Auto industry faces challenges in the second half of the year

Auto industry faces challenges in the second half of the year

The U.S. auto industry has experienced a growth of 2.9% in sales during the first half of the year compared to the previous year. However, there are concerns about whether this momentum can be sustained in the last six months of the year. Cox Automotive, a leading data and research firm, highlights several factors that could hinder future sales growth.

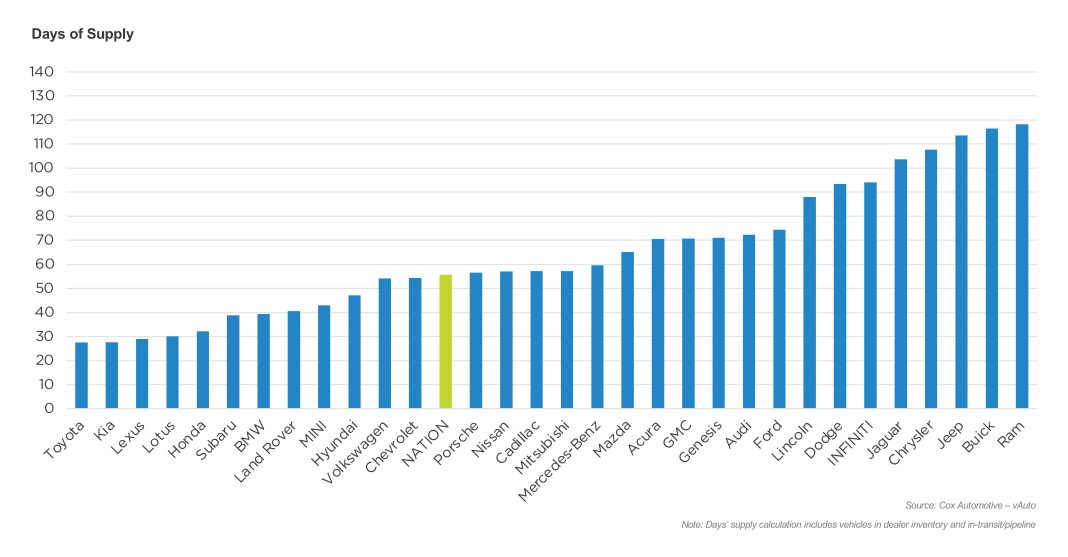

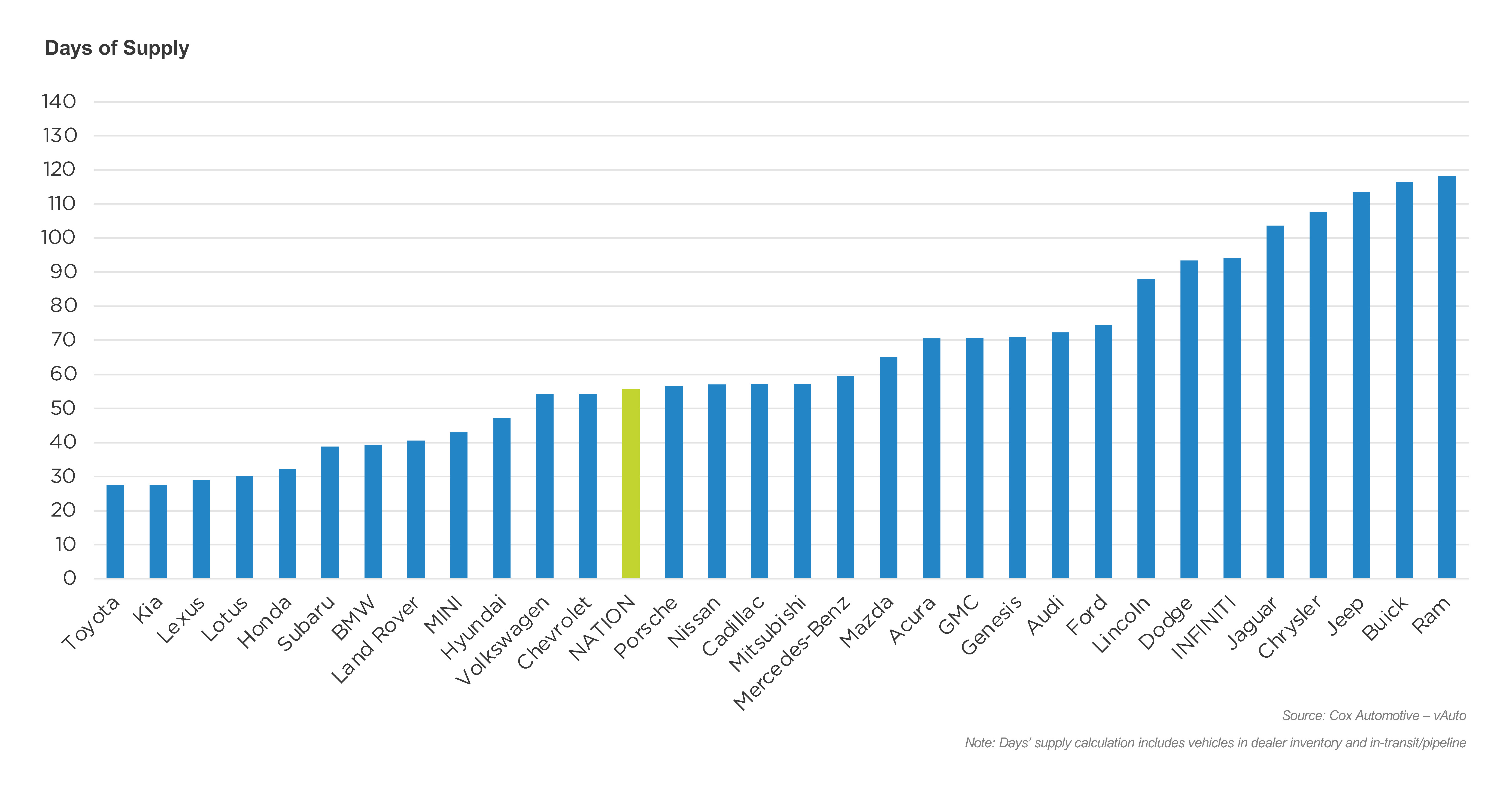

One of the major challenges facing the industry is the increasing vehicle inventory levels. As dealerships struggle to sell off their stock, they are likely to offer more incentives to entice buyers. This could potentially affect the profitability of automakers, as they may have to reduce prices or offer discounts to move their vehicles. Furthermore, the uncertainty surrounding the economy, interest rates, and the upcoming U.S. presidential election adds to the cautious outlook for the industry.

Cox Automotive predicts that sales growth will slow down in the second half of the year, with an estimated 15.7 million units sold by the end of 2024, representing a modest 1.3% increase compared to 2023. Unlike previous years, where consumer sales were the primary driver of growth, commercial sales are now leading the way. This shift in dynamics could impact automakers’ profits, as commercial sales tend to be less lucrative than consumer sales.

Despite these challenges for automakers, consumers stand to benefit from the current market conditions. The unprecedented supply of new vehicles, coupled with record-high pricing during the pandemic, has created a favorable environment for buyers. Many consumers who have been waiting to purchase a new vehicle now have a wide selection and competitive pricing options available to them.

