Building wealth is a goal that many people aspire to achieve. However, there are misconceptions and unrealistic expectations surrounding the process. In a speech at an event focused on creating a $10 million portfolio, the speaker found that the audience’s expectations did not align with the reality of wealth-building.

The speaker started by debunking a common myth perpetuated by the investment industry – the idea that investing in stocks and bonds alone can make someone wealthy in a short amount of time. While investing in the stock market can yield positive returns, it requires time for compound interest to work its magic. The speaker emphasized that to truly accumulate wealth, individuals need at least 30 years for their investments to grow significantly.

To illustrate this point, the speaker used a hypothetical scenario. Starting with an initial investment of $50,000 and assuming a tax-deferred investment strategy with a proven 10 percent annual return, the speaker showed how the investment would grow over time. After 10 years, the investment would reach $129,687. After 20 years, it would grow to $336,375. Finally, after 30 years, it would amount to $872,470.

While these figures might seem substantial, the speaker highlighted that $872,470 would only generate $87,200 of income for 10 years, which is not considered wealthy. Furthermore, most individuals do not have 30 years to wait before they can start enjoying the fruits of their investments. This brought the speaker to the question of what aspiring wealth-seekers should do.

The speaker shared five fundamental steps to building wealth effectively:

1. Master your debt: Borrow only for wealth-building purposes and ensure that your debt is manageable.

2. Increase your income: Strive for steady and significant income growth by creating additional income streams.

3. Limit future spending: While it’s important to reward yourself, allocate a significant portion of your extra income toward growing your wealth.

4. Set aside a start-over fund: Prepare for unexpected income loss by saving enough money to cover living expenses and restart income streams if necessary.

