Monterey Car Week, a highly anticipated event for classic car enthusiasts, experienced a 3% decline in auction sales compared to last year. The total sales at the five auctioneers in Monterey fell to $391.6 million this year. This follows a 14% decline from the peak of 2022. The decrease in sales can be attributed to a shift in preferences among wealthy collectors.

According to Hagerty, the classic-car insurance company, out of the 1,143 cars up for sale, only 821 were sold, resulting in a 72% sell-through rate. The average sale price of cars this year was $476,965, slightly lower than the previous year’s average of $477,866.

One of the reasons for the decline in sales is the saturation of similar cars at multiple auctions. Simon Kidston, the founder of Kidston and a leading advisor to wealthy car collectors, highlighted the issue of too many similar cars vying for the same buyers. Additionally, many entries had already been in dealer windows for months or even years, which affected their appeal to buyers.

Another factor contributing to the decline in sales is the changing preferences of a new generation of collectors. Gen Xers and millennials, who are now driving the market, prefer cars from the 1980s, 1990s, and 2000s. This has led to a surplus of classic cars from the 1950s and 1960s, which were once popular with baby boomers. These older classics are struggling to find buyers, resulting in a lower sell-through rate for pre-1981 cars priced at $1 million or more.

In contrast, younger collectors are showing a strong interest in cars less than 4 years old, with a sell-through rate of 73%. Hagerty’s Supercar Index, which tracks sports cars from the 1980s through the 2000s, has seen a 60% increase since 2019. On the other hand, the Blue Chip Index, which includes classic cars from the 1950s and 1960s, has experienced a 3% decline.

Despite the overall decline in sales, rare and exceptional cars still command high prices. The top-selling car of the week was a 1960 Ferrari 250 GT SWB California Spider, which sold for $17 million. The second-highest selling car was a 1938 Alfa Romeo 8C 2900B Lungo Spider, one of only five in existence, which sold for $14 million.

Looking ahead, the classic car market is expected to face challenges as many older collectors start selling off or downsizing their collections. This changing of the guard is likely to put downward pressure on prices for older cars for years to come.

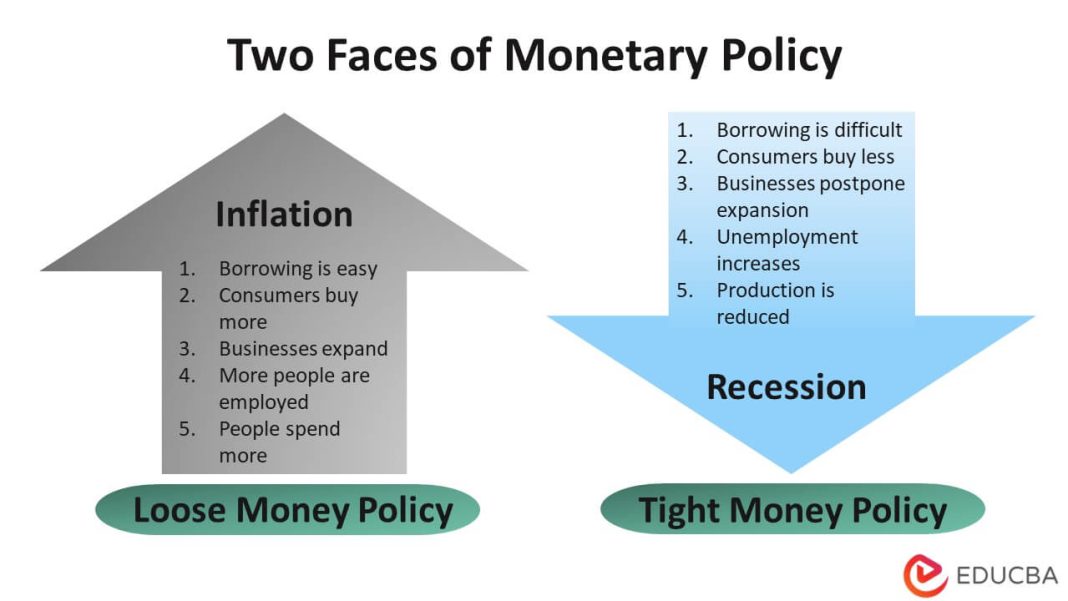

There are also external factors impacting the classic car market, such as high interest rates. Financing has been a common method for buyers at the lower end of the market, but rising rates have increased the opportunity cost of buying a classic car. Potential buyers are now weighing the potential returns from investing their money elsewhere.

In conclusion, the decline in auction sales during Monterey Car Week can be attributed to a combination of factors. The market is experiencing saturation of similar cars, a shift in preferences among collectors, and external factors such as high interest rates. Despite these challenges, rare and exceptional cars continue to fetch high prices. However, the broader trend indicates that prices for older cars may face downward pressure in the coming years.