BlueScope Steel, a major steel producer in Australia, has reported a decline in net profit due to competition from Chinese and Indonesian steel producers and a weakening Chinese housing market. Despite these challenges, the company’s North American division, which is of a similar size, has not suffered as much. BlueScope Steel’s net profit for the year ending June 30 was $805.7 million, compared to $1 billion the previous year.

BlueScope Steel, a major steel producer in Australia, has reported a decline in net profit due to competition from Chinese and Indonesian steel producers and a weakening Chinese housing market. Despite these challenges, the company’s North American division, which is of a similar size, has not suffered as much. BlueScope Steel’s net profit for the year ending June 30 was $805.7 million, compared to $1 billion the previous year.

However, the company has announced that shareholders will receive a dividend of 30 cents per share for the second half of the financial year. The board’s target is 60 cents per share per annum. The company’s Managing Director and CEO, Mark Vassella, has highlighted that although the Earnings Before Interest and Taxation were lower than last year, at $1.34 billion, this demonstrates BlueScope’s resilience. The strength in the U.S. steelmaking and global downstream operations has offset the impact of low Asian steel prices on the Australian and New Zealand steelmaking businesses.

Vassella also noted that Chinese steelmakers have been running at high levels of production, despite weak domestic construction. This has resulted in excess steel flowing into Asian markets. He believes that some Chinese competitors are not operating sustainably and may be at cash break-even or cash-loss positions. This indicates that their business model is not viable.

In addition to competition from China, softer demand from the Australian construction industry has contributed to BlueScope’s challenges. Housing approval numbers have reduced, and the backlog from the previous period is being worked through. However, the company predicts that underlying demand for housing will remain strong in the medium term. The company also faces inflationary pressures, including higher electricity costs, which add to the challenges.

