Gasoline prices have fallen while shelter costs remain elevated, contributing to a decrease in the U.S. annual inflation rate. The consumer price index (CPI) slowed to 3 percent in June, down from 3.3 percent in May, which was below the consensus estimate of 3.1 percent. This marks the 39th consecutive month that the CPI has been at or above 3 percent. The six-month annualized rate also dropped to a nine-month low of 3.3 percent.

Gasoline prices have fallen while shelter costs remain elevated, contributing to a decrease in the U.S. annual inflation rate. The consumer price index (CPI) slowed to 3 percent in June, down from 3.3 percent in May, which was below the consensus estimate of 3.1 percent. This marks the 39th consecutive month that the CPI has been at or above 3 percent. The six-month annualized rate also dropped to a nine-month low of 3.3 percent.

One of the driving factors behind the decline in prices was gasoline. The index for gasoline decreased by 3.8 percent in June, following a 3.6 percent drop in May. Overall energy prices dropped by 2 percent during this period. However, crude oil prices have shown signs of renewed momentum amid tightness in global petroleum markets. U.S. crude prices are currently trading at around $82 per barrel on the New York Mercantile Exchange.

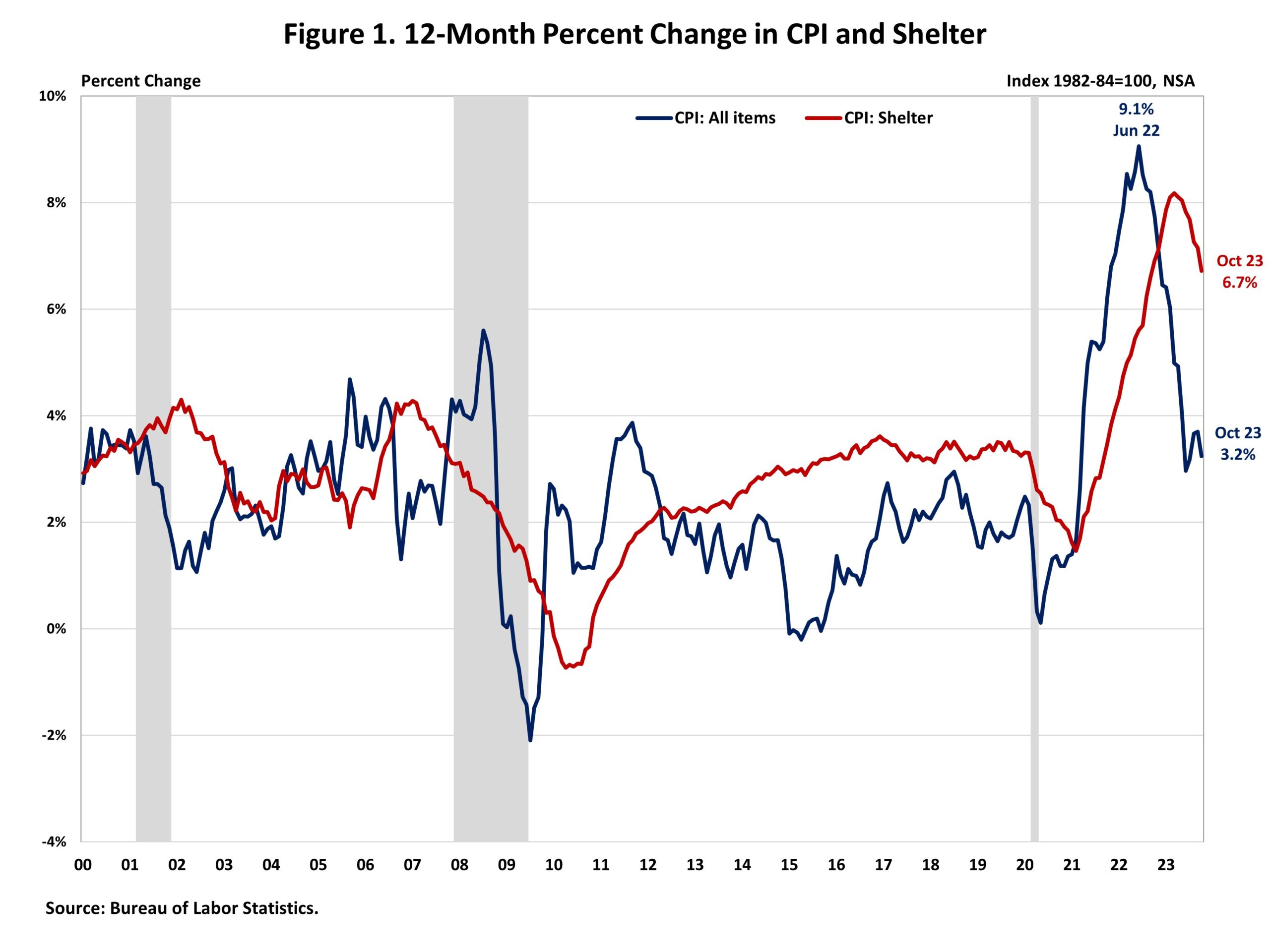

While gasoline prices have fallen, shelter costs have remained a major factor for elevated inflationary pressures. Shelter inflation, which includes the cost of housing, has been a persistent trouble spot and accounts for more than two-thirds of the increase in core CPI over the past year. Shelter costs edged up by 0.2 percent in June and are up 5.2 percent compared to the same time last year. Despite expectations for a decrease in shelter inflation, it has yet to materialize, making it difficult to achieve the Federal Reserve’s 2 percent inflation target.

In addition to gasoline and shelter costs, other components of the CPI also experienced changes. The food index rose by 0.2 percent, with supermarket prices increasing by 0.1 percent and food away from home rising by 0.4 percent. Core inflation, which excludes volatile food and energy components, eased to 3.3 percent in June, down from 3.4 percent the previous month. On a month-over-month basis, the core CPI rose by 0.1 percent, below the consensus forecast of 0.2 percent.

The latest CPI data align with a cooling economy, which supports the case for a potential interest rate cut by the Federal Reserve. Fed Chair Jerome Powell recently stated that “more good data” is needed before the central bank can comfortably cut interest rates. The June CPI readings coming in lower than expected could strengthen the case for a rate cut in September.

Financial markets reacted positively to the CPI data, with the leading benchmark index up by as much as 0.2 percent. However, the Treasury market saw a decrease in yields, with the benchmark 10-year yield falling to 4.2 percent. The U.S. Dollar Index also plummeted below 105.

While there is anticipation for an interest rate cut in September, some officials, like Minneapolis Fed President Neel Kashkari, believe that more evidence is needed to convince them that inflation is moving sustainably toward the Fed’s 2 percent target. The June Summary of Economic Projections suggests that only a single rate cut is expected this year, with officials projecting a median policy rate of 5.1 percent. The Fed’s preferred inflation gauge, the personal consumption expenditure price index, is expected to reach 2 percent by 2026.

Overall, the recent CPI data provides evidence of progress being made in returning to the Federal Reserve’s 2 percent inflation target. However, more data and evidence are needed before the central bank can confidently make decisions regarding interest rates. The next CPI report is estimated to show an annual inflation rate of 3.2 percent in July, with the core CPI expected to be 3.6 percent.