The housing market in the United States is experiencing a decline in confidence among homebuilders due to high mortgage rates and borrowing costs. According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), builder confidence fell to its lowest point of the year in August, with a reading of 39, down from 41 in July. This is the lowest reading since December 2023 and below the key threshold of 50, which indicates builders’ confidence in the near-term sales outlook.

The housing market in the United States is experiencing a decline in confidence among homebuilders due to high mortgage rates and borrowing costs. According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), builder confidence fell to its lowest point of the year in August, with a reading of 39, down from 41 in July. This is the lowest reading since December 2023 and below the key threshold of 50, which indicates builders’ confidence in the near-term sales outlook.

One of the contributing factors to the decline in confidence is the increase in mortgage rates. High interest rates have kept mortgage rates and borrowing costs elevated, which has put pressure on both customers and those in the construction industry. In fact, a measure of present sales also slumped in August, with a reading of 44. Furthermore, a survey conducted by the NAHB revealed that 33 percent of builders had to cut home prices in order to boost sales, marking the highest share of discounted homes so far this year.

Prospective-buyer traffic also declined in August, reaching a new low for 2024 with a decline of two points to 25. However, there is a glimmer of optimism as sales expectations in the next six months increased by one point to 49. This increase may be attributed to the anticipation that the Federal Reserve will cut interest rates. The Federal Reserve has been considering interest rate cuts due to current inflation data and the recent decrease in mortgage rates.

Freddie Mac reported that mortgage rates hit their lowest level in over a year during the week of August 8. The decline in rates was attributed to weak labor market data. Sam Khater, Freddie Mac’s chief economist, stated that the decline in mortgage rates increases prospective homebuyers’ purchasing power and should begin to pique their interest in making a move.

