Title: Boeing Announces Cost Cuts and Supplier Reductions Amidst Worker Strike

Introduction:

Boeing, the multinational aerospace corporation, has recently announced significant cost-cutting measures in response to a strike by over 30,000 factory workers. These measures include a hiring freeze, a pause on nonessential staff travel, and a reduction in supplier spending. The strike, which began after the rejection of a tentative labor deal, has halted most of Boeing’s aircraft production. This article explores the impact of the strike on Boeing and its suppliers, as well as the company’s efforts to reach a new contract agreement.

The Impact of the Strike on Suppliers:

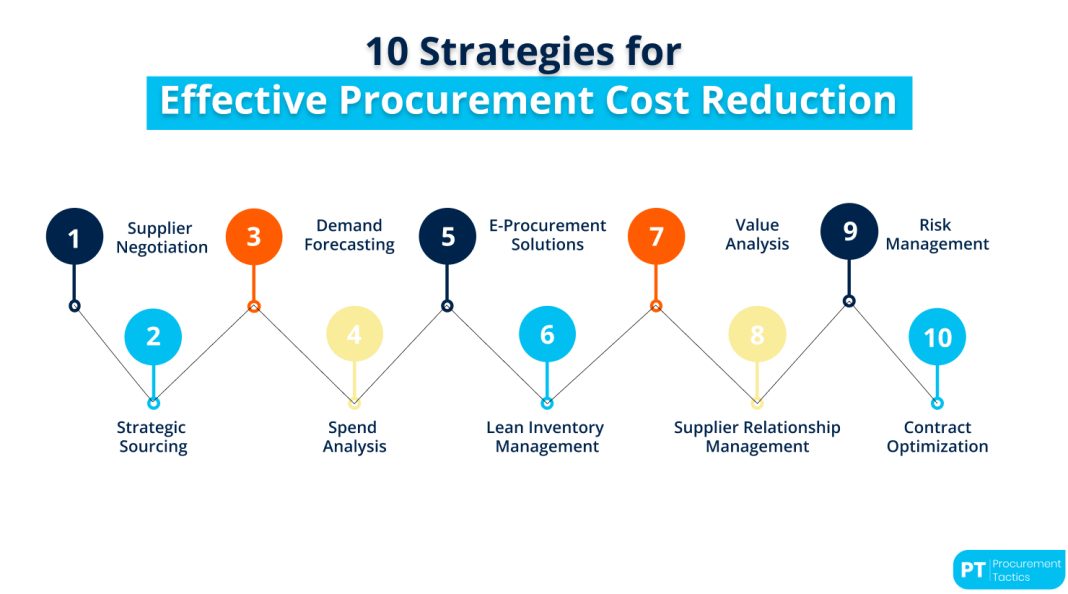

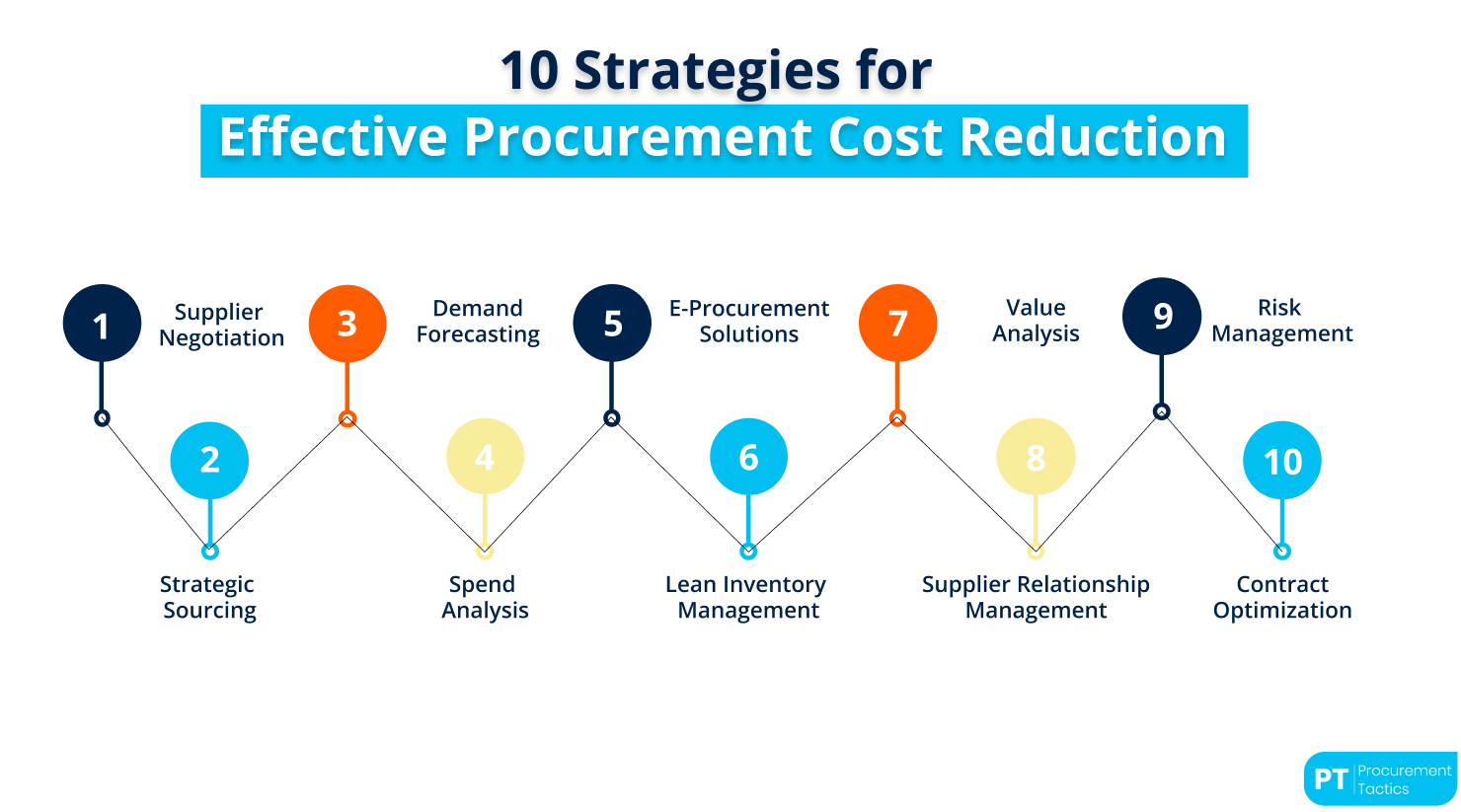

As Boeing factory workers walk off the job, the strike is expected to have ripple effects on the hundreds of suppliers that rely on Boeing’s work. To mitigate the financial impact, Boeing plans to make “significant reductions” to supplier spending and halt most purchase orders for its 737 Max, 767, and 777 jetliners. This move is the first clear sign of how the strike will affect the broader aerospace industry.

Boeing’s Response and Preservation of Cash:

Boeing’s Chief Financial Officer, Brian West, emphasized the company’s commitment to reaching a new contract agreement that reflects the workers’ feedback and enables operations to resume. However, West also highlighted the challenging period the company is facing and the need to preserve cash. As a result, Boeing is considering temporary furloughs for many employees, managers, and executives in the coming weeks. The financial impact of the strike will depend on its duration, but Boeing is focused on conserving cash and safeguarding its shared future.