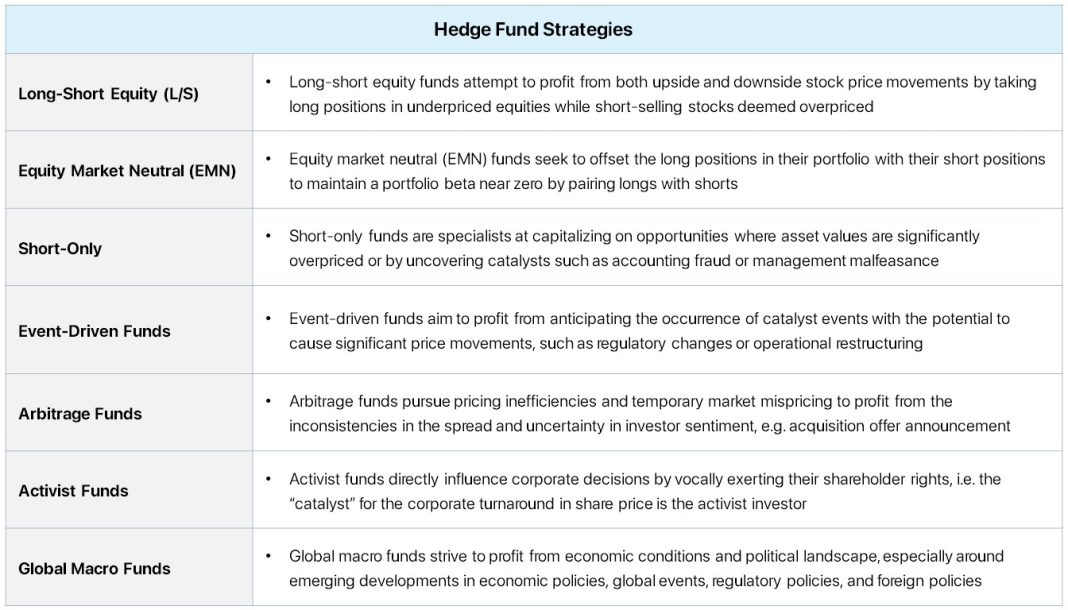

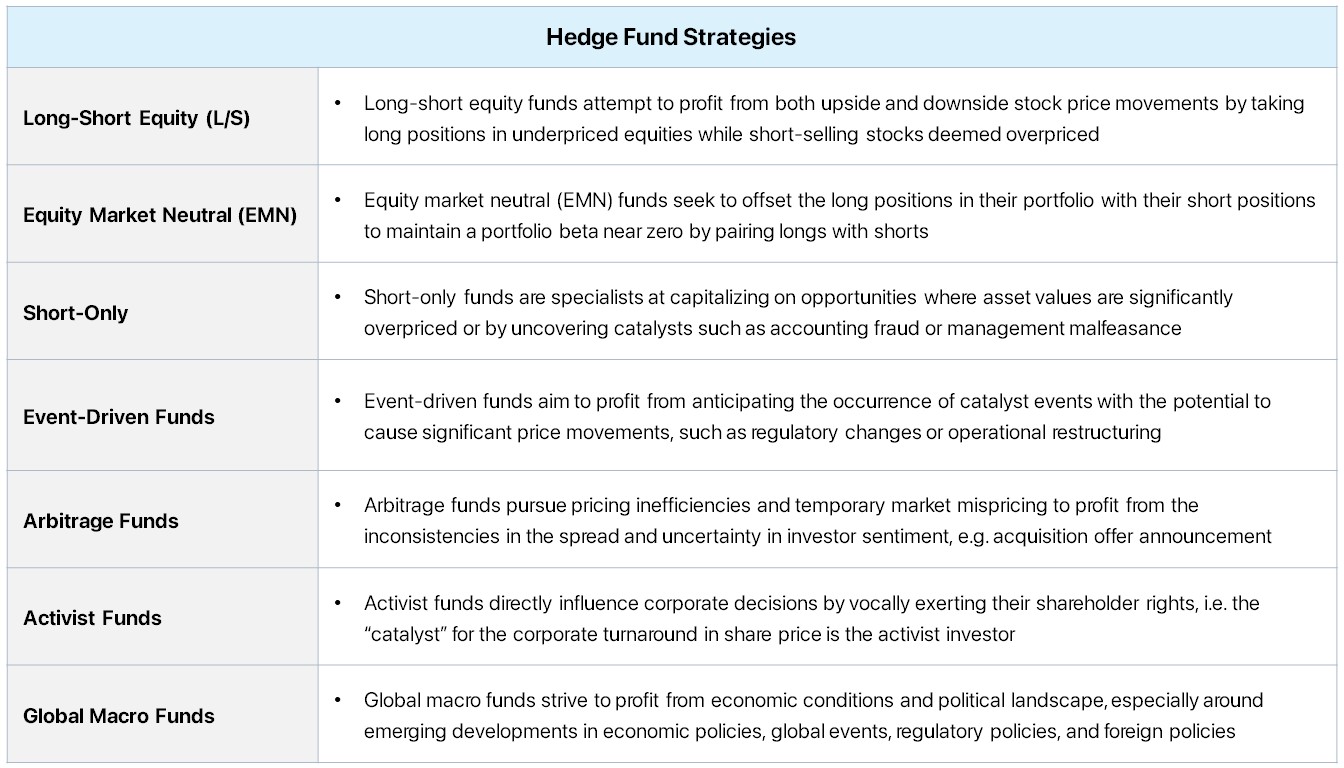

5. Go beyond Wall Street: While stocks and bonds have their place, exploring alternative investments that offer higher yields is essential for achieving ROIs exceeding 10 percent.

The speaker focused primarily on the last strategy, emphasizing the importance of diversifying investments beyond traditional avenues. They categorized investments based on the time and attention required:

1. Passive investments: These require minimal time and attention, such as mutual funds and managed stock and bond accounts. While they offer safety, they provide the lowest ROI, averaging around 7 to 10 percent.

2. Semi-active investments: These require some time and attention, including direct lending, super-safe options like selling puts on reliable stocks, rental real estate, and managed tax liens. They offer a safer range of 8 to 16 percent ROI.

3. Active investments: These demand significant time and attention, primarily involving investments in entrepreneurial businesses. The key is to invest in businesses you understand and can control. Active investments can deliver several years of 100 percent growth followed by 25 to 50 percent returns.

The speaker assured the audience that while there is always a risk of losing money in any investment, wise choices within each investment category can yield returns within their respective natural ranges.

However, the audience’s disappointment was palpable. These retired or nearly retired individuals had attended the event with dreams of creating a $10 million portfolio and acquiring million-dollar ideas. They sought a shortcut to a 10,000 percent ROI that had eluded them throughout their lives. The speaker’s realistic approach, with the potential for consistent, but not immediate, growth, did not meet their expectations.

This anecdote highlights the importance of managing expectations when it comes to wealth-building. It is crucial to understand that wealth accumulation is a long-term process that requires patience, discipline, and a diversified approach. While there are no guarantees of overnight success, making informed choices and exploring a range of investment options can lead to steady and sustainable wealth creation.