Former NFL running back Adrian Peterson has been ordered by a Houston judge to turn over numerous assets to pay off a debt of over $12 million. The request was made by the court-appointed receiver, Robert Berleth, who stated that Peterson “is known to have numerous assets” at his home in Missouri City, Texas. To ensure a peaceful process, the judge ordered constables in Fort Bend County, Texas, to accompany Berleth to Peterson’s residence.

Peterson’s debt troubles began in 2016 when he took out a loan of $5.2 million from a Pennsylvania lending company. Over the years, the debt has grown due to interest and attorney’s fees, resulting in a judgment of $8.3 million against him in 2021. The receiver highlighted in a court filing that no offsets have been made against this judgment thus far.

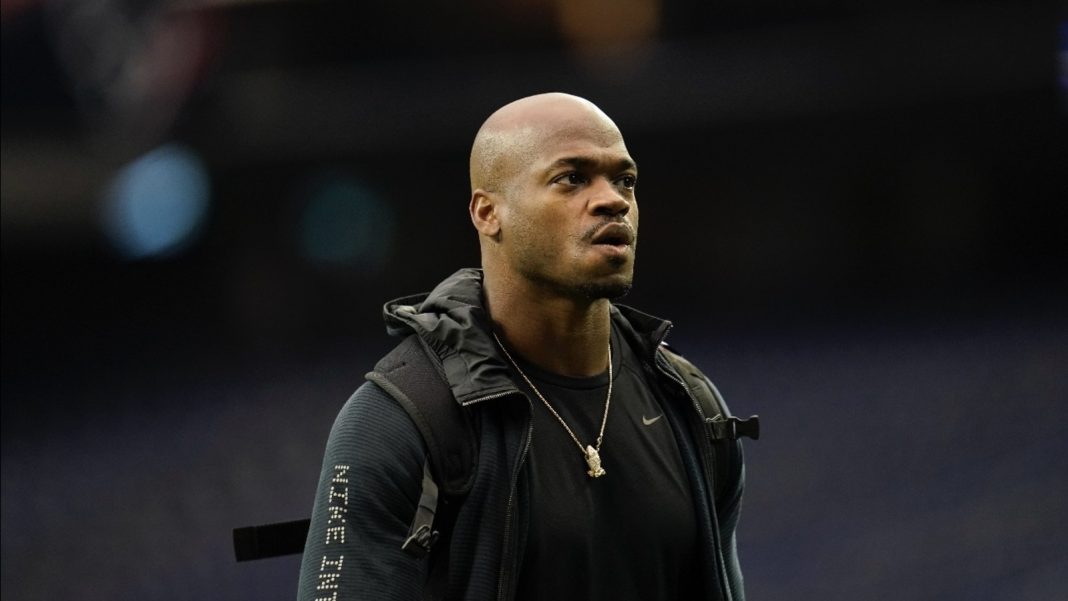

Adrian Peterson, now 39 years old, last played in the NFL during the 2021 season. Throughout his illustrious 15-year career, Peterson achieved significant milestones and accolades. He was named the NFL MVP in 2012, received four All-Pro honors, and was selected to the Pro Bowl seven times. Additionally, Peterson led the league in rushing three times and ranks fifth all-time with 14,918 rushing yards and 90 touchdowns. He played for seven teams, most notably the Minnesota Vikings from 2007 to 2016.

The court’s decision to order Peterson to turn over assets highlights the seriousness of his debt situation. While Peterson’s career was marked by remarkable achievements on the field, it serves as a reminder that financial management is crucial for athletes even after their playing days are over.

This case also sheds light on the challenges faced by professional athletes in managing their finances. While they may earn significant incomes during their careers, many athletes struggle with financial issues once they retire. A 2009 Sports Illustrated article estimated that 78% of NFL players face bankruptcy or financial stress within two years of retirement. The causes can vary, including poor financial management, extravagant spending, and investment scams.

To combat these challenges, financial literacy programs and guidance are essential for athletes. Organizations like the NFL Players Association offer resources and educational programs to help players make informed financial decisions. These initiatives aim to equip athletes with the necessary skills to manage their finances effectively and avoid falling into debt.

Furthermore, the case of Adrian Peterson highlights the importance of seeking professional advice when dealing with significant financial matters. Engaging with financial advisors, accountants, and attorneys can help athletes navigate complex financial situations and avoid potential pitfalls. These experts can provide guidance on managing debts, investments, and legal matters, ensuring that athletes protect their financial well-being.

In conclusion, Adrian Peterson’s legal battle over his debt serves as a cautionary tale for athletes and the broader public. It emphasizes the need for financial literacy and professional guidance to navigate the complexities of managing wealth. While Peterson’s on-field accomplishments are remarkable, they also highlight the importance of responsible financial management throughout an athlete’s career and beyond.