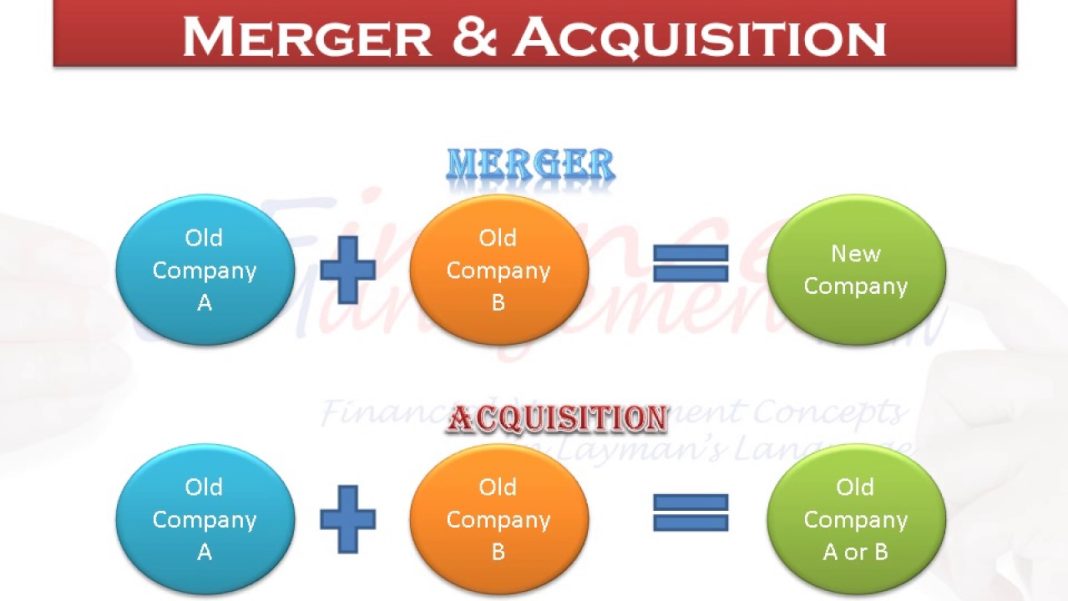

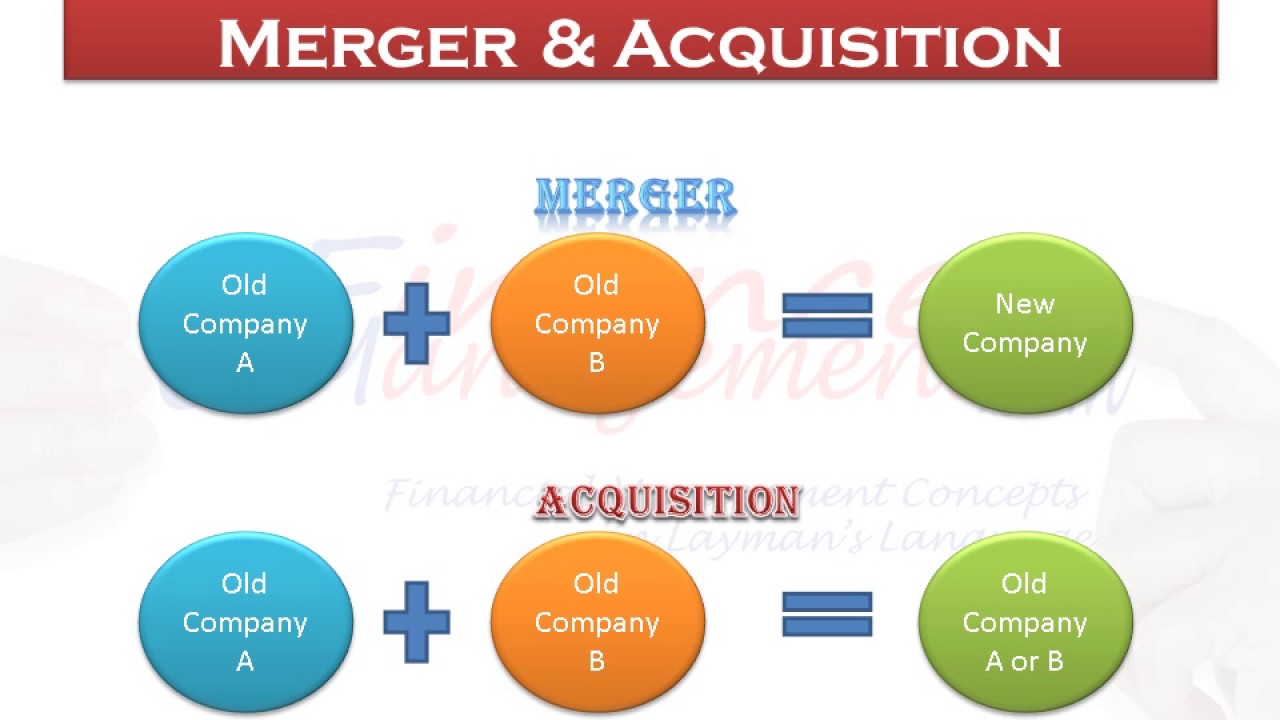

Recognizing the growing demand for strength training, Hydrow made the decision to acquire Speede Fitness. This move allows the company to expand into one of the fastest-growing segments in fitness. According to a survey by Life Time fitness, over one-third of respondents stated that their primary fitness goal for 2024 is “building muscle.” This represents an increase of more than 3% from the previous year. By incorporating Speede Fitness’ advanced technology, which includes artificial intelligence-powered cameras, sensors, and a large touch screen, Hydrow aims to offer a superior strength training experience to its customers.

Hydrow’s acquisition and sales growth come at a time when its competitor, Peloton, is facing challenges in turning around its business. Peloton, credited with creating the connected fitness market, attempted to acquire Hydrow during the height of the Covid-19 pandemic. However, Hydrow declined the offer. Now, Peloton is struggling with declining sales and losses, making it an acquisition target for private equity firms.

The contrasting fortunes of Hydrow and Peloton raise questions about the broader at-home fitness market and the internal challenges faced by Peloton. While Peloton primarily sells cardio machines, which are falling out of favor with consumers, Hydrow’s focus on strength training has allowed it to thrive. In fact, Hydrow’s sales for its connected rowing machine have seen a significant increase, with a 23% jump compared to the previous year. On Amazon, sales have soared by 273% in the 12 months leading up to March 31.

Peloton’s struggles highlight the importance of staying attuned to customer preferences and evolving trends in the fitness industry. While Peloton introduced its rowing machine, the Peloton Row, in September 2022, it has failed to generate much attention or promotion. Similarly, its AI-powered device for guided strength training, the Peloton Guide, has received minimal recognition. In Peloton’s fiscal third-quarter shareholder letter, the Guide was only mentioned in relation to a $9.1 million write-down for product inventory.

The success of Hydrow and its ability to capitalize on the shift towards strength training raises questions about Peloton’s approach and product positioning. It is evident that consumers are increasingly gravitating towards strength training and seeking more variety in their fitness routines. By focusing on this growing segment and leveraging advanced technology, Hydrow has positioned itself as a frontrunner in the fitness market. As the industry continues to evolve, it will be interesting to see how both Hydrow and Peloton adapt to meet the changing needs and preferences of consumers.