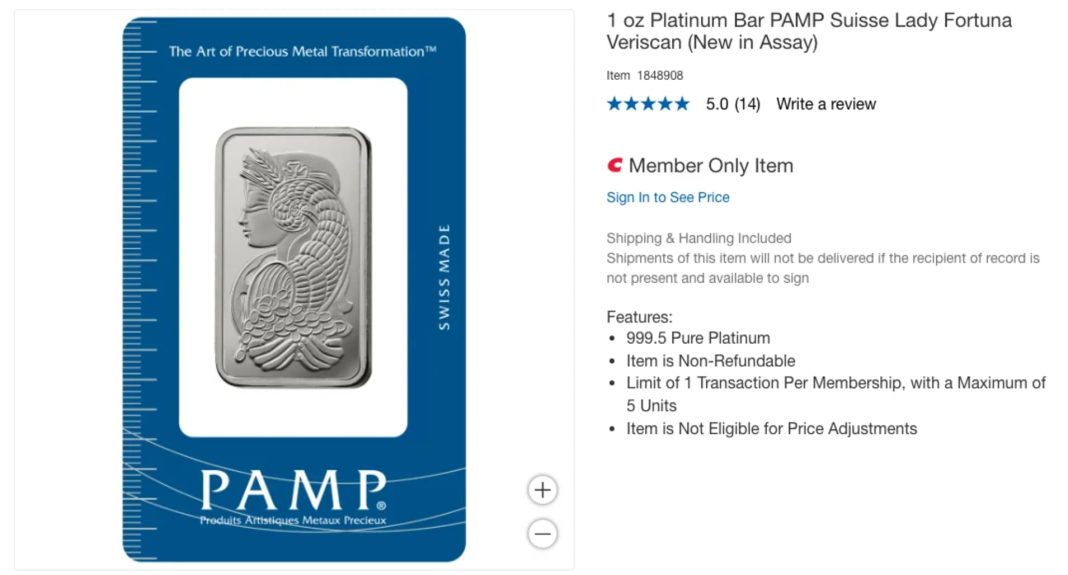

In recent months, Costco has successfully penetrated the booming precious metals market, capturing the attention of savvy investors and collectors alike. The wholesale giant’s latest addition—a series of Swiss-made platinum bars—has sparked significant interest, further expanding its lineup that initially featured gold bars and silver coins. Each 1-ounce platinum bar is available for $1,089.99, exclusively on Costco’s website, though potential buyers in Louisiana, Nevada, and Puerto Rico will find themselves unable to complete a purchase, as these states are excluded from delivery options. To make a purchase, consumers will also need a Costco membership, which ranges from $65 to $130 annually.

Costco’s foray into precious metals isn’t merely a whimsical business strategy; rather, it reflects a broader trend among investors seeking tangible assets amid economic uncertainty. As inflation concerns linger and stock market volatility persists, commodities like gold and platinum become increasingly appealing. Notably, Costco’s introduction of gold bars in August 2023 was a resounding success, with reports indicating that they were selling out within hours of restocks—an impressive feat that illustrates the high demand for these assets. Richard Galanti, Costco’s chief financial officer, noted during a September earnings call, “When we load them on the site, they’re typically gone within a few hours, and we limit two per member.” This rapid turnover underscores the growing interest in precious metals as a hedge against inflation and economic instability.

The dynamics of precious metals pricing further elucidate this trend. Over the past year, the value of gold has surged by over 40%, and it has seen an impressive increase of more than 70% over the last five years. In contrast, platinum has experienced a more volatile trajectory. While it has appreciated by approximately 15% in the last twelve months, it has also faced a decline of more than 8% after reaching a peak of $1,100 earlier in 2024. This volatility can be attributed to various factors, including changes in industrial demand, particularly from the automotive sector, where platinum is used in catalytic converters. As studies indicate, the demand for electric vehicles is reshaping the automotive industry, which could influence platinum’s future price trajectory.

The strategic move by Costco into the precious metals market aligns with broader economic shifts and consumer behaviors. As more individuals turn to physical assets for wealth preservation, retailers like Costco are positioning themselves as convenient gateways to these investments. According to analysts at Wells Fargo, Costco’s gold bar sales alone have peaked at an astonishing $200 million monthly. This figure not only highlights the retailer’s capacity to tap into this lucrative market but also signals a cultural shift where people are increasingly viewing precious metals as integral components of their financial portfolios.

In conclusion, Costco’s entry into the platinum market is more than a mere addition to its product range; it reflects an acute awareness of consumer needs in a shifting economic landscape. For those contemplating the purchase of precious metals, the allure of tangible assets is strong—especially when backed by a reputable retailer. As the market evolves, both seasoned investors and newcomers alike may find Costco’s offerings an accessible and attractive option in their quest for financial security.