The United States is facing a dire situation with its national debt, according to Tesla CEO Elon Musk. In a post on social media, Musk expressed concern that unless steps are taken to slow down the growth of America’s national debt, the U.S. dollar will become worthless. This warning comes as Gen. H.R. McMaster calls for a doubling of defense spending to prepare for potential threats and warns that the world is on the cusp of World War III.

The United States is facing a dire situation with its national debt, according to Tesla CEO Elon Musk. In a post on social media, Musk expressed concern that unless steps are taken to slow down the growth of America’s national debt, the U.S. dollar will become worthless. This warning comes as Gen. H.R. McMaster calls for a doubling of defense spending to prepare for potential threats and warns that the world is on the cusp of World War III.

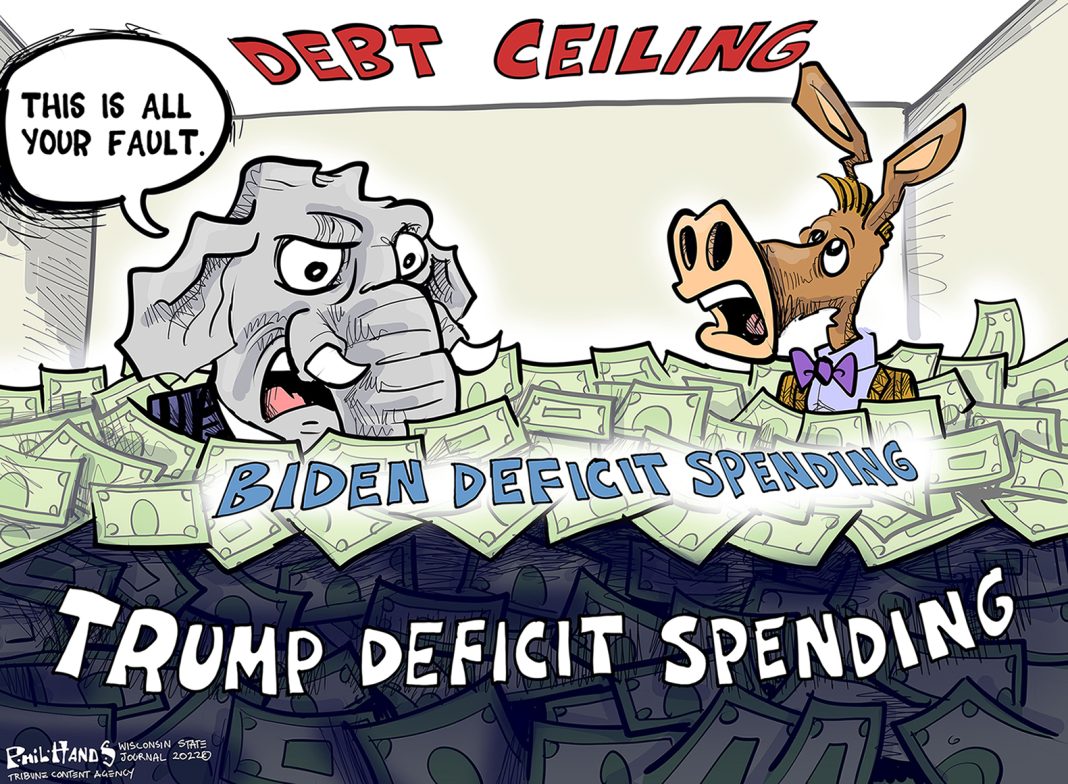

Musk has been a vocal advocate for ending the conflict in Ukraine through a negotiated settlement, as he believes that additional U.S. aid to Ukraine has only prolonged the bloody stalemate. He has also been a consistent critic of the Biden administration’s massive deficit spending, calling it unsustainable. In December 2021, he expressed concern for the “insane” federal deficit and vowed to reject President Joe Biden’s “Build Back Better” bill, which was estimated to add $160 billion to deficits over ten years.

More recently, Musk warned that a reckoning is inevitable for America’s ballooning national debt. He reacted to a post indicating that the interest payments on America’s $34 trillion national debt were already around $1 trillion per year and projected to rise to $3 trillion annually in less than ten years. He also highlighted that it took approximately 63 percent of all personal income taxes in February 2024 just to pay the interest on the national debt.

Musk’s concerns about deficit spending are shared by other prominent figures, including billionaire investor Warren Buffett. Buffett believes that when push comes to shove, the government will choose to raise taxes rather than reduce spending. He predicts that higher taxes are likely in the future as the government grapples with the consequences of large fiscal deficits.

The Congressional Budget Office (CBO) has reported that deficit spending in the United States reached $1.7 trillion in 2023, accounting for 6.3 percent of gross domestic product (GDP). The CBO projects that deficit spending will grow to 8.5 percent of GDP by 2054. Additionally, the debt-to-GDP ratio, which was around 35 percent in the 1980s, is estimated to reach 166 percent by 2054, posing significant risks to America’s fiscal and economic outlook.

Analysts at the University of Pennsylvania warn that once the debt-to-GDP ratio reaches approximately 200 percent, the government will reach a point of no return where future tax increases or spending cuts will be unable to prevent a default on its debt. This default would have severe consequences for the U.S. and global economies.

JPMorgan CEO Jamie Dimon also predicts that America’s debt-to-GDP ratio will sharply increase and become unsustainable in about 10 years. He refers to this as a “cliff” that the country is approaching rapidly.

The International Monetary Fund (IMF) has joined the chorus of voices expressing concern about the Biden administration’s fiscal stance. The IMF warns that massive deficit spending and growing public debt could stoke inflation and potentially lead to financial chaos.

In conclusion, Elon Musk’s warning about the national debt reflects a growing concern among prominent figures about the unsustainable path of America’s finances. With deficit spending reaching alarming levels and the debt-to-GDP ratio projected to continue rising, urgent action is needed to avoid a potential crisis. The voices of Musk, Buffett, and other experts serve as a call to action for policymakers to address this critical issue before it spirals out of control.