**Financial Markets Await Confirmation of September Interest Rate Cut**

Federal Reserve Chair Jerome Powell is set to deliver a highly anticipated speech at the central bank’s annual Jackson Hole Economic Symposium. This speech is expected to provide insights into the possibility of an interest rate cut in September. Market watchers are eagerly awaiting Powell’s remarks, which will take place at 10 a.m. EST in Jackson Hole, Wyoming.

**Powell’s Remarks: A Signal for Rate Cut**

While no surprises are expected in Powell’s address, there is anticipation that he will hint at the Federal Reserve’s plans to start cutting interest rates in the near future. Mark Malek, the Chief Investment Officer at brokerage firm Siebert, suggests that any statement indicating a probable interest rate cut soon will be well-received by the financial markets. Powell himself has previously indicated that a rate cut next month is on the table, as the Fed gains confidence in inflation returning to its 2 percent target.

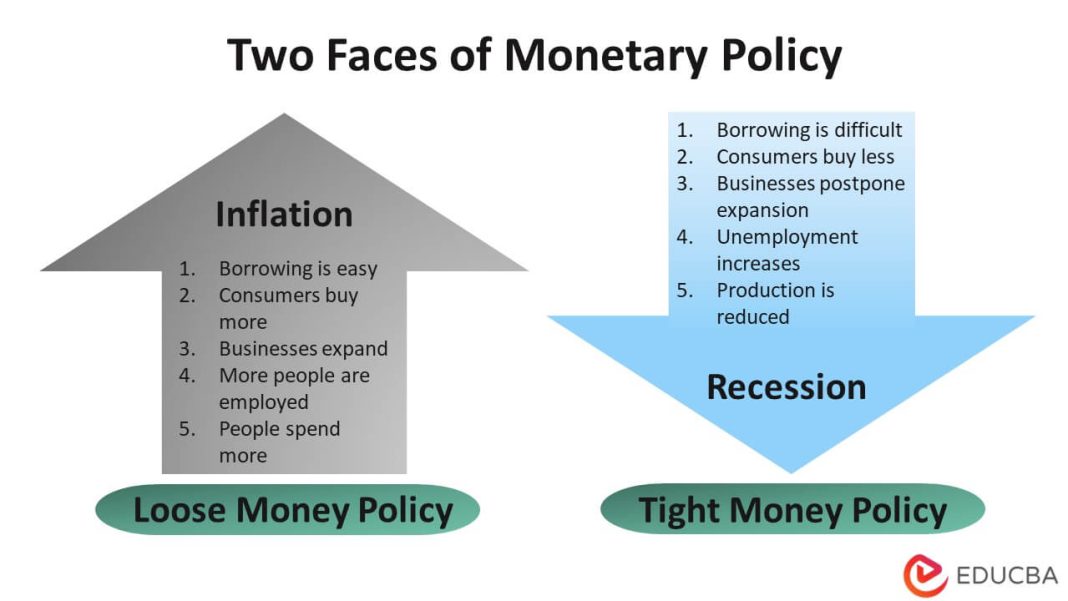

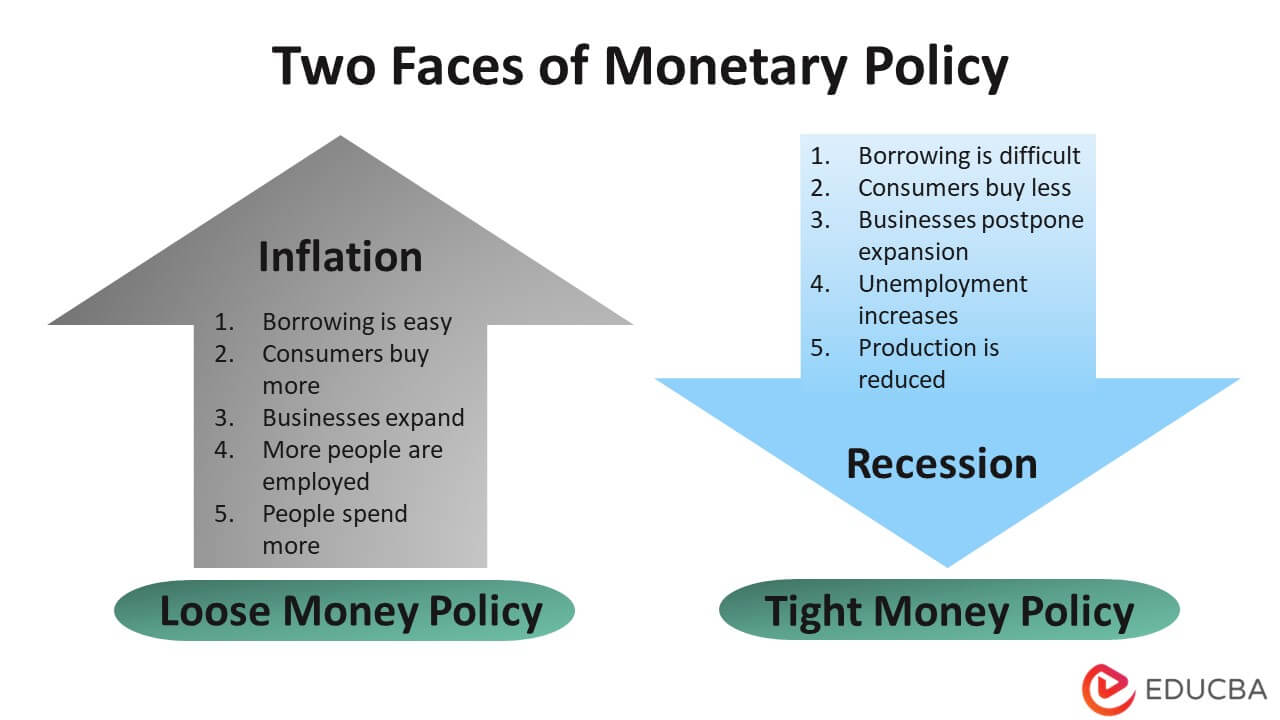

**The Case for Starting Monetary Policy Easing**

Powell’s colleagues also seem to be in favor of loosening monetary policy. Minutes from the July meeting revealed that a “vast majority” of participants agreed that the Fed can start cutting interest rates. Some even believed that the central bank could have initiated a rate cut last month. Philadelphia Fed Bank President Patrick Harker, who is not a voting member of the Federal Open Market Committee (FOMC), expressed support for lowering the benchmark rate, stating that the Fed needs to ease monetary policy methodically and signal well in advance.