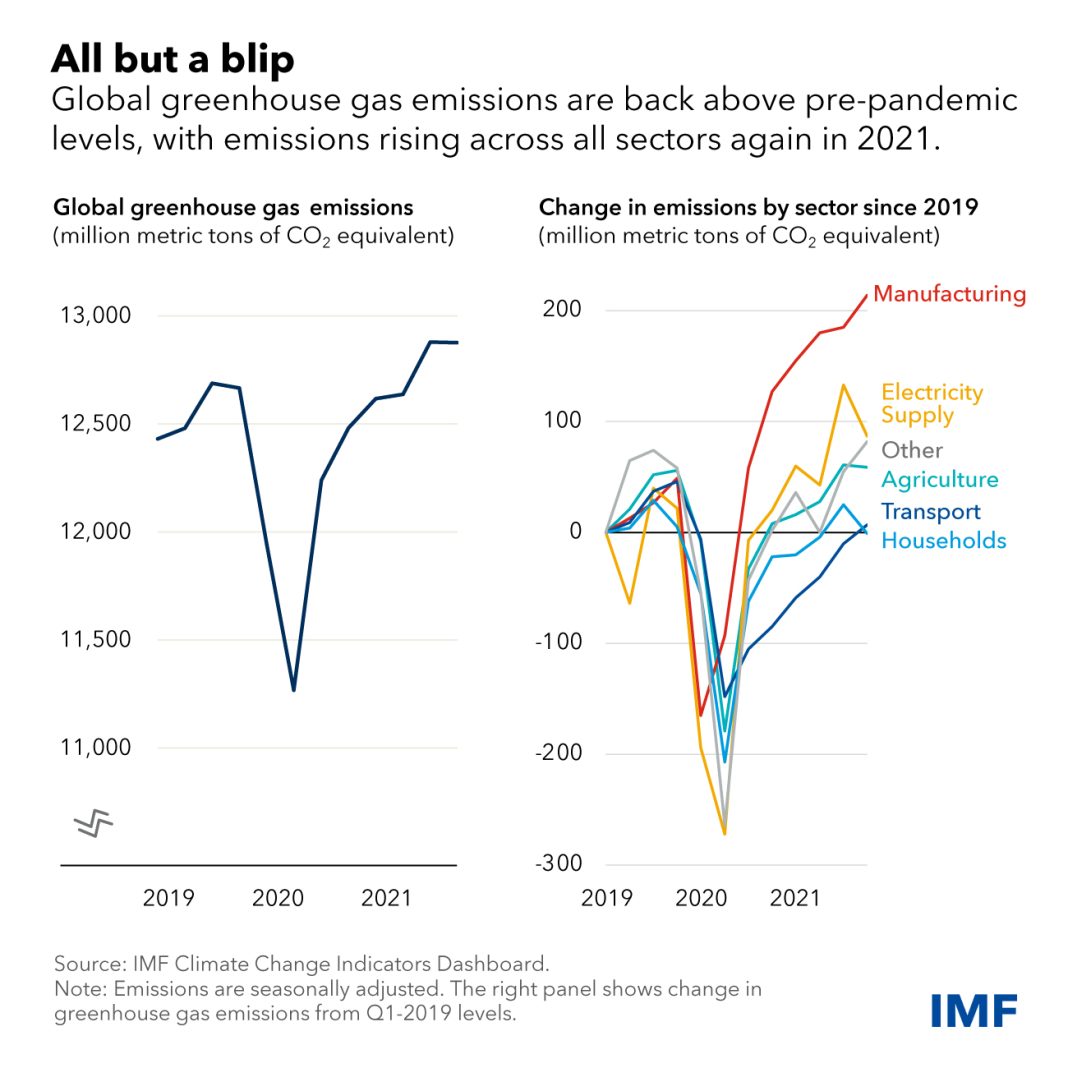

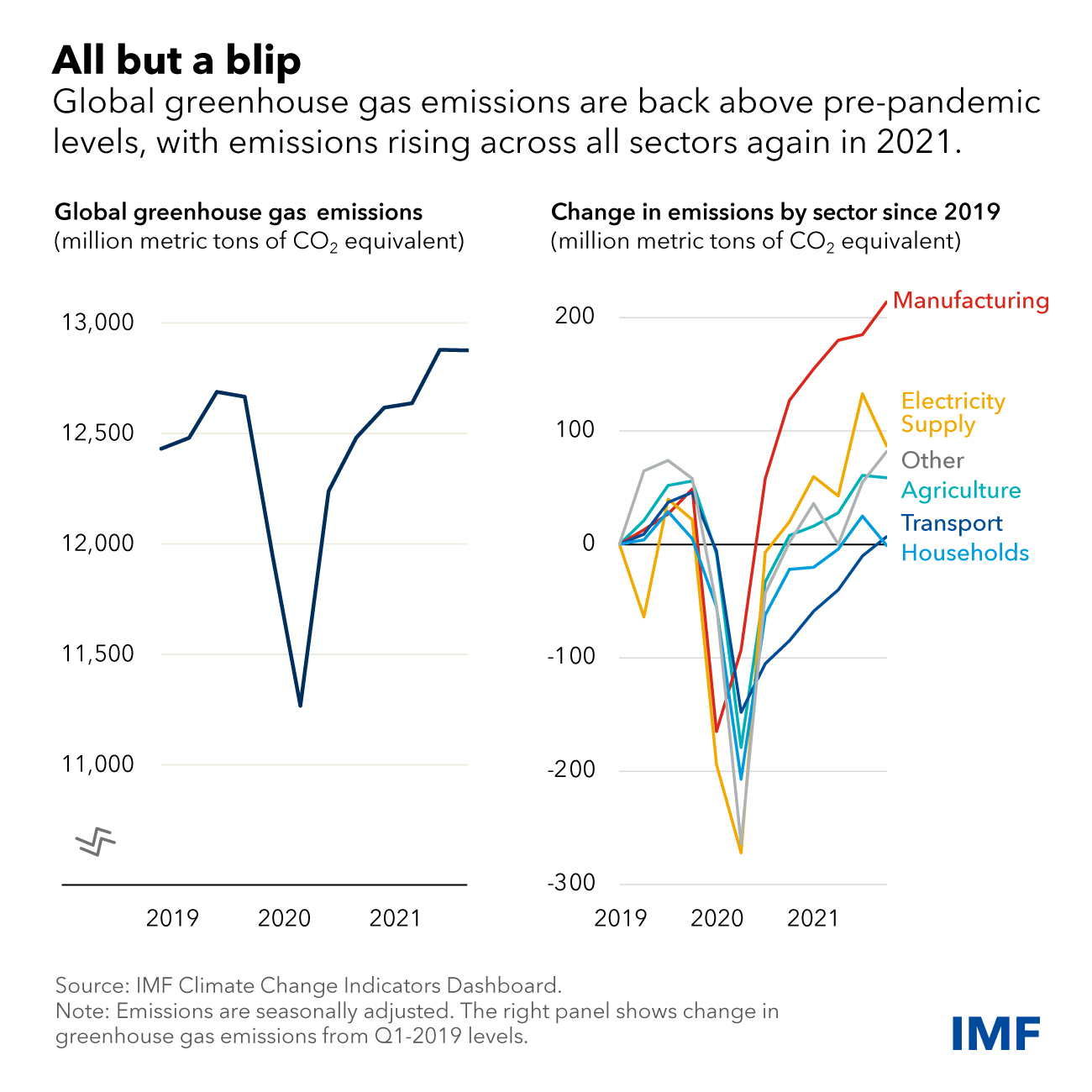

Despite being one of Australia’s largest emitters of greenhouse gases, BlueScope has managed to achieve a 12.2 percent reduction in emissions intensity compared to its FY2018 baseline. This is in line with its target for 2030. The reduction in emissions is primarily driven by the ramp-up of the North Star expansion, as well as operating and process efficiencies at Glenbrook and Port Kembla Steelworks.

BlueScope is actively working on projects to achieve a low-carbon future, including collaborations with Rio Tinto and BHP. The company is also conducting the Australian Direct Reduced Iron options study, known as Project IronFlame. These initiatives align with BlueScope’s commitment to sustainability and reducing its environmental impact.

The company’s worldwide operations have shown mixed performance. The Asian operation saw a 13 percent increase in earnings to $159.6 million, while the New Zealand and Pacific division experienced a 66 percent decline to $43.7 million. Earnings from the North American operation only dipped 3 percent to $935.1 million.

BlueScope has responded to the challenging market conditions by increasing its focus on managing costs and revenue performance. The company is also closely monitoring the timing of capital expenditure. This approach is particularly relevant for the Australian business, as it aims to ensure ongoing resilience in an environment of sustained low prices and cost escalations.

Looking ahead, BlueScope forecasts its first half-year earnings for FY2025 to be between $350 million and $420 million. Despite the current challenges, the company remains optimistic about its ability to navigate the market and deliver solid results. By actively managing costs, focusing on revenue performance, and pursuing a low-carbon future, BlueScope is positioning itself for long-term success in the steel industry.