Boeing’s Credit Ratings and Debt Concerns:

Moody’s and Fitch Ratings have both expressed concerns about the strike’s potential impact on Boeing’s credit ratings. Moody’s has placed all of Boeing’s credit ratings under review for a possible downgrade, while Fitch Ratings warns that a prolonged strike could put Boeing at risk of a downgrade. Such a downgrade would increase the manufacturer’s borrowing costs, adding to its existing debt burden. Therefore, resolving the strike and returning to full-scale production is crucial for Boeing’s financial stability.

Boeing’s Need for a New Deal and CEO’s Intentions:

Boeing’s new CEO, Kelly Ortberg, is keen to resume negotiations and reach a new contract agreement as soon as possible. The company acknowledges the importance of addressing the workers’ feedback and resolving the strike to secure a shared future. Despite the challenges posed by the strike, Boeing remains committed to maintaining funding for safety, quality, and direct customer support work.

Conclusion:

Boeing’s announcement of cost-cutting measures and reductions in supplier spending reflects the significant impact of the ongoing strike on the aerospace giant. The company’s focus on preserving cash, safeguarding its future, and reaching a new contract agreement demonstrates its commitment to addressing the concerns of its workers. Resolving the strike promptly is crucial for Boeing’s financial stability and maintaining its credit ratings. The ripple effects of this strike extend beyond Boeing, affecting the broader aerospace industry and its suppliers.