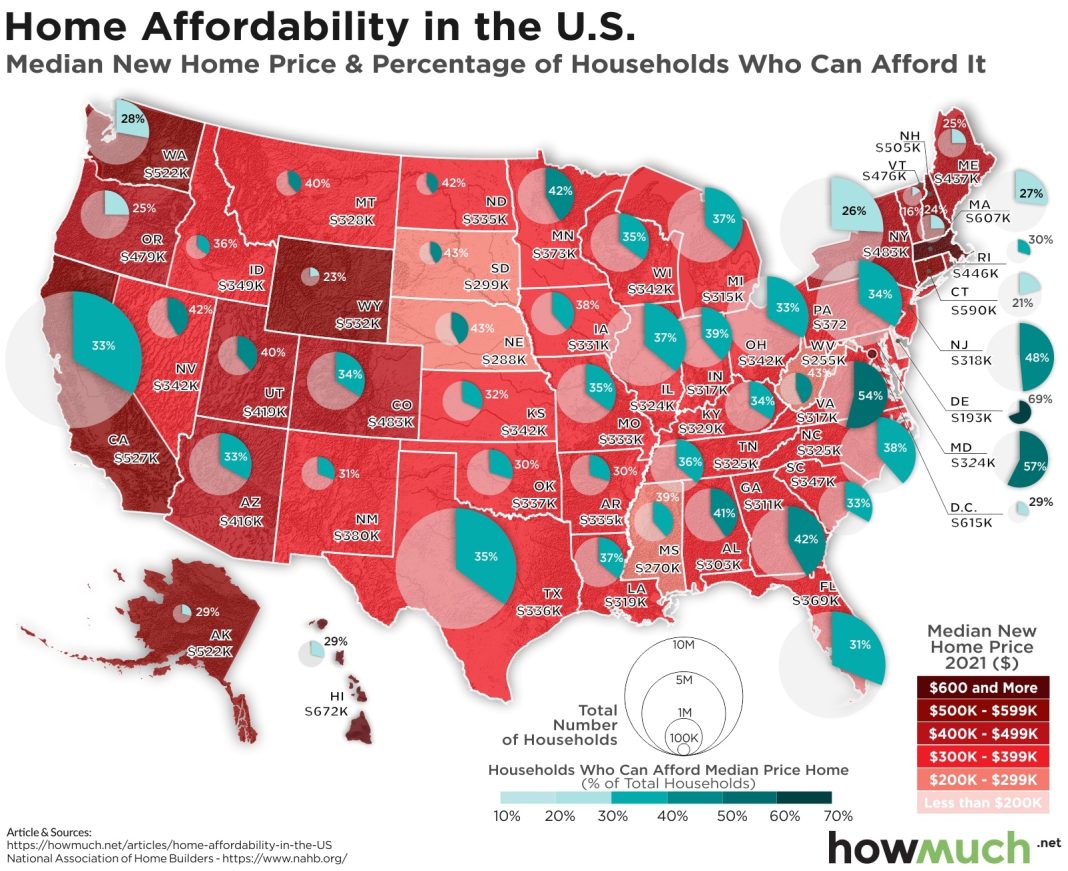

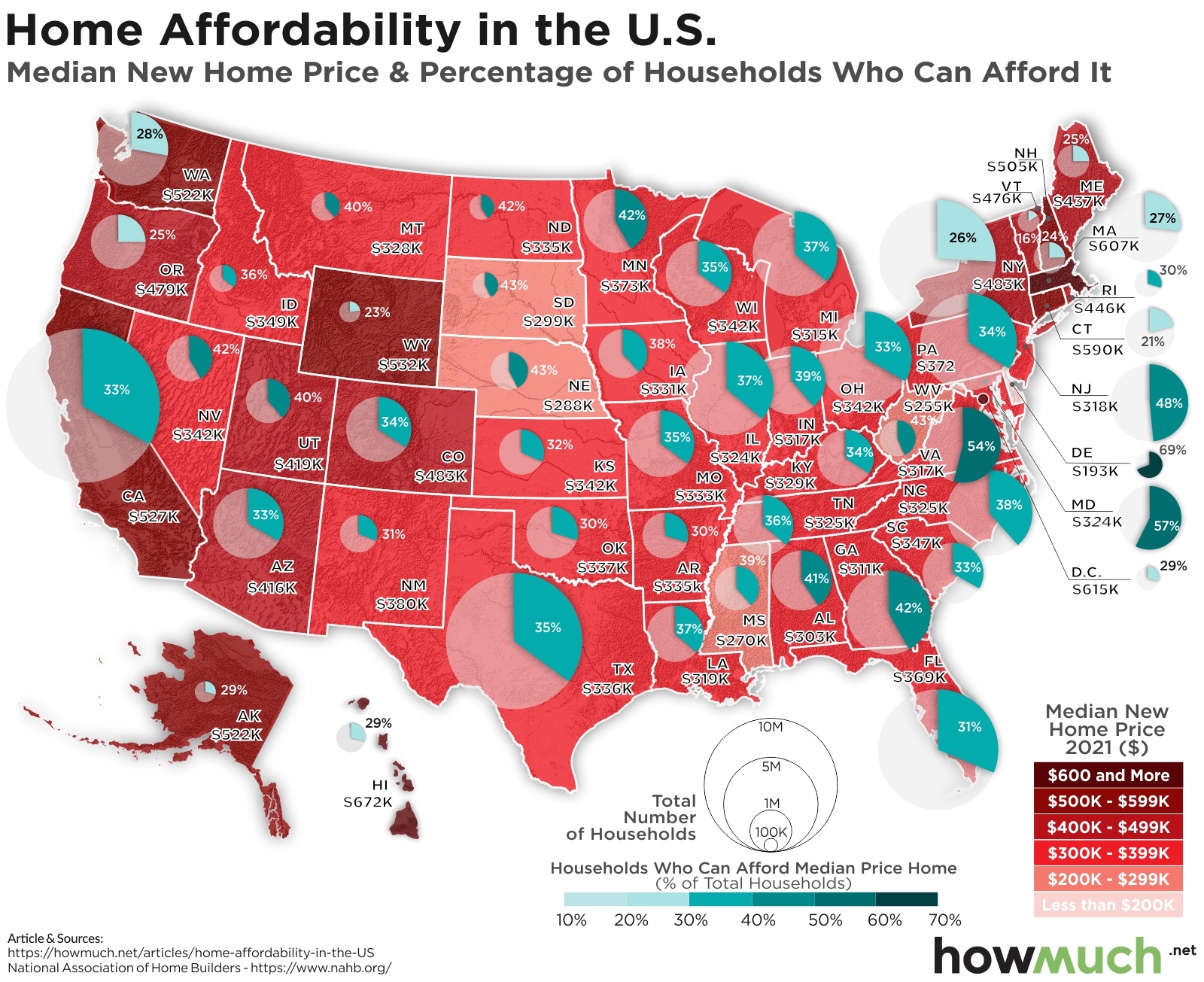

Despite the decrease in mortgage rates, housing prices continue to rise. Data released by the National Association of Realtors (NAR) showed that the median price of a single-family existing home in the United States grew by 4.9 percent over the past year, reaching $422,100. This rise in prices puts additional pressure on prospective homebuyers. NAR chief economist Lawrence Yun acknowledged the wealth gains for homeowners but highlighted the difficulty for those wanting to buy a home, as the required income to qualify has roughly doubled in the past few years.

Limited inventory also poses a challenge for first-time buyers. In the second quarter, the NAR reported that first-time buyers had to contend with limited inventory. However, the NAR predicts that housing affordability will improve in the coming months as more supply reaches the market.

Carl Harris, the chairman of the NAHB and a custom homebuilder from Kansas, emphasized the challenging housing affordability conditions faced by prospective homebuyers in August. He suggested that the only sustainable solution to address high housing costs is to implement policies that allow builders to construct more attainable and affordable housing.

Elevated housing costs are not only impacting homebuyers but also contributing to inflation. Despite an overall easing of inflation to 2.9 percent in July, the shelter component of the Consumer Price Index (CPI) unexpectedly rose by 0.4 percent, doubling June’s increase. The shelter index has risen by 5.1 percent over the past year, accounting for more than 70 percent of the total 12-month increase in the core inflation measure, which excludes food and energy. This highlights the impact of housing costs on inflation and the need to address the issue.

In conclusion, the decline in homebuilder confidence in August is a result of high mortgage rates and borrowing costs. Prospective homebuyers are facing challenging housing affordability conditions, with rising prices and limited inventory. However, the anticipation of interest rate cuts by the Federal Reserve and the recent decrease in mortgage rates may improve buyer interest and builder sentiment in the coming months. It is crucial to implement policies that promote the construction of more attainable and affordable housing to address the issue of high housing costs. Additionally, elevated housing costs are contributing to inflation, emphasizing the need to find sustainable solutions to tackle this problem.