The Dangers of Buying Flood-Damaged Cars: How to Avoid a Costly Mistake

Introduction:

When a storm strikes and causes flooding, the impact is not limited to the immediate victims. The repercussions can spread across the nation, affecting unsuspecting buyers of flood-damaged cars. According to Carfax, there are currently 454,000 flooded cars on the road, with many owners unaware of their vehicle’s true condition. It’s crucial to know how to avoid buying a flood car to protect yourself from potential problems down the line.

Flood Cars Titled as ‘Salvage’ and Resold:

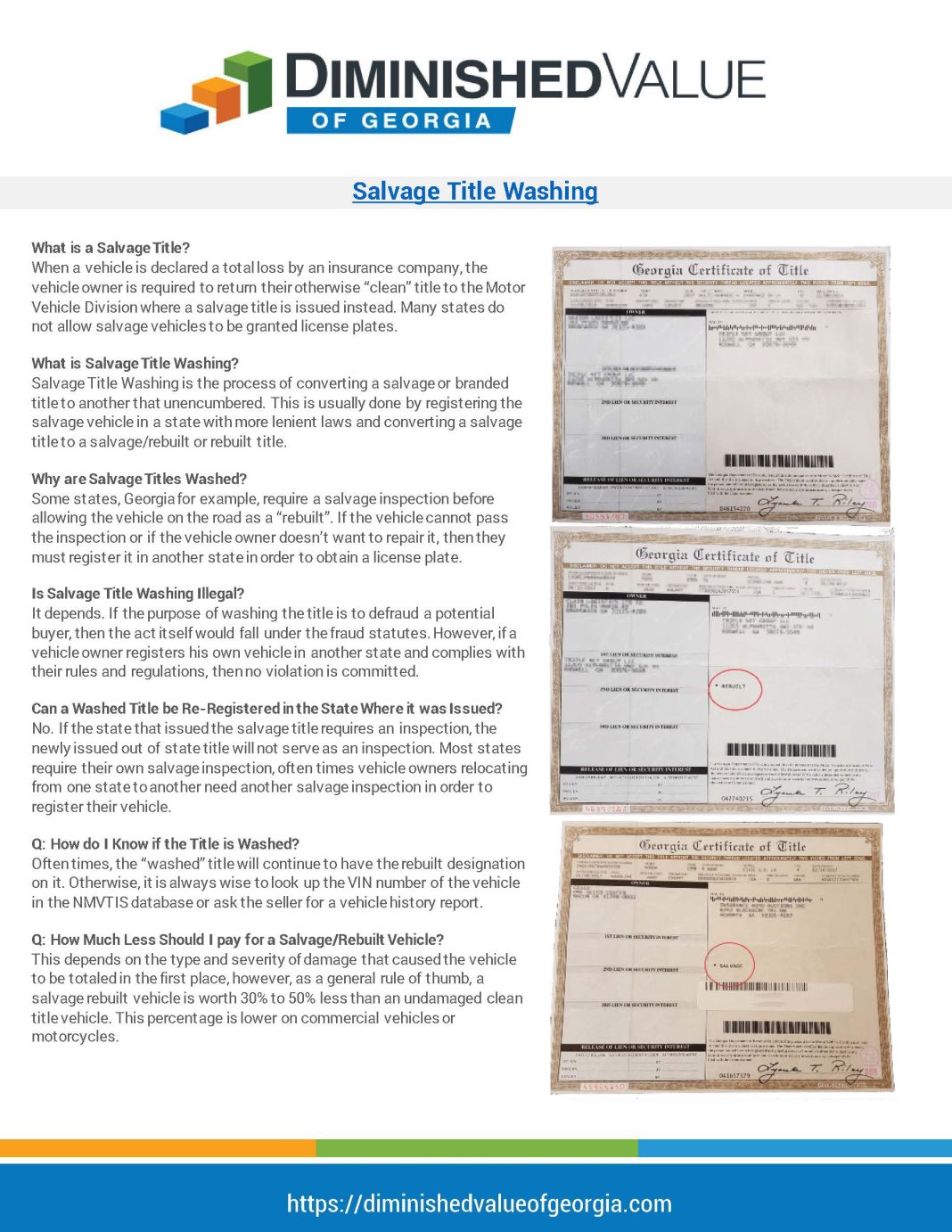

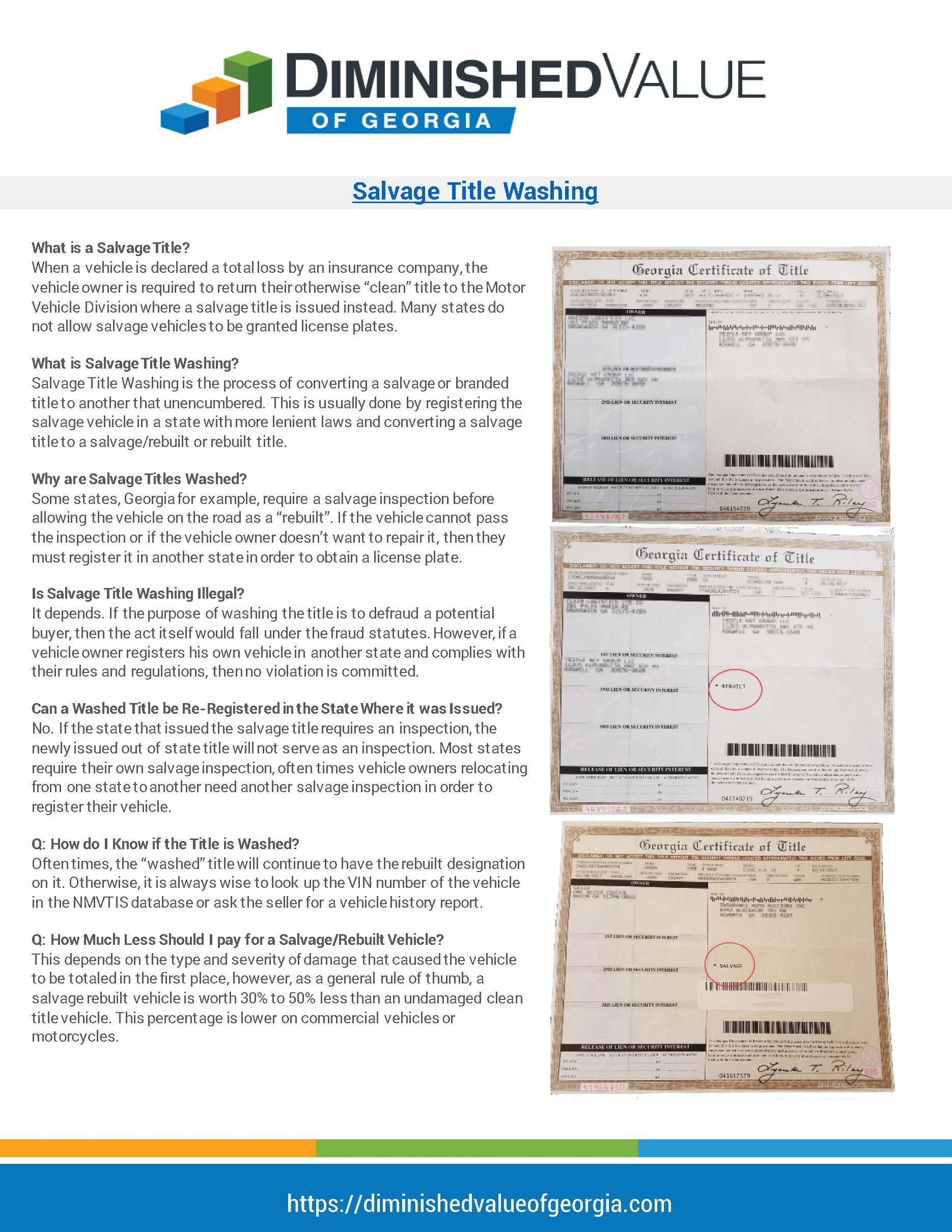

After an insurance company declares a flood-damaged car a total loss, it is typically sold at salvage auctions to junkyards and vehicle rebuilders. However, it is legal to resell the vehicle to the public as long as the damage is disclosed in the title. Salvage titles are usually marked with the words “salvage” or “flood,” but in some cases, they may have a number code or obscure letter instead. Before a salvage title car can be registered again, necessary repairs must be made, and it must pass a thorough inspection. Once it meets these requirements, it is issued a new title, “rebuilt,” and can be registered for consumer use. However, Consumer Reports’ investigation reveals that some flood-damaged vehicles have entered the market with clean titles, raising concerns for potential buyers.

The Importance of Vehicle History Reports:

To protect yourself from unknowingly purchasing a flood-damaged car, it is crucial to conduct thorough research. The National Motor Vehicle Title Information System (NMVTIS) is an excellent resource when buying a used car. This site directs you to government-approved vehicle history reports and helps crack down on the practice of “title washing.” Title washing often occurs when cars are flooded or stolen, and they receive clean titles in states with lax regulations. You can also check the National Insurance Crime Bureau’s (NICB) VIN check, which reveals if a participating NICB insurer has designated the car as salvage. For a comprehensive history, ordering a Carfax report is highly recommended. In addition to the title history, it provides information about the car’s maintenance and accident history.

Limitations of Titles and Vehicle History Reports:

While titles and vehicle history reports are valuable tools, they are not foolproof and cannot guarantee a problem-free vehicle. Conducting a detailed inspection of the car is essential. This is especially true if the car originates from a storm-prone state. When inspecting a car for flood damage, start with the sniff test. A musty odor reminiscent of an old basement could indicate water damage. On the other hand, an overpowering scent, like that of a perfume factory, may be a red flag that the seller is attempting to mask something. Take note of any new upholstery in an older vehicle, as this is often a sign that something happened. Checking the wiring under the dash is another crucial step. The wires should be flexible, and if they feel brittle, it suggests that the vehicle has been in a flood. Additionally, pay attention to areas where mud or silt may accumulate during a flood, such as the glove box, alternator crevices, starter motor, power steering pump, and under the spare tire. Turning on the car’s radio and checking the door speakers for crackling sounds can also provide insight into flood damage. Look for water lines on the door and signs of oxidation under the hood, such as rust or a green patina on copper.

The Timing Factor:

It’s essential to be cautious when buying a used car after a storm. Some states do not check for existing salvage titles before issuing new ones. This creates an opportunity for fraudulent sellers to obtain a clean title and sell the car to unsuspecting buyers. This practice is more prevalent in the months following a major storm or flooding. Trusting your instincts and being vigilant about the details can help you avoid falling victim to such scams.

The Risks of Buying a Flood Car:

Purchasing a flood-damaged car comes with significant risks. The vehicle may have major engine problems or experience ongoing issues, making it unreliable. Additionally, insurability becomes a concern. Insurance companies typically do not offer comprehensive or collision policies for cars with salvage titles, leaving you with only liability insurance. Considering these risks, it is crucial to do your due diligence and avoid buying a flood car.

Conclusion:

Buying a flood-damaged car can lead to countless headaches and financial losses. By following the guidelines outlined above, you can protect yourself from purchasing a vehicle with hidden damage. Conducting thorough research, utilizing vehicle history reports, and performing a detailed inspection are essential steps to avoid falling victim to unscrupulous sellers. Remember, if a deal seems too good to be true, it probably is. Trust your instincts and seek out reputable dealers or sellers to ensure a safe and reliable purchase.