Eurozone Inflation and ECB’s Decision to Keep Interest Rates Unchanged

Eurozone Inflation and ECB’s Decision to Keep Interest Rates Unchanged

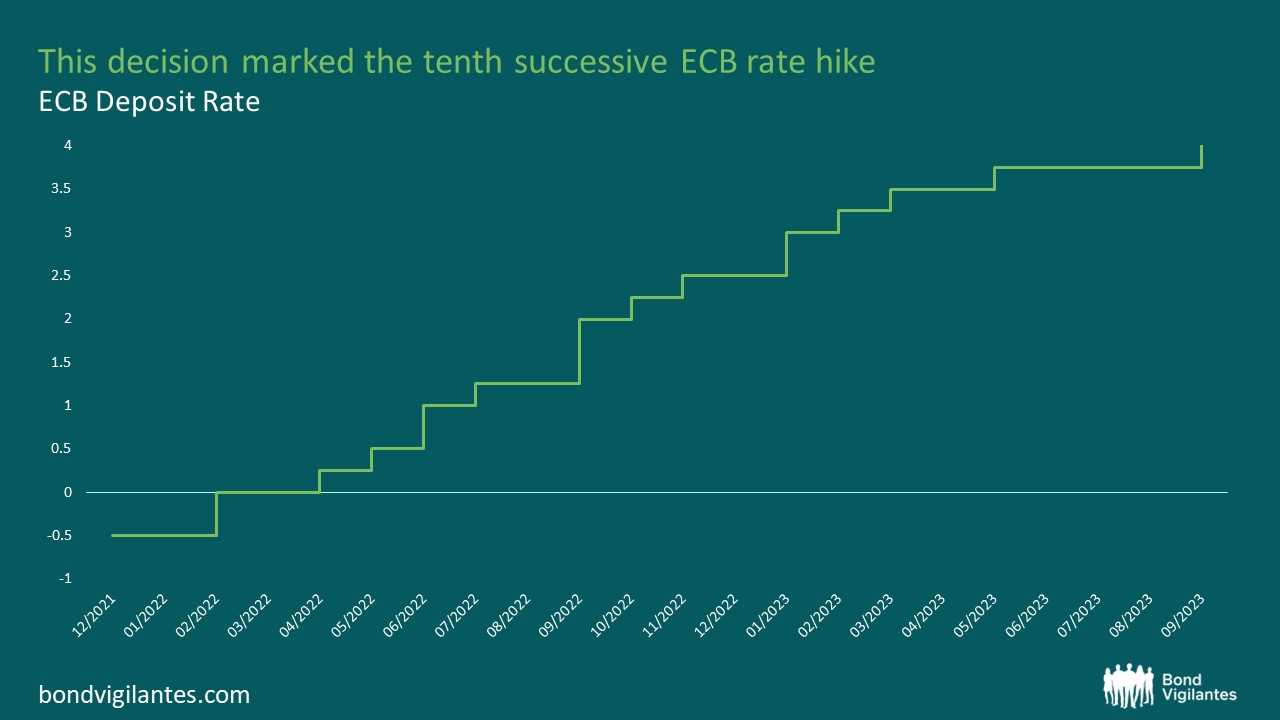

Eurozone inflation has seen a significant decline from its peak of 11.6 percent in October 2022 to 2.5 percent in June. However, this is still below the European Central Bank’s (ECB) target of 2 percent. As a result, the ECB has decided to maintain its benchmark interest rate at 3.75 percent, citing elevated price pressures, particularly in the services sector, which are expected to lead to above-target inflation that will persist well into 2025.

The governing council of the ECB reached this decision on July 18, choosing to pause on further rate cuts after reducing rates by a quarter-point in June. The council’s rationale for this decision is based on economic data that suggests the central bank’s efforts to bring inflation down to its target will take longer than anticipated. Despite progress, reaching the desired inflation target has proven to be more challenging than initially expected.

The ECB’s decision to keep interest rates unchanged reflects its tight monetary policy, which aims to keep borrowing costs high and limit demand. The council highlights that domestic price pressures remain high, with elevated inflation in the services sector and headline inflation expected to remain above the target well into the next year. This concern about elevated service-sector inflation aligns with the International Monetary Fund’s prediction that it will slow down overall inflation worldwide, including in the United States, during the latter half of the year.

The persistence of high inflation may delay anticipated rate cuts by both the ECB and the U.S. Federal Reserve. Higher interest rates result in increased costs for borrowing, spending, and investing, ultimately cooling demand and alleviating inflationary pressures. Consequently, if inflation remains stubbornly high, it could postpone rate cuts by central banks.

Whether the ECB will cut rates at its September meeting remains uncertain. Policymakers have made it clear that they are not committing to a particular rate path and will base their decision on incoming economic and financial data. ECB President Christine Lagarde asserts that the bank is determined to ensure inflation returns to the medium-term target of 2 percent in a timely manner, and policy rates will remain restrictive as long as necessary to achieve this objective.

The decision to keep interest rates unchanged means that European homebuyers and businesses waiting for lower borrowing costs will have to wait longer. The ECB’s current stance mirrors that of the Federal Reserve, which is expected to keep its benchmark interest rate unchanged at 5.25–5.5 percent during its July policy meeting. However, market expectations indicate a high probability of a rate cut in September.

Regarding economic activity in the euro area, Lagarde notes that growth slowed in the second quarter, with services being the primary driver while industrial production and goods exports remained weak. Lagarde predicts that inflation in the euro area will fluctuate around current levels for the rest of the year, with next year’s declines influenced by tight monetary policy and weaker labor cost growth. She also mentions that domestic inflation remains high, driven by elevated wage growth compensating for the period of high inflation.

In the United States, Federal Reserve Chair Jerome Powell recently expressed increased conviction that inflation is heading back to the target of 2 percent. Annual U.S. inflation stood at 3 percent in June, down from 3.3 percent in May. Powell’s statement has raised hopes among investors for an imminent rate cut. He emphasizes that the Fed will not wait until inflation reaches 2 percent before implementing a rate cut. Currently, the Fed’s benchmark interest rate stands at the highest level in 23 years, ranging from 5.25 to 5.5 percent.

In conclusion, despite a decline in eurozone inflation, it remains below the ECB’s target. The ECB’s decision to keep interest rates unchanged reflects concerns about elevated price pressures, particularly in the services sector, which are expected to result in above-target inflation lasting well into 2025. This decision aligns with the Federal Reserve’s stance, as both central banks navigate the challenges of persistent inflation. The impact of these decisions will be felt by European homebuyers and businesses awaiting lower borrowing costs.