**Size and Frequency of Rate Cuts**

While the market has largely priced in a rate cut in September, there is uncertainty regarding the size and frequency of future rate reductions. Ian Shepherdson, the Chief Economist at Pantheon Macroeconomics, suggests that Powell might indicate the possibility of multiple rate cuts before the end of the year. However, the exact size of the rate cut is not expected to be announced in Powell’s speech. According to the CME FedWatch Tool, investors believe there is a 74 percent chance that the Fed will initiate the next cycle with a quarter-point cut. Harker, on the other hand, prefers to wait for more data before committing to a specific size.

**The Impact of Rate Cuts on Everyday Life**

While the size of the rate cut may be uncertain, some experts argue that it may not have a significant impact on everyday life. Mark Malek suggests that a quarter percentage-point move in overnight interbank lending rates will not materially affect individuals. Mortgage rates, auto loans, and credit card rates are more closely tied to longer maturity yields controlled by bond traders. Furthermore, an immense rate reduction could potentially have an unwanted negative effect.

**The Importance of Powell’s Language**

Given the recent market volatility and concerns about a potential recession, Powell’s language during his speech will be closely scrutinized. Market experts believe that the Fed must start cutting interest rates before the U.S. economy slips into a recession. Positive economic reports have reassured investors that the Federal Reserve will be able to cut rates before any potential downturn. Therefore, every word spoken by Powell will be under the microscope, as financial markets eagerly await confirmation of a September interest rate cut.