The Rise of AI Chips as Collateral for Lending: A Game-Changing Trend in the Financial Industry

The Rise of AI Chips as Collateral for Lending: A Game-Changing Trend in the Financial Industry

Introduction

In the world of lending, necessity has always been the driving force behind innovation. Lenders want to lend, and borrowers want to borrow, but finding the right collateral can be a challenge. However, a new trend has emerged in the lending landscape: the use of Artificial Intelligence (AI) chips as collateral. This game-changing development is reshaping the industry and opening up new possibilities for both lenders and borrowers.

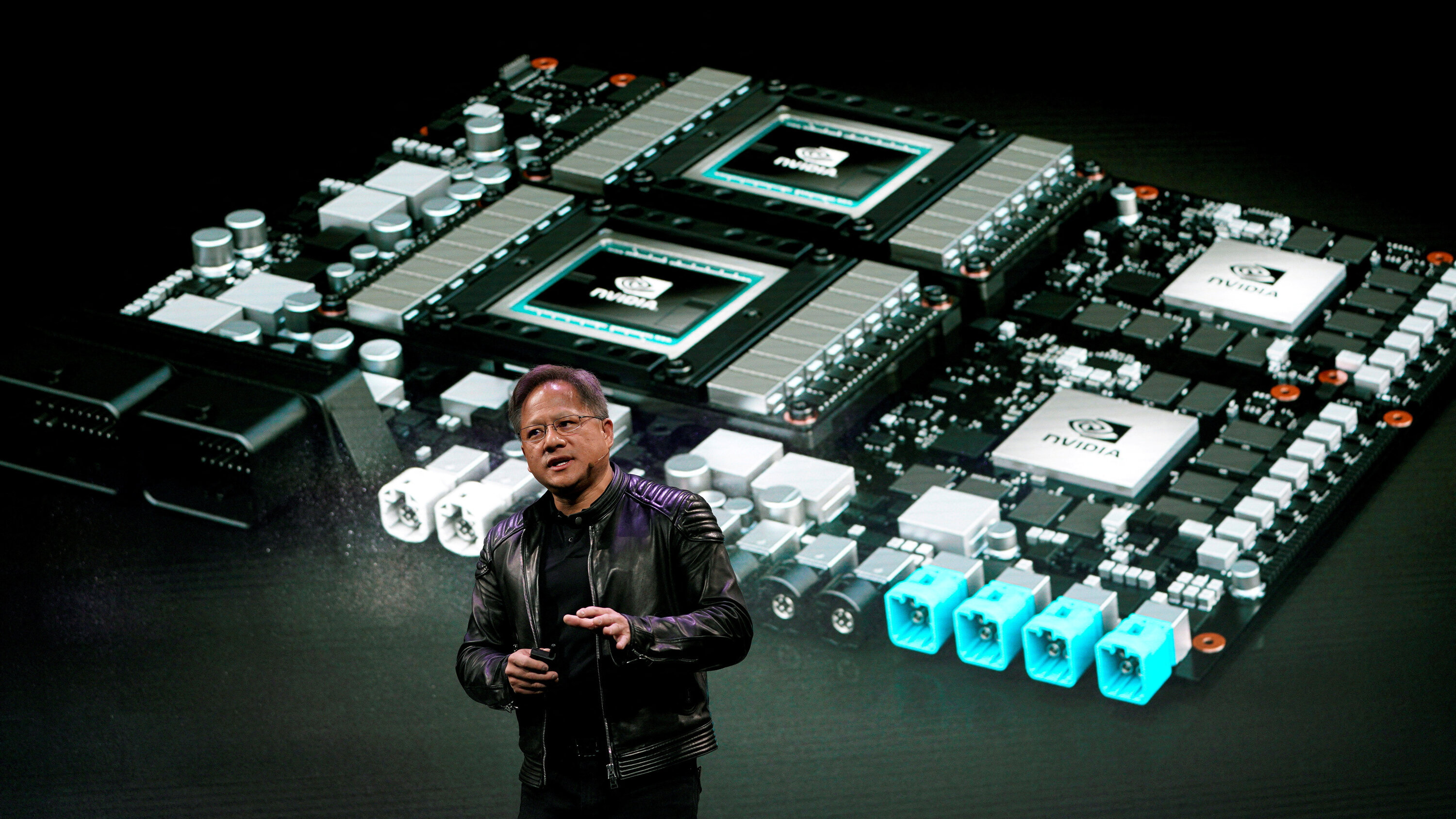

The Collateral of the Realm: NVIDIA’s GPU Chip

Currently, the most sought-after collateral in the lending space is NVIDIA’s graphics-processing-unit (GPU) chip. Giants like Amazon and Microsoft are gobbling up these chips at an unprecedented rate, causing prices to skyrocket. Asa Fitch and Miriam Gottfried report for The Wall Street Journal that these chips have become so valuable that they are now being used to backstop loans, giving them a whole new level of utility and power.

Over $10 billion has already been raised using GPU chips as collateral. This is particularly significant considering that many AI startups, although growing rapidly, are not yet profitable. Traditional lenders, who typically offer lower interest rates, have been hesitant to venture into this sector. As a result, asset-based lenders, who are accustomed to working with small businesses and real estate developers, have stepped in to provide capital for this high-flying technology niche.

Access to Capital: A Make-or-Break Factor

Michael Intrator, the CEO of CoreWeave, a New Jersey-based startup that owns AI chips and associated computing gear in data centers, emphasizes the importance of access to capital in this rapidly evolving industry. He states that success or failure hinges on the ability to secure funding quickly. For now, although the interest rates are in the low double digits, it allows companies like CoreWeave to move at the necessary scale. Intrator hopes that over time, his company will be able to obtain cheaper funding.

The Deal Structure: A Metaphorical Lockbox