While some automakers have thrived in this market, Cox Automotive identifies potential headwinds for the industry as a whole. Wall Street analysts have been predicting pricing and profit challenges for most automakers compared to previous years. The uncertain future could make it difficult for automakers to build upon recent sales successes.

Cox Automotive points out several “winners” and “underperformers” in the industry. General Motors, Toyota Motor, and Honda Motor are expected to be the top-selling automakers in the first half of the year. Toyota, in particular, has the potential to challenge GM for the top spot if it continues its growth. On the other hand, Tesla and Stellantis are projected to experience declines in sales. Tesla’s sales are estimated to be down by 14.3%, while Stellantis is forecasted to be down by 16.5% through June.

Stellantis CEO Carlos Tavares has acknowledged the mistakes made by the company, describing them as “arrogant.” He is determined to correct these mistakes and address the sales declines and bloated inventories. However, Cox Automotive warns that the industry’s supply and demand dynamics have shifted, signaling the end of the seller’s market. This could lead to a further deterioration in new vehicle grosses and dealer profitability.

In conclusion, while the U.S. auto industry has seen growth in the first half of the year, challenges lie ahead in the second half. Factors such as increasing vehicle inventory levels, uncertainties in the economy and political landscape, and the shift towards commercial sales pose potential hurdles for automakers. However, these circumstances present favorable conditions for consumers who have been waiting to purchase a new vehicle. The industry will need to navigate these challenges to maintain growth and profitability in the coming months.