The deal structure for these loans is interesting and unique. Fitch and Gottfried describe it as a “metaphorical lockbox” that houses all of CoreWeave’s AI chips. The revenue generated from clients using these chips is directed towards paying off the lenders. This structure bears some resemblance to most accounts-receivable factoring structures but with a twist. Veteran lenders might scoff at the term “metaphorical lockbox,” but it effectively encapsulates the innovative nature of these loans.

AI Lending Beyond Wall Street: Retail Investors Join the Game

The AI boom is not limited to Wall Street and big corporations. Retail investors are also actively participating in this trend. Robinhood, the popular brokerage among millennials and Gen Zers, has recently reduced its margin lending rates to as low as 6.75 percent for balances up to $50,000. This move allows retail investors to take advantage of the AI revolution and capitalize on investment opportunities with more favorable rates.

However, it’s crucial to be cautious about the potential risks associated with margin investing. Almost Daily Grant’s warns that the aggregate margin debt outstanding reached $775.5 billion by the end of April 2022, a 23 percent increase from the previous year. This level of debt is equivalent to 2.8 percent of GDP, reminiscent of the peak of the late 1990s dot-com bubble. While the numbers are not yet at their highest, the current trend raises concerns about the stability of the market.

The Future of AI Lending: A Balancing Act

The success of lending and borrowing in the AI space is intricately tied to the strength of the AI boom itself. At present, there is an insatiable demand for AI chips, but companies, both big and small, are struggling to generate sufficient revenue from AI to justify the costs associated with computing power. This challenge demonstrates the delicate balancing act that lenders and borrowers must navigate in this evolving landscape.

Conclusion

The rise of AI chips as collateral for lending is revolutionizing the financial industry. As traditional lenders shy away from the AI sector, asset-based lenders are seizing the opportunity to provide capital to high-growth AI startups. Retail investors, too, are participating in this trend, with Robinhood reducing margin lending rates to attract more customers. However, caution is necessary to prevent excessive leverage and potential market instability. The future of AI lending relies on the continued growth of the AI industry and finding the right equilibrium between demand and profitability.